£20,000 in savings? Here’s how I’d aim to turn that into passive income of £994 a month

Turning £20,000 into £11,938 a year – or £994 a month – in passive income might seem ambitious. And while it’s not straightforward, it’s absolutely possible in the stock market.

Owning shares in companies that distribute their earnings as dividends can be a great way to earn extra cash. And one of the best demonstrations of this comes from Warren Buffett.

Warren Buffett and Coca-Cola

In 1994, the great man’s investment vehicle, Berkshire Hathaway, owned 400m shares in Coca-Cola (NYSE:KO), with a market value of $1.3bn. In 2024, that investment returned dividends of $776m (before tax).

That’s almost 60% of the cash Buffett initially invested. Put another way, it’s the equivalent of earning £11,938 on a £20,000 investment – and the annual distributions just keep growing.

The most impressive thing, in my view, is that Berkshire hasn’t used any of the cash it has received to buy more Coca-Cola shares. The dividends have gone up by themselves.

Buffett’s a skilled investor, but this particular example’s only partly about that. It’s also about the value of waiting, being patient, and holding on to stocks for the long term.

Finding the right stocks

Buffett’s success has been the result of Coca-Cola being able to increase its dividend every year. But investors should note that the rate of growth has been slower over the last 10 years.

Coca-Cola dividends per share 2004-24

Created at TradingView

Since 2014, the company’s dividend increases have typically been between 2% and 6%. But between 2004 and 2014, they were more in the 7-11% range.

That makes a difference to anyone getting started today. And while I think a lot of investors underestimate Coca-Cola’s prospects, I suspect a return to 10% dividend growth’s unlikely.

As a result, I’d look elsewhere for a stock that can increase its dividends for the next 30 years. And the most obvious candidate to me is a constituent of the FTSE 100.

Diageo

Diageo’s (LSE:DGE) facing a barrage of challenges at the moment. These include weak macroeconomic conditions in certain markets and the possibility of trade tariffs in the US.

