Why I’m looking to buy FTSE 100 and FTSE 250 shares right now

On the face of it, right now doesn’t look like a good time to be buying UK shares. Higher taxes and National Insurance contributions have resulted in business confidence reaching its lowest level in years.

Despite this, I’m setting my sights on the UK stock market. At times like this, I think there are some great opportunities for investors – with a couple of caveats.

Survival of the fittest

Higher taxes and National Insurance contributions are going to challenge UK firms. But I think the best businesses – those that have lower costs or the ability to increase prices – will cope better than others.

As a result, I expect some companies to find themselves in a stronger competitive position a couple of years from now. And this could be a very good thing from a long-term perspective.

I think investors might overlook this point in some cases. And this could create some outstanding investment opportunities.

I’m therefore aiming to identify businesses that can weather the immediate storm and emerge in a stronger position for the long term. And there are a couple of stocks on my radar right now.

Howden Joinery Group

Howden Joinery Group’s (LSE:HWDN) a business I think has a huge long-term advantage. The firm’s big strength is its ability to charge customers less while making more money itself – a win for all parties.

The foundation of this is its trade-only sales strategy. This means it can operate out of warehouses and this brings down costs significantly, with no need to lease (or buy) expensive retail showrooms.

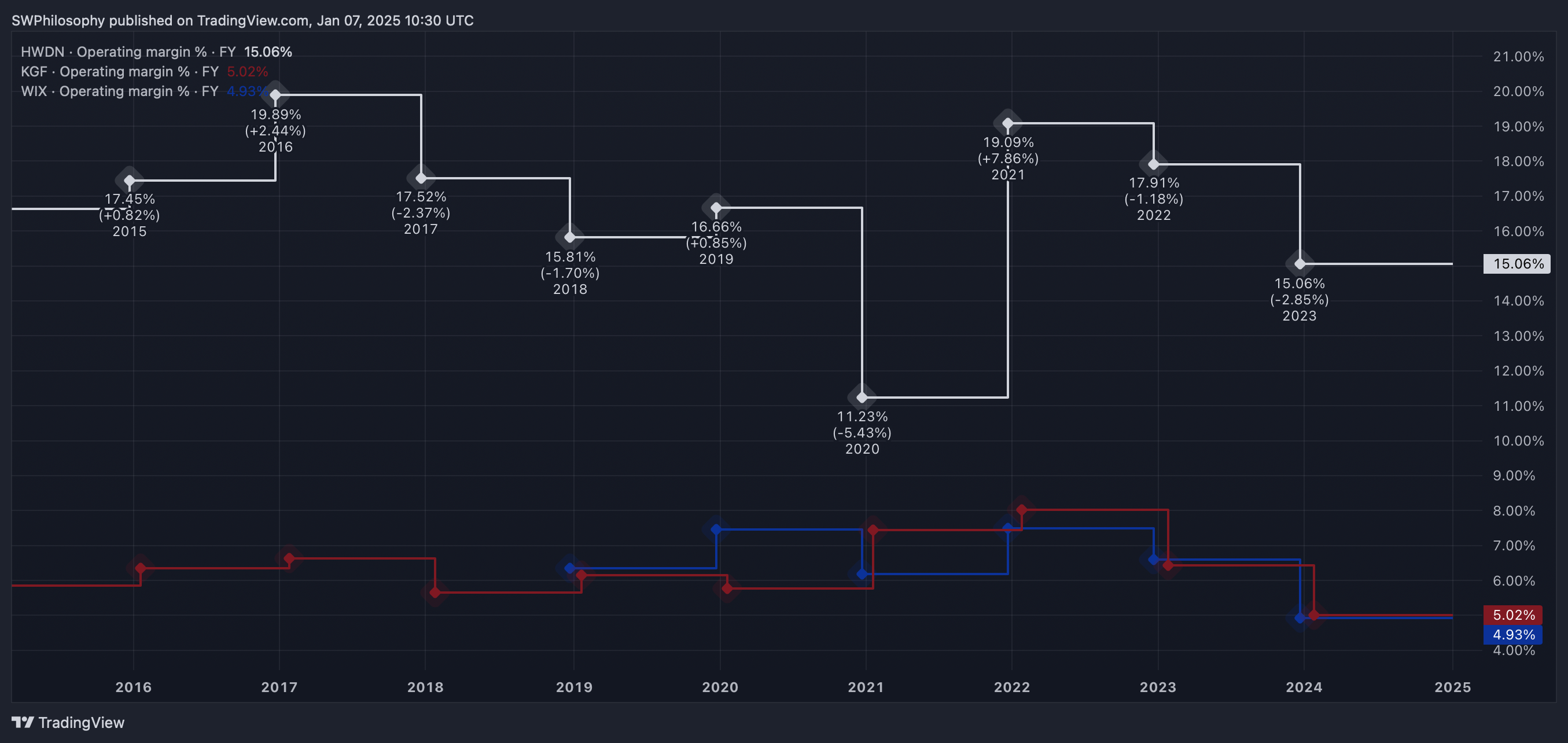

The results show up in the company’s profitability. Howden consistently manages operating margins above 15%, which is significantly higher than the likes of Kingfisher (6%) or Wickes (5%).

Howden Joinery Group vs Kingfisher vs Wickes Operating Margins 2015-24

Created at TradingView

This doesn’t make the firm immune to the effects of an economic downturn – and this is a key risk. But it should mean the business is more resilient in a difficult environment and emerges stronger as a result.

AG Barr

Another business I think could be unusually resilient is soft drinks producer AG Barr (LSE:BAG). In addition to higher costs, the firm’s also facing challenges from the rise of GLP-1 drugs that might threaten sales volumes.

This is a risk, but I think the company’s main brand puts it in a stronger position than its rivals. There aren’t many drinks that can compete with Coca-Cola, but Irn Bru has shown itself to be one of them.

AG Barr’s latest update offered investors a clear demonstration of this. Revenue grew 5.2% and a lot of this was the result of increasing prices without significant declines in sales volumes.

Not every business can do this. So while short-term challenges might limit profit growth in the near future, I expect long-term shareholders should benefit from a stronger competitive position.

Quality and value

Howden’s and AG Barr are two UK stocks I’m looking at right now – but they aren’t the only ones. There are several businesses I think could emerge from a difficult trading environment in a stronger position.

Investors looking to buy shares in quality companies at attractive prices should consider the UK stock market. Not everything looks good to me, but I think there could be some good opportunities.

The post Why I’m looking to buy FTSE 100 and FTSE 250 shares right now appeared first on The Motley Fool UK.

Investing in AI: 3 Stocks with Huge Potential!

🤖 Are you fascinated by the potential of AI? 🤖

Imagine investing in cutting-edge technology just once, then watching as it evolves and grows, transforming industries and potentially even yielding substantial returns.

If the idea of being part of the AI revolution excites you, along with the prospect of significant potential gains on your initial investment…

Then you won’t want to miss this special report inside Motley Fool Share Advisor – ‘AI Front Runners: 3 Surprising Stocks Riding The AI Wave’!

And today, we’re giving you exclusive access to ONE of these top AI stock picks, absolutely free!

More reading

Stephen Wright has no position in any of the shares mentioned. The Motley Fool UK has recommended A.G. Barr Plc. and Howden Joinery Group Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.