10%+ dividend growth! 2 FTSE 250 shares tipped to turbocharge dividends

Are you searching for dividend stocks to buy? Here are two FTSE 250 income shares I think are worth serious consideration.

Both are tipped to grow annual dividends by double-digit percentages during the next two years.

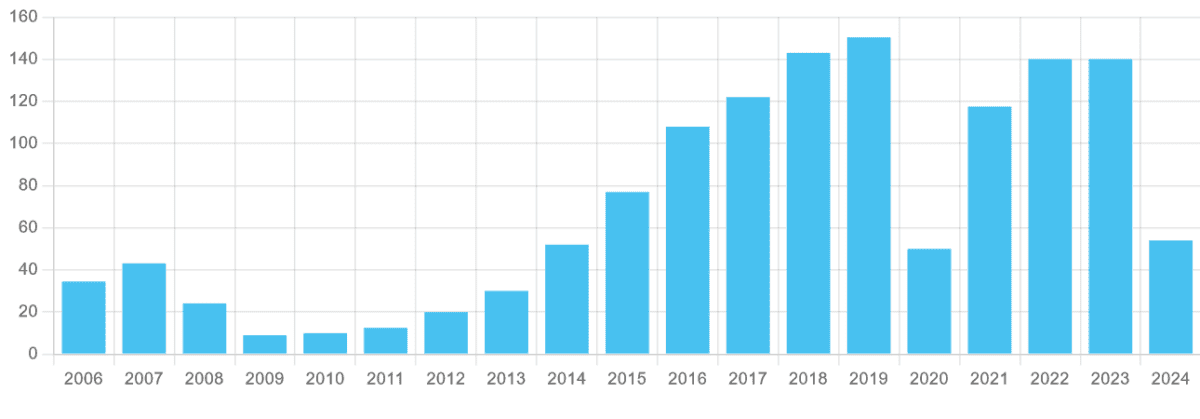

Bellway

Dividend yields: 2.6% for 2025, 3.4% for 2026

Dividends at Bellway (LSE:BWY) have been up and down like a seesaw in recent years. In the last financial year (ending July 2024), shareholder payouts more than halved due to the UK’s sinking housing market.

Such volatility can be part-and-parcel of investing in cyclical shares. And the battle isn’t won yet for the likes of Bellway, with stubborn inflation leading economists to revise up their interest rate expectations. Higher rates would dampen demand for the company’s homes.

Yet despite this, City analysts still expect dividends here to soar again. This is unsurprising to me given the ongoing strength of industry data. Fresh Office for National Statistics data showed home values in September rise at their fastest rate since February 2023.

City analysts think Bellway’s profits will increase 18% this financial year. And so the annual dividend is expected to jump 18%, to 63.9p per share.

Another 32% payout rise is tipped for financial 2026, to 84.5p. This is supported by predictions of a 31% profits increase.

Forecasts can turn out to be wrong, of course, but I’m confident Bellway will make good on these, thanks to its strong dividend cover. Predicted cash rewards are covered 2.5 times over by expected earnings for both the next two years.

This is comfortably above the widely regarded safety benchmark of two times. So Bellway may have plenty of wiggle room even if the housing market recovery begins to cool.

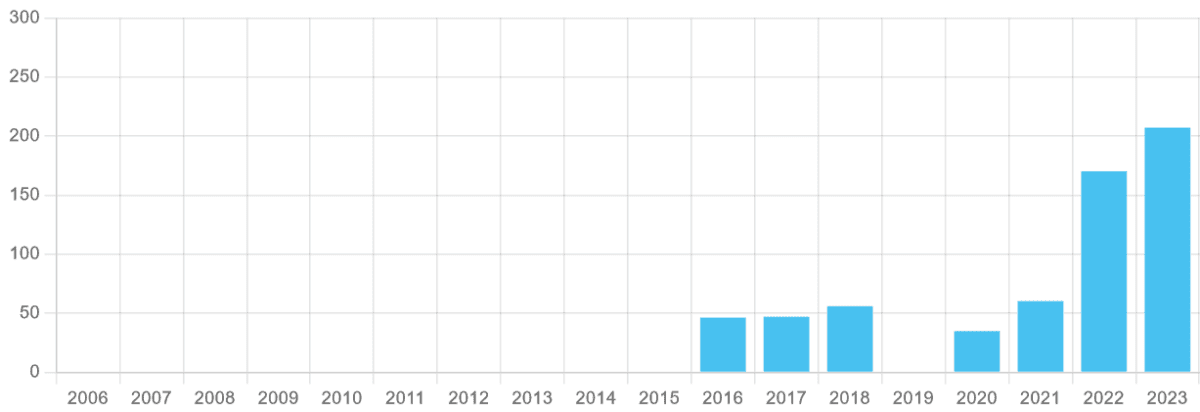

TBC Bank Group

Dividend yields: 6.7% for 2024, 8.1% for 2025

Dividends at TBC Bank Group (LSE:TBCG) have rebounded strongly since the depths of the Covid-19 crisis. And as with the housebuilder, City analysts are tipping robust payout growth for the next two years.

For 2024, a total payout of 7.56 Georgian lari (£2.18) per share is predicted. That’s up 5% from last year’s levels. Dividend growth is expected to accelerate to 20% next year, too, resulting in a reward of 9.10 lari.

Forecasts are supported by expected earnings growth of 11% and 20% in 2024 and 2025.

These bright estimates reflect the resilience of Georgia’s economy and the boost this is giving to financial services providers. TBC’s latest financials showed pre-tax profits up 19.1% in the September quarter.

Dividends are never guaranteed, as we’ve seen. But I expect the company to meet these forecasts. As with Bellway, TBC enjoys excellent dividend cover for the period, with a high reading of three times. This provides a wide buffer if economic conditions worsen, for instance, and falling loan demand hits profits.

On top of this, TBC has a strong balance sheet it use to help it pay dividends. As of September, the bank’s CET1 capital ratio was 16.6%, well above regulatory requirements.

The post 10%+ dividend growth! 2 FTSE 250 shares tipped to turbocharge dividends appeared first on The Motley Fool UK.

But there may be an even bigger investment opportunity that’s caught my eye:

Investing in AI: 3 Stocks with Huge Potential!

🤖 Are you fascinated by the potential of AI? 🤖

Imagine investing in cutting-edge technology just once, then watching as it evolves and grows, transforming industries and potentially even yielding substantial returns.

If the idea of being part of the AI revolution excites you, along with the prospect of significant potential gains on your initial investment…

Then you won’t want to miss this special report inside Motley Fool Share Advisor – ‘AI Front Runners: 3 Surprising Stocks Riding The AI Wave’!

And today, we’re giving you exclusive access to ONE of these top AI stock picks, absolutely free!

More reading

Royston Wild has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.