Down 78%, is this once-hot AI growth stock set to explode like the Rolls-Royce share price?

Until recently, it was all going swimmingly for Super Micro Computer (NASDAQ: SMCI). The growth stock joined the prestigious S&P 500 in March, by which point it had surged by a staggering 6,600% in five years.

Then everything started unravelling for the IT infrastructure company. As I write, the share price has lost 78% of its value in just eight months. Talk about a fall from grace!

However, Rolls-Royce stands as a powerful example of what’s achievable through a successful turnaround. The FTSE 100 engine maker was on the brink of bankruptcy during the pandemic, yet it survived and is now thriving. The stock’s soared 1,300% in four years!

Might such an epic rebound be on the cards for Super Micro stock at some point? Here are my thoughts.

Incredible growth

For those unfamiliar, the company makes hardware for data centres and artificial intelligence (AI) applications. Its energy-efficient servers (often packed with Nvidia‘s chips) have seen incredible demand as the generative AI revolution has exploded globally.

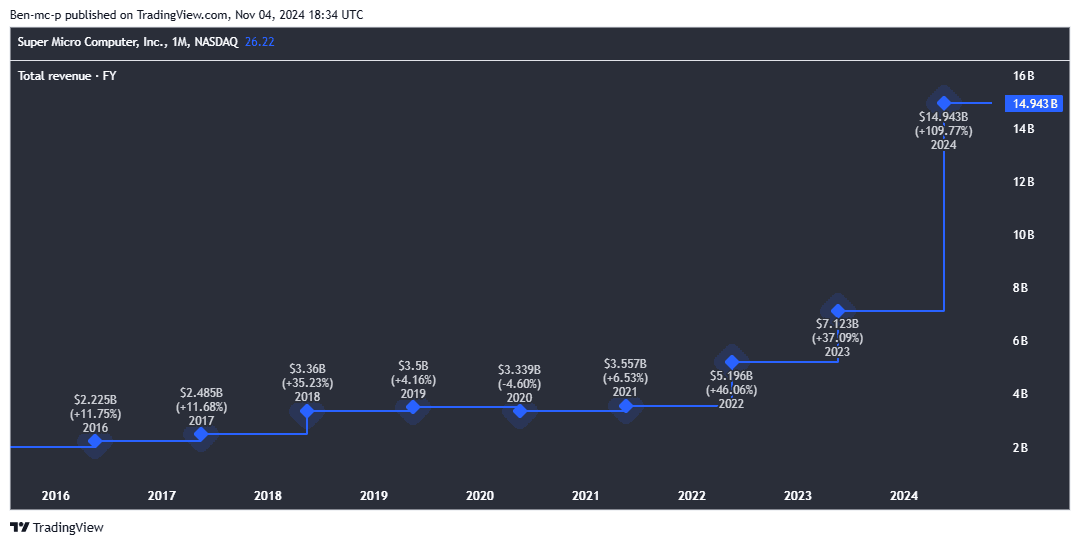

We can see this in Super Micro’s revenue, which more than doubled to $14.9bn last year.

Omnishambles

So why have the wheels come off? The reasons are almost too numerous to list. But starting in August, the firm said it wouldn’t be able to file its audited annual report on time. That’s obviously never a good sign.

Then an explosive report from short seller Hindenburg Research was published. In this, it made a number of serious allegations against Super Micro. The main ones were:

- Accounting manipulation

- Rehiring of top executives who were directly involved in past accounting scandals at the firm

- Significant undisclosed business dealings with companies controlled by the CEO’s family members

- Continuing to do business with Russia, violating US sanctions

Last month, it was reported that the US Department of Justice is in the early stages of investigating the company. Oh, and the Nasdaq is also threatening to delist the stock due to the missing annual report.

And as if all that wasn’t enough, Super Micro recently disclosed that Ernst & Young has resigned as its auditor (after just 17 months).

Should I buy Super Micro stock?

Now, it needs to be stated that Super Micro denies all these allegations. Also, Hindenburg Research is a short seller, which means it borrows shares and sells them, hoping to buy them back later at a lower price after a scathing report (pocketing the difference as profit). So it benefits from the stock’s decline.

Of course, it’s always possible for Super Micro to turn things around. A new auditor and management could stabilise things, while revenue and earnings may well continue to climb higher due to growing AI demand.

Moreover, the stock appears dirt cheap, trading at a mere 7 times forecast earnings for this financial year. So I wouldn’t totally rule out a big share price recovery.

However, I want no part of this. Reports say that Nvidia has started to route orders away from Super Micro due to these alleged accounting issues. If so, that could seriously impact future growth.

Moreover, on announcing its resignation, Ernst & Young said it was “unwilling to be associated with the financial statements prepared by management“. Yikes!

There’s far too much uncertainty here for me. Therefore, I’ll invest elsewhere in November.

The post Down 78%, is this once-hot AI growth stock set to explode like the Rolls-Royce share price? appeared first on The Motley Fool UK.

Should you buy Super Micro Computer now?

Don’t make any big decisions yet.

Because Mark Rogers — The Motley Fool UK’s Director of Investing — has revealed 5 Shares for the Future of Energy.

And he believes they could bring spectacular returns over the next decade.

Since the war in Ukraine, nations everywhere are scrambling for energy independence,

he says. Meanwhile, they’re hellbent on achieving net zero emissions.

No guarantees, but history shows…

When such enormous changes hit a big industry, informed investors can potentially get rich.

So, with his new report, Mark’s aiming to put more investors in this enviable position.

Click the button below to find out how you can get your hands on the full report now, and as a thank you for your interest, we’ll send you one of the five picks — absolutely free!

More reading

- 2 high-yield FTSE 250 shares I’d buy today — and 1 that I’d avoid

- 3 reasons the Rolls-Royce share price could soar over the next decade

- Here’s how much income I’d get if I invested my entire £20k ISA in cheap BT shares

- 2 FTSE dividend shares yielding more than 6% with P/Es of less than 9!

- Up 105% in a year! Is this rocketing FTSE bank the perfect pick for my Stocks and Shares ISA?

Ben McPoland has positions in Rolls-Royce Plc. The Motley Fool UK has recommended Nvidia and Rolls-Royce Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.