Legal & General shares are forecast to return 25% in 2025! Can they do it?

At first glance, Legal & General (LSE: LGEN) shares look like an open-and-shut buy-and-hold case for me.

This is a solid FTSE 100 blue-chip that offers a magnificent trailing yield of 8.85%, smashing the returns on cash. The only possible verdict is Buy then hang on for the long term, surely?

But it’s more complicated than that. With a big stake in Legal & General, even Iâm not totally persuaded.

That sky-high dividend is a thing of beauty, and incredibly, the yield is forecast to climb to 9.5% this year. But it also has a dark side.

Will it ever grow?

It has wafer-thin cover of just 1.1 times earnings, which gives pause for thought. Can Legal & General really afford its largesse?

The board reckons it can, but it’s also cautious. Last June, it announced new dividend guidance. After hiking the dividend by 5% in full-year 2024, it will increase at a slower 2% thereafter.

Legal & General has a heap of excess capital on top of its regulatory requirements, roughly £9bn at last count. The board also expects to generate another £5bn to £6bn of capital between now and 2027 and felt sufficiently confident to announce a £200m share buyback in June.

Yet that capital generation was slightly lower than hoped, and the share buyback wasnât exactly dazzling.

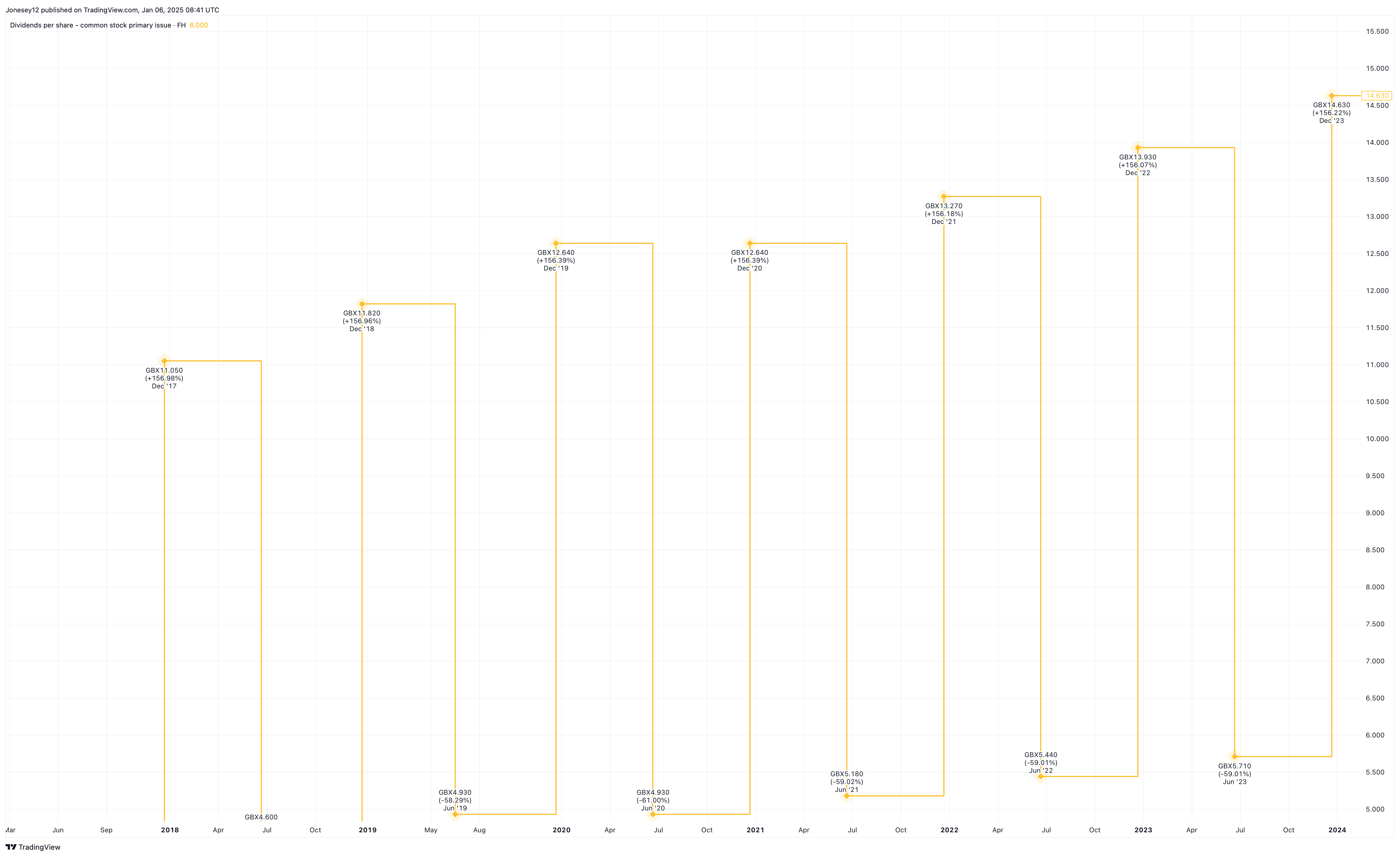

The dividend has grown at an average pace of around 3% in recent years, so a drop to 2% is a disappointment. Although given the massive yield, it’s hard to complain. Let’s see what the chart says.

Chart by TradingView

Now letâs turn to the share price. Here, the news is poor. It fell 6.3% over the last 12 months, reducing the total return to around 2.5% after the dividend. Over five years, the stock is down 25%, wiping out most of the income. Saving cash would have done better.

The last five years have obviously been bumpy, as they saw the pandemic, the cost-of-living crisis and political turmoil.

The financials sector should get a lift when interest rates finally start falling. As the return from low-risk rivals like cash and bonds drops, ultra-high-yielders like this one will look more tempting.

I’m still hanging around for those dividends

Lower interest rates should also boost the stock market generally, potentially driving up the value of the £1.2trn of assets Legal & General manages. The downside is that this could hit sales of personal annuities, which have rebounded lately as rates rise.

