I was wrong about the IAG share price last year. Should I buy it in 2025?

The International Consolidated Airlines Group (LSE:IAG) share price had a stellar 2024. In fact, it was one of the best-performing FTSE 100 stocks of last year.

I didn’t see that coming at all. But with analysts bullish on the stock for 2025, should I be looking to buy it for my portfolio now?

What went wrong for me?

I suspected a higher cost of living would result in lower demand for air travel in 2024. And I thought this would be especially true of International Consolidated Airlines, which doesn’t own a budget airline like easyJet or Ryanair.

I was wrong about this – demand held up fairly well for the owner of British Airways and Iberia. And even I have to admit that management did an impressive job of putting its cash to good use.

In August, the firm backed out of a deal to buy a stake in Air Europa, Spain’s third-largest airline. Instead, it reduced its debt and set about returning cash to shareholders.

I think all of this is highly positive for shareholders and it’s therefore not a big surprise to see the shares performing well. And analysts are optimistic that 2025 could be another strong year for the stock.

Outlook

Airlines are a highly cyclical business, but there are reasons to be positive about International Consolidated Airlines in 2025. Fuel prices – one of its largest costs – are set to fall, with the outlook for oil prices looking fairly weak.

On top of this, capacity constraints on flights across the Atlantic should also put the company in a strong position when it comes to pricing. Adding this to lower costs could prove a powerful combination.

I wouldn’t buy the stock on the basis of what might happen in just the next year, but there are also more durable positives to consider. Shifting to more fuel-efficient aircraft should generate ongoing cost reductions.

All of this has caused analysts at Deutsche Bank to upgrade the stock to a Buy. But while it’s hard to dispute the fact that IAG is doing a lot right, I’m still unconvinced by the long-term outlook.

Share buybacks

I’m wary about investing in cyclical companies when things look like they’re going well. And International Consolidated Airline’s recent share buyback announcement reminds me of the risks with these kinds of businesses.

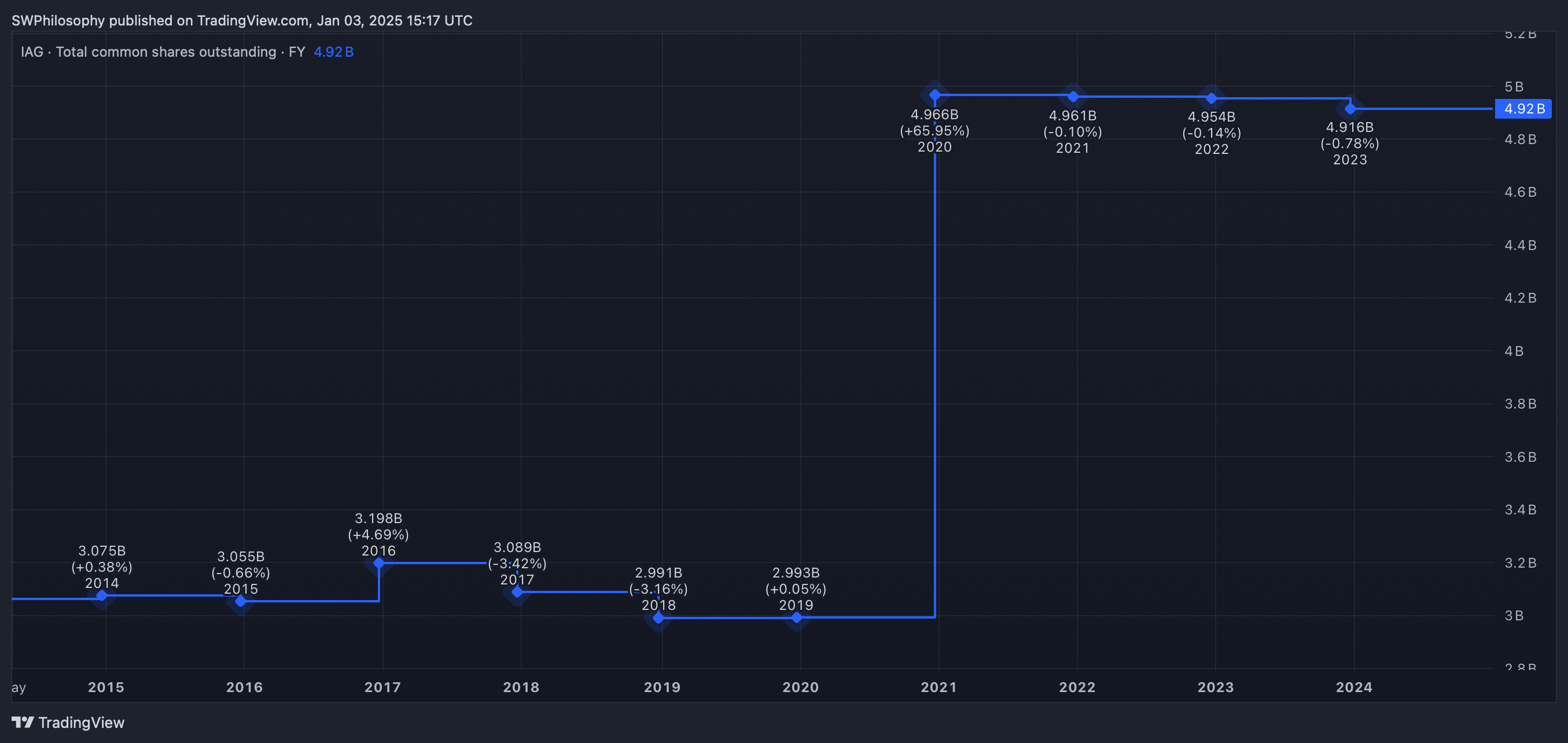

Back in 2020, the firm issued shares to shore up its balance sheet in response to the challenges of Covid-19 travel restrictions. In doing so, it increased the share count by around 66%.

IAG share count 2014-2024

Created at TradingView

Now that things have improved, the firm is planning to buy (at least some of) them back again. But from a long-term perspective, this doesn’t fill me with enthusiasm.

The company was issuing stock at around £1.49 and is now looking to buy it back at around £3. That’s exactly the wrong way round in terms of making money for shareholders.

Should I buy?

I don’t blame IAG’s management for failing to predict the Covid-19 pandemic. But the risk of issuing shares at low prices and buying them back at higher ones doesn’t make me feel good about the business.

This is why I’m staying away from the stock in my own investing. Whatever the next year brings, I think the cyclical challenges for this type of business pose too great of a threat.

The post I was wrong about the IAG share price last year. Should I buy it in 2025? appeared first on The Motley Fool UK.

But here’s another bargain investment that looks absurdly dirt-cheap:

Like buying £1 for 31p

This seems ridiculous, but we almost never see shares looking this cheap. Yet this Share Advisor pick has a price/book ratio of 0.31. In plain English, this means that investors effectively get in on a business that holds £1 of assets for every 31p they invest!

Of course, this is the stock market where money is always at risk — these valuations can change and there are no guarantees. But some risks are a LOT more interesting than others, and at The Motley Fool we believe this company is amongst them.

What’s more, it currently boasts a stellar dividend yield of around 10%, and right now it’s possible for investors to jump aboard at near-historic lows. Want to get the name for yourself?

More reading

- FTSE shares: a generational opportunity to get rich?

- Are IAG shares the next Rolls-Royce?

- At 7x forward earnings, this could be the FTSE 100’s biggest winner in 2025

- The IAG share price is up 93% in 2024! What next?

- Here’s what £10k invested in the FTSE 100 at the start of 2024 would be worth today

Stephen Wright has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.