Why the BP share price fell 16% in 2024

It’s easy to think the BP (LSE:BP) share price has been falling because oil prices have been heading lower. But that’s only part of the problem.

Election results on both sides of the Atlantic have also changed the landscape. And I think BP’s recent track record’s also a significant issue.

BP’s issues

After a positive first quarter, oil prices fell in 2024. This was due to higher output from some OPEC+ producers accompanied by weak demand from China and a post-pandemic recovery that began to falter.

Brent crude oil 2023-24

Created at TradingView

The company estimates a $1 drop in the price of Brent causes a $340m fall in annual pre-tax profits. And BP can’t do much to influence oil prices, making this a key risk.

As a result of oil prices falling from April to the end of the year, earnings per share consistently came in lower than the year before. But this shouldn’t be a surprise for investors.

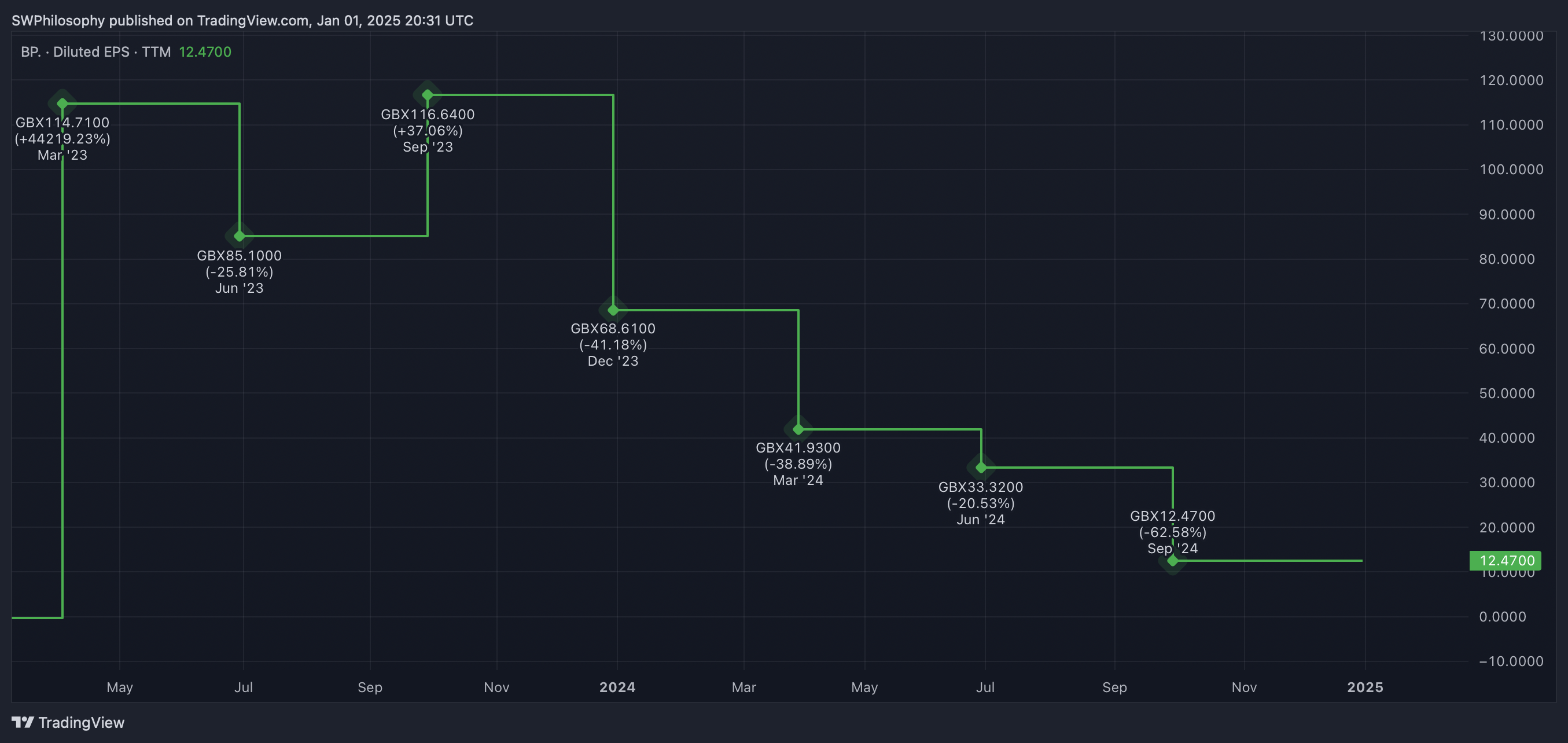

BP earnings per share (ttm) 2023-24

Created at TradingView

Anyone considering investing in oil stocks should be prepared for at least some volatility as the price of crude changes. With BP however, this isn’t the only risk to consider.

Election results

With oil a commodity, the main advantage a company can have is lower production costs. And elections on both sides of the Atlantic significantly impacted BP last year.

The UK elected a government looking to transition away from hydrocarbons and towards renewables. As a result, taxes for UK oil companies look set to rise – especially in core operations.