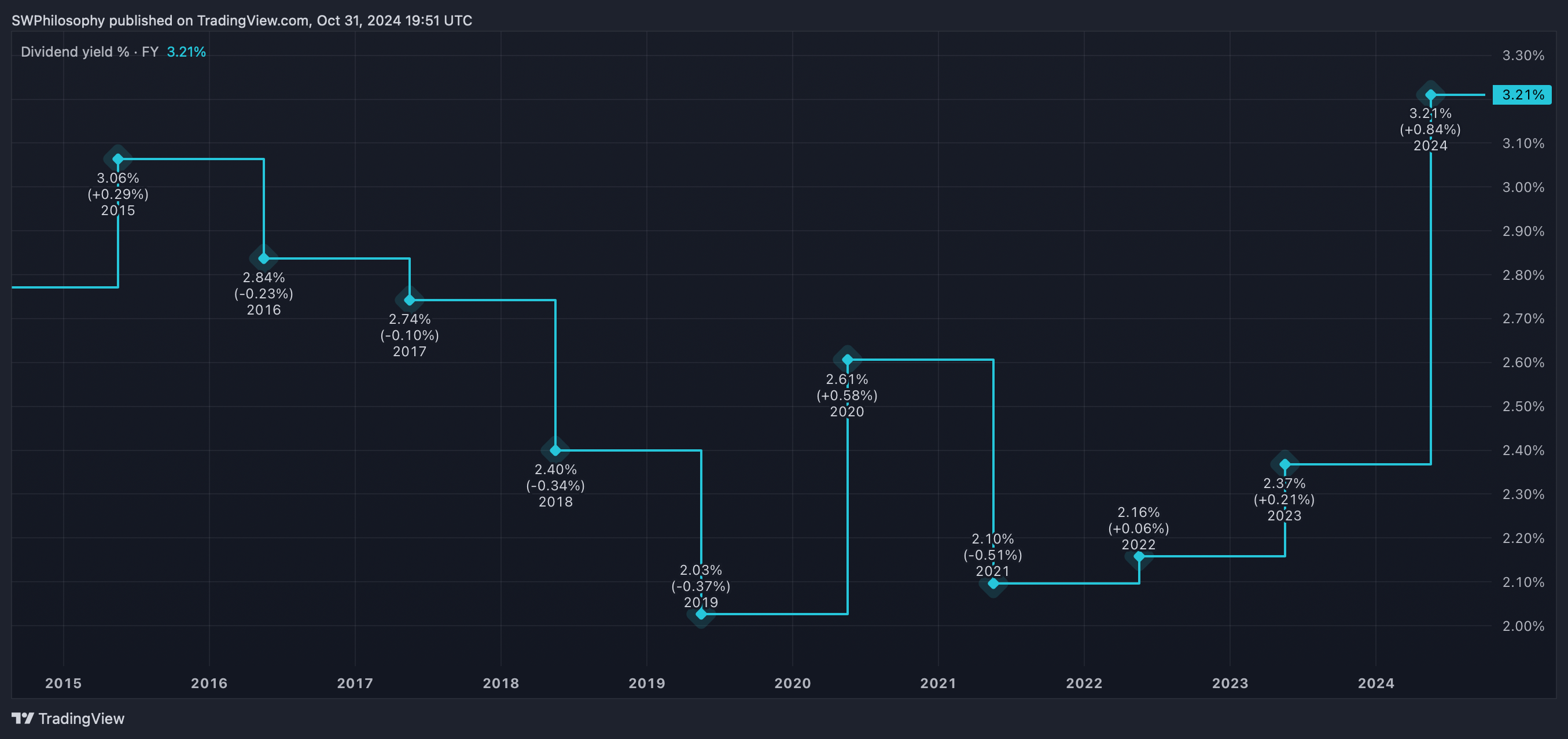

As a result, the stock’s trading with an unusually high dividend yield. For the first time since around 2015, investors who buy the stock today start with a 3.3% return.

Diageo dividend yield 2014-24

Created at TradingView

From there, it’s about growth – to match Buffett’s result, Diageo’s dividend needs to grow by 10% a year for 30 years. That’s a big ask, but the company’s in a strong competitive position.

Consumer tastes might evolve, but Diageo’s scale means it can make acquisitions to stay on trend. That’s been the key to its success so far and I think it looks like a durable advantage.

Dividend growth

As Buffett says, the best companies are ones that can increase their earnings – and dividends – without needing more cash. Coca-Cola’s a great example.

I think Diageo’s a similar type of business. And with the stock unusually cheap, I’ll be looking to add to my stake in November.

The post £20,000 in savings? Here’s how I’d aim to turn that into passive income of £994 a month appeared first on The Motley Fool UK.

But there may be an even bigger investment opportunity that’s caught my eye:

Investing in AI: 3 Stocks with Huge Potential!

🤖 Are you fascinated by the potential of AI? 🤖

Imagine investing in cutting-edge technology just once, then watching as it evolves and grows, transforming industries and potentially even yielding substantial returns.

If the idea of being part of the AI revolution excites you, along with the prospect of significant potential gains on your initial investment…

Then you won’t want to miss this special report inside Motley Fool Share Advisor – ‘AI Front Runners: 3 Surprising Stocks Riding The AI Wave’!

And today, we’re giving you exclusive access to ONE of these top AI stock picks, absolutely free!

More reading

- 2 FTSE 100 shares I plan to hold for AT LEAST 5 years!

- Unlocking a £111k yearly second income starting with a £20k ISA!

- Diageo: time for me to sell this FTSE 100 stock before 5 November?

- 3 shares I’d consider for a Lifetime ISA

- Here are the latest share price targets for Diageo

Stephen Wright has positions in Berkshire Hathaway and Diageo Plc. The Motley Fool UK has recommended Diageo Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.