If an investor puts £750 a month in a Stocks and Shares ISA, here’s what they could have in 10 years

The Stocks and Shares ISA can be a very powerful wealth-building tool. These accounts typically offer access to a vast range of investments, and any gains and income generated within them are completely tax-free.

Want to see an example of how this type of ISA can be used to build wealth? Here’s a look at how much capital that could potentially be accumulated putting £750 a month into one of these products for the next 10 years.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

ISA returns can vary

With a Stocks and Shares ISA, returns can vary significantly depending on the chosen investments. Pick the right mix of funds and/or stocks and it’s possible to achieve returns of more than 10% a year. Invest in the wrong assets, on the other hand, and you could be looking at low single-digit or even negative returns.

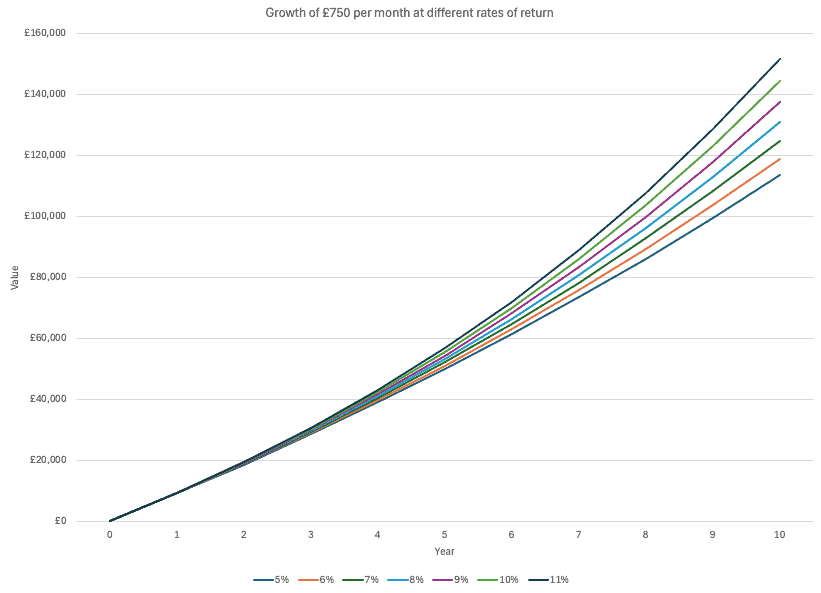

In the chart below, I show how much a £750 contribution a month could grow to at different rates of return. At 5% a year, it could grow to around £115k. At 8% a year, it would grow to around £130k. Meanwhile, at 11% a year, it would grow to around £150k. Bear in the mind that the total amount of contributions over 10 years would be £90,000 (£9k a year). So in some cases, we’re looking at considerable capital gains (tax-free in the ISA).

Achieving high returns

Now, with a sound investment strategy, achieving a 8% annual return isn’t so difficult. Typically, the stock market (as a whole) tends to generate returns of around 7-10% a year over the long term. So with a global tracker fund such as the Vanguard FTSE All-World UCITS ETF, an 8% return could be very achievable. It’s worth noting that over the last decade, this ETF has returned about 9% on an annualised basis (excluding currency fluctuations, trading fees, and platform fees).

Achieving an 11% annual return’s more tricky. But it certainly isn’t impossible. If I was aiming for this kind of return, I’d have to be a little bit more active with my investments. Instead of just lumping all my cash in a global tracker fund, I’d invest in a range of funds and stocks, with the goal of outperforming the market.

Individual stocks can soar

I’ll point out that I’ve been able to achieve outperformance in recent years with an active strategy. One stock that’s helped me beat the market is Apple (NASDAQ: AAPL). Since I first bought it about six years ago, it’s risen about 450%. That equates to an annualised return of more than 30% (ignoring currency movements).

Now, while I still like Apple, I don’t see it as a strong buy for me today. Currently, the stock’s forward-looking price-to-earnings (P/E) ratio is about 34. That multiple could make it hard for the stock to outperform the market in the years ahead as a lot will depend on earnings growth (and there is the risk that this could be low, especially if iPhone sales are muted).

But there are plenty of other stocks I’m bullish on. Some shares I’ve been buying recently include Uber, CrowdStrike, and JD Sports Fashion.

The post If an investor puts £750 a month in a Stocks and Shares ISA, here’s what they could have in 10 years appeared first on The Motley Fool UK.

Should you buy Apple now?

Don’t make any big decisions yet.

Because Mark Rogers — The Motley Fool UK’s Director of Investing — has revealed 5 Shares for the Future of Energy.

And he believes they could bring spectacular returns over the next decade.

Since the war in Ukraine, nations everywhere are scrambling for energy independence,

he says. Meanwhile, they’re hellbent on achieving net zero emissions.

No guarantees, but history shows…

When such enormous changes hit a big industry, informed investors can potentially get rich.

So, with his new report, Mark’s aiming to put more investors in this enviable position.

Click the button below to find out how you can get your hands on the full report now, and as a thank you for your interest, we’ll send you one of the five picks — absolutely free!

More reading

- 1 overlooked reason Warren Buffett’s made so much money by investing in Apple

- How much would I need in a Stocks and Shares ISA to earn £300 a month?

- Investing £5,000 in a Nasdaq 100 index fund 5 years ago would be worth this much now

- 5 Stocks and Shares ISA mistakes to avoid

- Is the stock market set for a crash in 2025?

Edward Sheldon has positions in Apple, CrowdStrike, JD Sports Fashion, and Uber Technologies. The Motley Fool UK has recommended Apple, CrowdStrike, and Uber Technologies. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.