Over in the US, the incoming administration looks set to cut taxes and is aiming to incentivise energy production. The combination of these developments doesn’t help BP’s competitive position.

Importantly though, Shell‘s facing the same challenges. But the stock hasn’t fared as badly in 2024, which suggests the pressure on BP shares isn’t just about oil prices and windfall taxes.

Wrong place, wrong time

Over the last few years, BP’s managed to get itself in the wrong place at the wrong time in terms of its strategy. The company invested heavily in wind and solar energy projects a few years ago.

Unfortunately, BP’s expertise is in oil and gas. As a result, its forays into renewable energy generation resulted in big losses in 2022 when it could have been cashing in on high oil prices.

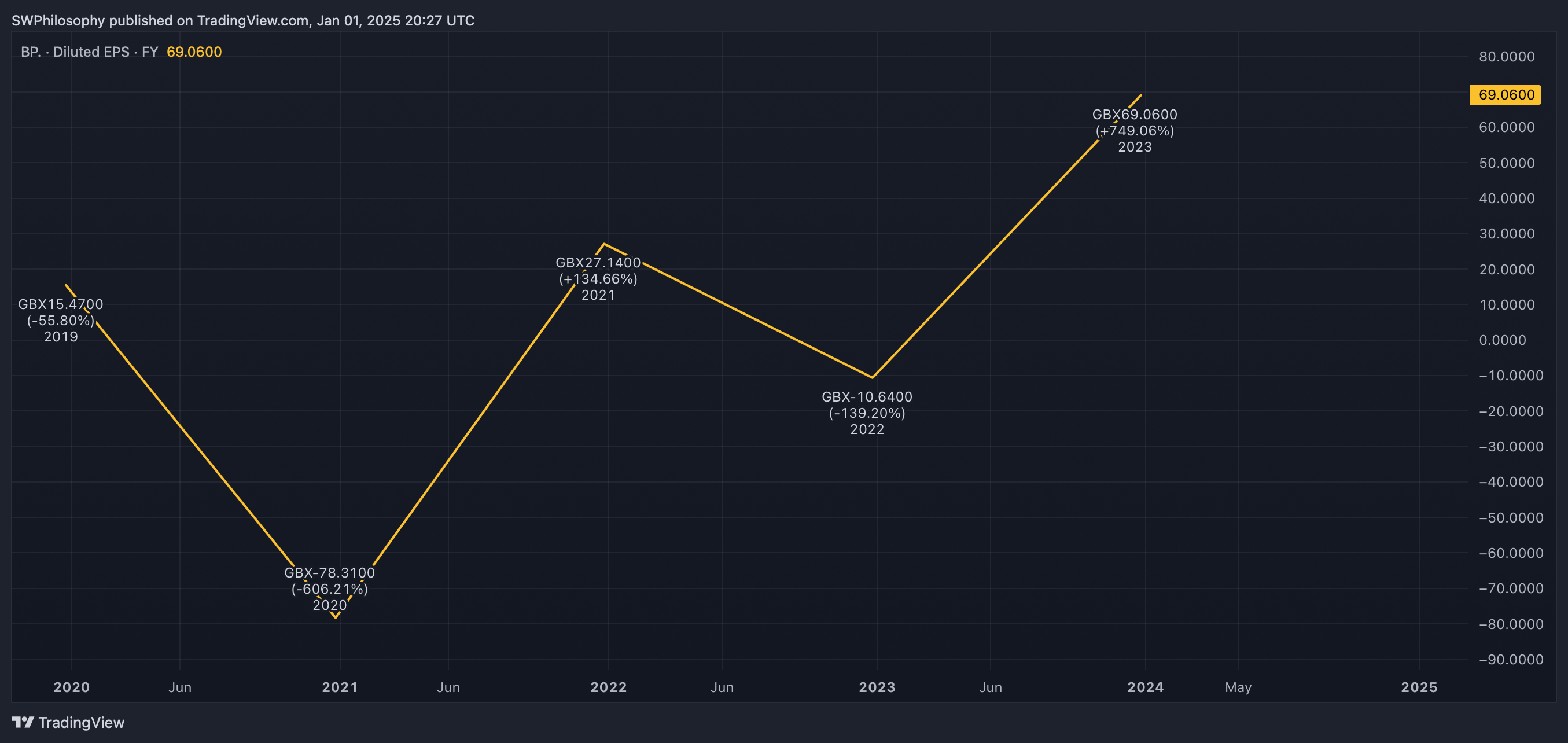

BP earnings per share 2020-23

Created at TradingView

Since then, the firm has shifted back to its core competencies. But it seems to be doing this just as oil prices are starting to come down, having missed an opportunity when they were much higher.