Legal & General operates in a mature and competitive market, but it has one big opportunity: pension risk transfers, often called bulk annuities. This involves taking on responsibility for running companiesâ final salary pension schemes.

The market is worth £6trn in the UK, yet so far only a small number of companies have transferred their schemes to insurers. Plus thereâs a growing opportunity in the US, Canada, and the Netherlands.

This isnât without risk. Thereâs a reason companies want to pass on their pension liabilities. Legal & Generalâs actuaries need to manage them carefully.

Yet the 16 analysts following the stock predict a solid one-year share price increase of 15%. Combined with the forecast yield it could deliver a 25% total return.

Iâd be happy with that — no guarantees though. Iâm hanging on to my Legal & General shares despite recent underwhelming performance. But I’m biting my nails.

The post Legal & General shares are forecast to return 25% in 2025! Can they do it? appeared first on The Motley Fool UK.

But there are other promising opportunities in the stock market right now. In fact, here are:

5 stocks for trying to build wealth after 50

The cost of living crisis shows no signs of slowing… the conflict in the Middle East and Ukraine shows no sign of resolution, while the global economy could be teetering on the brink of recession.

Whether you’re a newbie investor or a seasoned pro, deciding which stocks to add to your shopping list can be a daunting prospect during such unprecedented times. Yet despite the stock market’s recent gains, we think many shares still trade at a discount to their true value.

Fortunately, The Motley Fool UK analyst team have short-listed five companies that they believe STILL boast significant long-term growth prospects despite the global upheaval…

We’re sharing the names in a special FREE investing report that you can download today. We believe these stocks could be a great fit for any well-diversified portfolio with the goal of building wealth in your 50’s.

More reading

- Legal & General shares could help turn £20k of savings into £150 of monthly passive income

- Does a 9.3% yield and a growing dividend make Legal & General shares a passive income no-brainer?

- My £3 a day passive income plan for 2025

- Here’s why the Legal & General share price could soar in 2025!

- £20k in a high-interest savings account? It could be earning more passive income in stocks

Harvey Jones has positions in Legal & General Group Plc. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.