Down 23% in a day but up 148% in 2 months, is this $7 growth stock a buy for me?

Red-hot growth stock Archer Aviation (NYSE: ACHR) hit a turbulent patch yesterday (2 December), ending the day 23% lower. Yet shares of the flying-taxi company are still up 148% in just two months!

Should I buy the dip? Let’s discuss.

What is Archer?

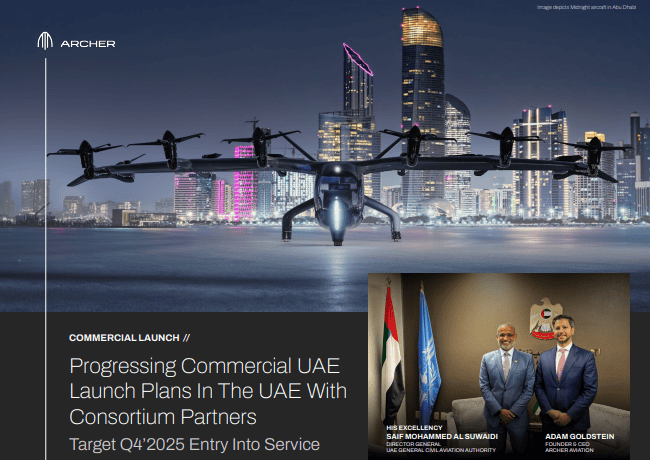

Archer Aviation is one of a handful of companies racing to commercialise electric vertical take-off and landing (eVTOL) aircraft. In other words, electric aircraft capable of taking off and landing much like helicopters, but with far less pollution and noise.

These air taxis are potentially ideal for urban areas. They could bypass congested roads, dramatically reduce travel times, and lower emissions.

For example, Archer plans a flying taxi network in Los Angeles (where traffic is horrendous) in early 2026 to turn an hour-long ground commute into minutes in the air. How so? Well, with no road congestion and traffic lights to contend with, its eVTOLs can travel uninterrupted at speeds of up to 150 mph!

The firm plans to operate an Uber-like ride-hailing service, as well as sell its aircraft (called Midnight) to third-parties. Its preliminary order book now exceeds $6bn.

In September, the US’s Federal Aviation Administration (FAA) approved eVTOLs. It was the first new category of aircraft regulated by the agency since the introduction of helicopters nearly a century ago.

Uncertainty has landed

The company is backed by Stellantis, which owns Fiat and Vauxhall. In August, it committed up to $400m to scale Midnight production to 650 aircraft annually at Archer’s Georgia facility through to 2030.

And this likely explains yesterday’s sell-off, as Stellantis CEO Carlos Tavares abruptly resigned over the weekend. The carmaker’s sales have been sluggish, forcing it issue a profit warning in September.

Tavares was supportive of Archer’s ambitions. But will the next CEO be as willing to keep pumping money into a speculative eVTOL venture? My hunch is yes, given the significant investments already made. But it adds uncertainty, and the market hates that.

US vs UAE

Archer ended Q3 with $502m in cash. However, it lost $115m in the quarter, so will clearly need further injections of cash to ramp up production of its aircraft. Shareholders therefore face the risk of dilution.

That might not matter long term, assuming the company can achieve commercial success. This is where another risk arises though, as the company is still waiting to achieve full certification for its aircraft.

It’s nearly completed Phase 3 of the FAA’s type certification process, while advancing through Phase 4, the final phase. So it’s on track to begin operating in late 2025 or early 2026.

However, the United Arab Emirates (UAE) may pip the US to launch the world’s first electric air taxi routes. There’s a bit of a race on between the two nations, and Archer aims to start services in the UAE in late 2025.

My move

To gain exposure to this industry, I’ve invested in rival Joby Aviation (backed by Uber).

| The two at a glance | Joby Aviation | Archer Aviation |

|---|---|---|

| Founded | 2009 | 2018 |

| Market cap | $5.5bn | $2.6bn |

| Cash position | $710m at the end of Q3, with a further $722m raised since | $502m at the end of Q3, with another $400m on the horizon |

| Aircraft | One pilot and four passengers at speeds of up to 200 mph | One pilot and four passengers at speeds of up to 150 mph |

| Design approach | Vertically integrated | Relies on aerospace suppliers for components |

| Manufacturing partner | Toyota | Stellantis |

| Expected commercial launch | Late 2025 | Late 2025 |

These stocks are highly speculative and carry a lot of risk, so I don’t want both in my portfolio.

However, this is also a potentially massive emerging market. I’m happy to hold one long term.

The post Down 23% in a day but up 148% in 2 months, is this $7 growth stock a buy for me? appeared first on The Motley Fool UK.

5 Shares for the Future of Energy

Investors who don’t own energy shares need to see this now.

Because Mark Rogers — The Motley Fool UK’s Director of Investing — sees 2 key reasons why energy is set to soar.

While sanctions slam Russian supplies, nations are also racing to achieve net zero emissions,

he says. Mark believes 5 companies in particular are poised for spectacular profits.

Open this new report — 5 Shares for the Future of Energy

— and discover:

- Britain’s Energy Fort Knox, now controlling 30% of UK energy storage

- How to potentially get paid by the weather

- Electric Vehicles’ secret

backdoor

opportunity - One dead simple stock for the new nuclear boom

Click the button below to find out how you can get your hands on the full report now, and as a thank you for your interest, we’ll send you one of the five picks — absolutely free!

More reading

Ben McPoland has positions in Uber Technologies. The Motley Fool UK has recommended Uber Technologies. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.