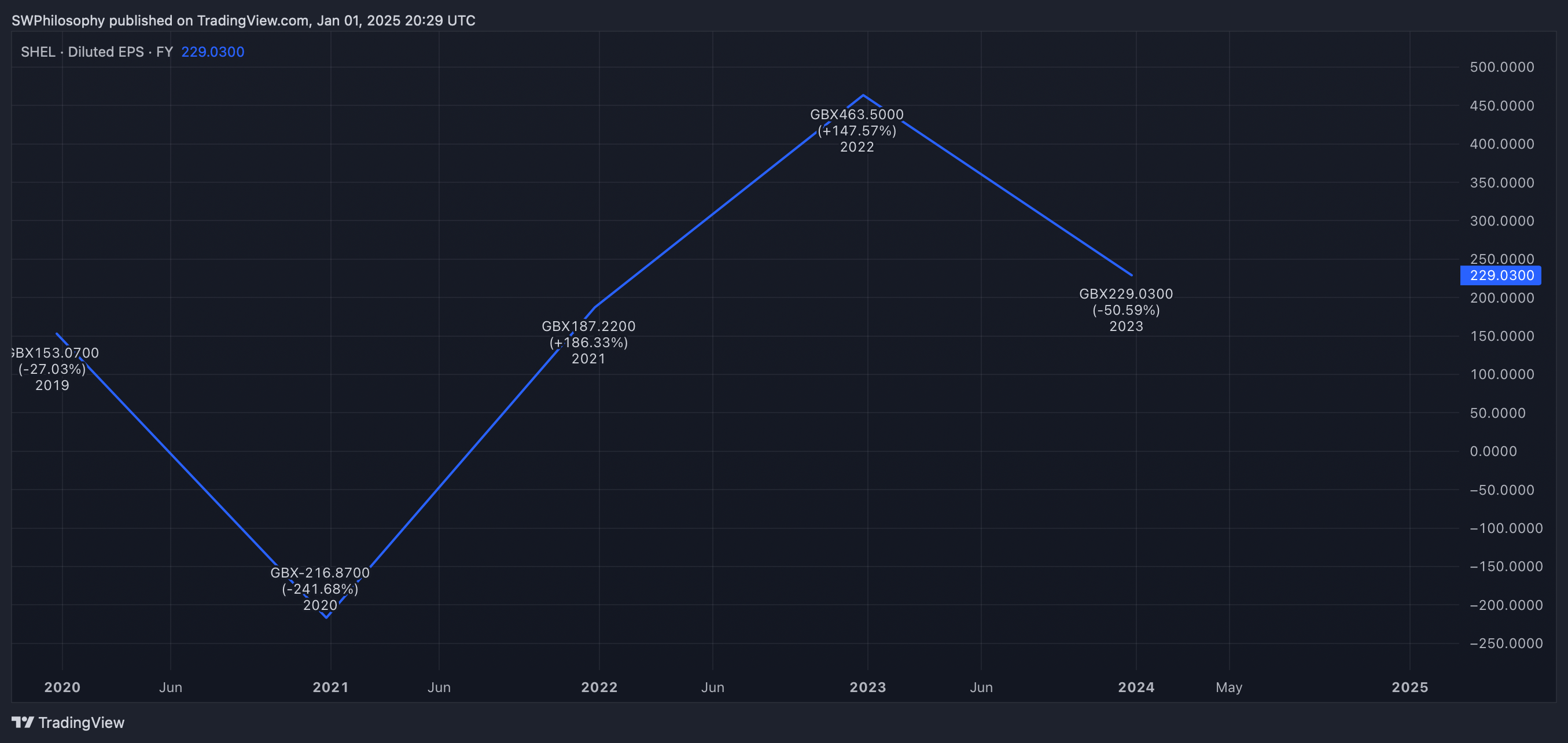

Shell earnings per share 2020-23

Created at TradingView

By contrast, Shell stayed focused on hydrocarbons. And I think this is a key part of why investors have been more tolerant of its earnings falling in 2024 – they benefitted when prices were high.

What now?

I think BP now has the right strategy and the difference in valuation means I like the stock better than Shell at today’s prices. But I’m not prepared to buy either at the moment.

To some extent, the latest windfall tax developments are probably priced in. But I see this as an ongoing risk that’s difficult to assess accurately and that’s enough to keep me on the sidelines.

The post Why the BP share price fell 16% in 2024 appeared first on The Motley Fool UK.

But here’s another bargain investment that looks absurdly dirt-cheap:

Like buying £1 for 31p

This seems ridiculous, but we almost never see shares looking this cheap. Yet this Share Advisor pick has a price/book ratio of 0.31. In plain English, this means that investors effectively get in on a business that holds £1 of assets for every 31p they invest!

Of course, this is the stock market where money is always at risk — these valuations can change and there are no guarantees. But some risks are a LOT more interesting than others, and at The Motley Fool we believe this company is amongst them.

What’s more, it currently boasts a stellar dividend yield of around 10%, and right now it’s possible for investors to jump aboard at near-historic lows. Want to get the name for yourself?

More reading

- BP share price to surge by 70% in 12 months!? How realistic is that forecast?

- Here’s the stunning BP share price forecast for 2025

- Is the BP share price set for a 75% jump?

- The BP share price is up 7% in a month but still looks great value with a P/E of 5.73 and 5.67% yield!

- 1 FTSE 100 stock I’ll avoid like the plague in 2025!

Stephen Wright has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.