4,123 shares of this UK dividend stock could get me £206 a month in passive income

I don’t withdraw any dividends that are paid into my Stocks and Shares ISA. Instead, I use all of the passive income I receive to buy more shares.

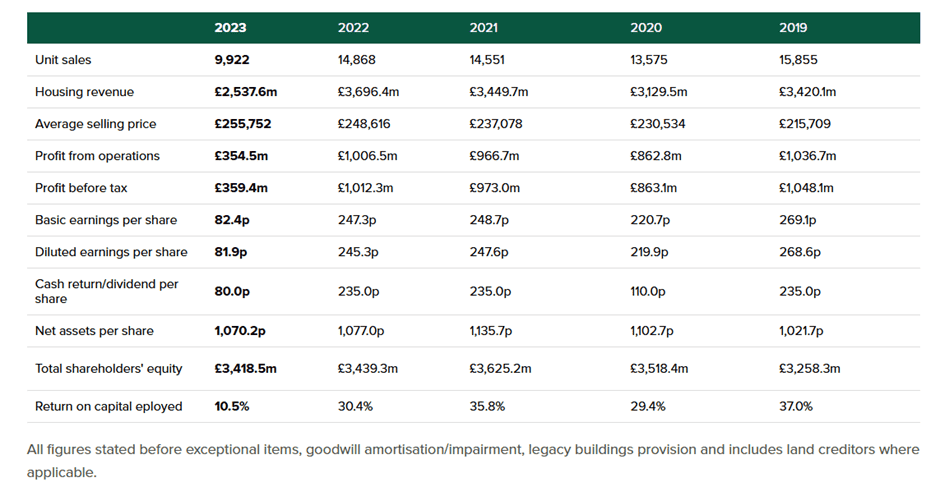

That’s what I’ve been doing with one of my biggest holdings, Persimmon (LSE:PSN). I first bought the stock several years ago, just after the pandemic wreaked havoc on the world. I was initially attracted by its generous dividend — it paid 235p a share during the year ended 31 December 2020 (FY20).

Even when the shares reached their all-time high in February 2020, the stock was still yielding over 7%.

Difficult times

But a collapse in the housing market prompted by increased borrowing costs and a cost-of-living crisis, means the days of a triple-digit payout are long gone. For FY24, the company said its intention is to “at least maintain” the FY23 dividend (60p) “with a view to growing this over time as market conditions permit”.

I’m therefore expecting to receive a payout of 60p this year. Based on a current (22 November) share price of £12.74, this implies a yield of 4.7%. Despite its recent woes, this is comfortably above the FTSE 100 average of 3.8%.

To achieve my target of £206 a month in passive income, I’d need to buy 4,123 shares, costing £52,527. Now that’s a lot of money, but my income figure hasn’t been chosen randomly.

In fact, according to the latest data from the Office for National Statistics, it’s the average amount of investment income received by UK households each year (£2,474).

But it doesn’t really matter how much is invested as it’s the yield that really counts. A return on 4.9% is the same (in relative terms) irrespective of the size of the investment.

However, given its track record of paying generous dividends, I’d like to think Persimmon’s payout will increase over the medium term.

But how likely is this?

An improving picture?

Analysts are expecting earnings per share (EPS) to be almost the same in FY24 (82.5p), as they were for FY23 (82.4p).

But things are predicted to get more interesting thereafter. EPS growth of 21% is forecast for FY25, and 24% in the following year. Persimmon has a reputation for paying out almost all of its earnings in dividends. From FY19 to FY23, it returned 84% to shareholders.

If it did this in FY26, the dividend would be 104p. Admittedly, it’s a long way shy of 235p but, if this was achieved, the stock’s currently yielding 8.2%.

But a recovery in the housing market isn’t guaranteed. And the housebuilder warned of early signs of supply chain inflation in its most recent update to investors. This is concerning given that the recent bout of price increases has already fundamentally changed the financial landscape for Britain’s construction industry.

Comparing 2023 with 2019, the average selling price achieved by Persimmon has increased by 18.6%. However, operating profit per house has fallen by 45.4%.

My verdict

Despite this, I’d still buy it today, if I was in a position to do so. I’m sitting on a large paper loss from my existing position in the company. And I’d like the opportunity to bring down the average cost price of my shares while benefitting from an above-average dividend. I do think it’s worth investors considering.

The post 4,123 shares of this UK dividend stock could get me £206 a month in passive income appeared first on The Motley Fool UK.

But there are other promising opportunities in the stock market right now. In fact, here are:

5 stocks for trying to build wealth after 50

The cost of living crisis shows no signs of slowing… the conflict in the Middle East and Ukraine shows no sign of resolution, while the global economy could be teetering on the brink of recession.

Whether you’re a newbie investor or a seasoned pro, deciding which stocks to add to your shopping list can be a daunting prospect during such unprecedented times. Yet despite the stock market’s recent gains, we think many shares still trade at a discount to their true value.

Fortunately, The Motley Fool UK analyst team have short-listed five companies that they believe STILL boast significant long-term growth prospects despite the global upheaval…

We’re sharing the names in a special FREE investing report that you can download today. We believe these stocks could be a great fit for any well-diversified portfolio with the goal of building wealth in your 50’s.

More reading

James Beard has positions in Persimmon Plc. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.