ETFs are soaring! Here’s a star fund for Stocks and Shares ISA investors to consider

Investing in exchange-traded funds (ETFs) can be a great way to diversify a Stocks and Shares ISA in a cost-effective way.

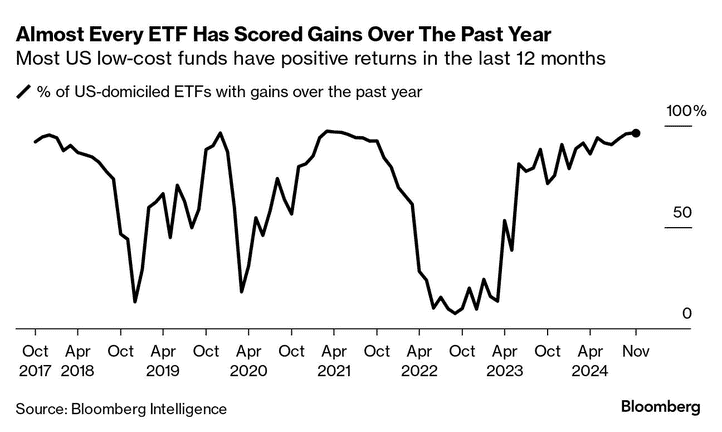

Putting money in one of these financial instruments has been especially lucrative over the past 12 months. According to Bloomberg Intelligence analysis, 96% of ETFs in the US have posted positive returns over this period, with the majority of products delivering double-digit returns.

Bloomberg comments: “If you’ve put money in an exchange-traded fund — those cheap products designed for the masses — you’re likely enjoying stellar gains, no matter what you’ve been betting on”.

Strong performers

It’s not just US funds that have been performing strongly over the past year. A number of London-listed ETFs I’ve bought for my own portfolio have delivered healthy gains.

The Xtrackers MSCI World Momentum ETF, for instance, has risen by exactly a third since November 2023. And the HSBC S&P 500 ETF’s up 28%, bolstered by the bull run in US shares.

UK-focused funds have also performed valiantly in recent times. The iShares Core FTSE 100 ETF’s up 15% since last November.

Past performance is no guarantee of future returns. And predicting how shares and funds will perform near-term in the current geopolitical and macroeconomic landscape’s especially tough.

But this doesn’t mean I’m not looking for more ETFs to buy. This is because I invest with a long-term view. The L&G Cyber Security ETF’s (LSE:ISPY) a fund I think ISA investors like me should pay close attention to.

L&G Cyber Security ETF

This fund — which is administered by Legal & General — has rocketed in value since its launch in 2015. It’s up 24% in the past 12 months alone.

The broader tech sector’s been powered by the buzz around artificial intelligence (AI) during the last year. This fund meanwhile, has been helped by speculation that AI development will create a new opportunity for hackers and other cyber criminals.

Analysts at Fortune Business Insights think the global cybersecurity market will be worth $562.7bn by 2032. That represents compound annual growth of 14.2% from today’s levels.

Investing in this L&G cybersecurity ETF could be an effective way to capitalise on this growing market. It holds shares in more than 30 sector players including Cloudflare, Crowdstrike, Palo Alto, and Cisco Systems.

Operational problems (like system failures and competitive pressures) could impact the performance of these companies. But by investing in a basket of these cyber firms, the impact could be minimal.

A wider threat is that 90% of the fund’s earnings are reported in US dollars. It could be more vulnerable to movements in the greenback than ETFs with wider currency diversification.

But on balance, I still expect the fund to keep delivering excellent long-term returns.

The post ETFs are soaring! Here’s a star fund for Stocks and Shares ISA investors to consider appeared first on The Motley Fool UK.

Passive income stocks: our picks

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

More reading

- 2 ISA mistakes I’m keen to avoid

- Want a £1,320 passive income in 2025? These 2 UK shares could deliver it!

- With P/E ratios below 8, I think these FTSE 250 shares are bargains!

- Are stocks and shares the only way to become an ISA millionaire?

- 4,775 shares in this dividend stock could yield me £1.6k a year in passive income

Royston Wild has positions in Legal & General, Hsbc ETFs Public – Hsbc S&P 500 Ucits ETF and Xtrackers (ie) Public – Xtrackers Msci World Momentum Ucits ETF. The Motley Fool UK has recommended Cloudflare and CrowdStrike. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.