Greggs shares plunge 11% despite growing sales. Is this my chance to buy?

Shares in Greggs (LSE:GRG) are down 11% on Thursday (9 January) after the company’s Q4 trading update. And looking at the report, I don’t think it’s hard to see why.

Overall, revenues increased by just under 8%, with around 2.5% coming from like-for-like sales growth. That’st strong, but is the big drop in the stock the buying opportunity I’ve been waiting for?

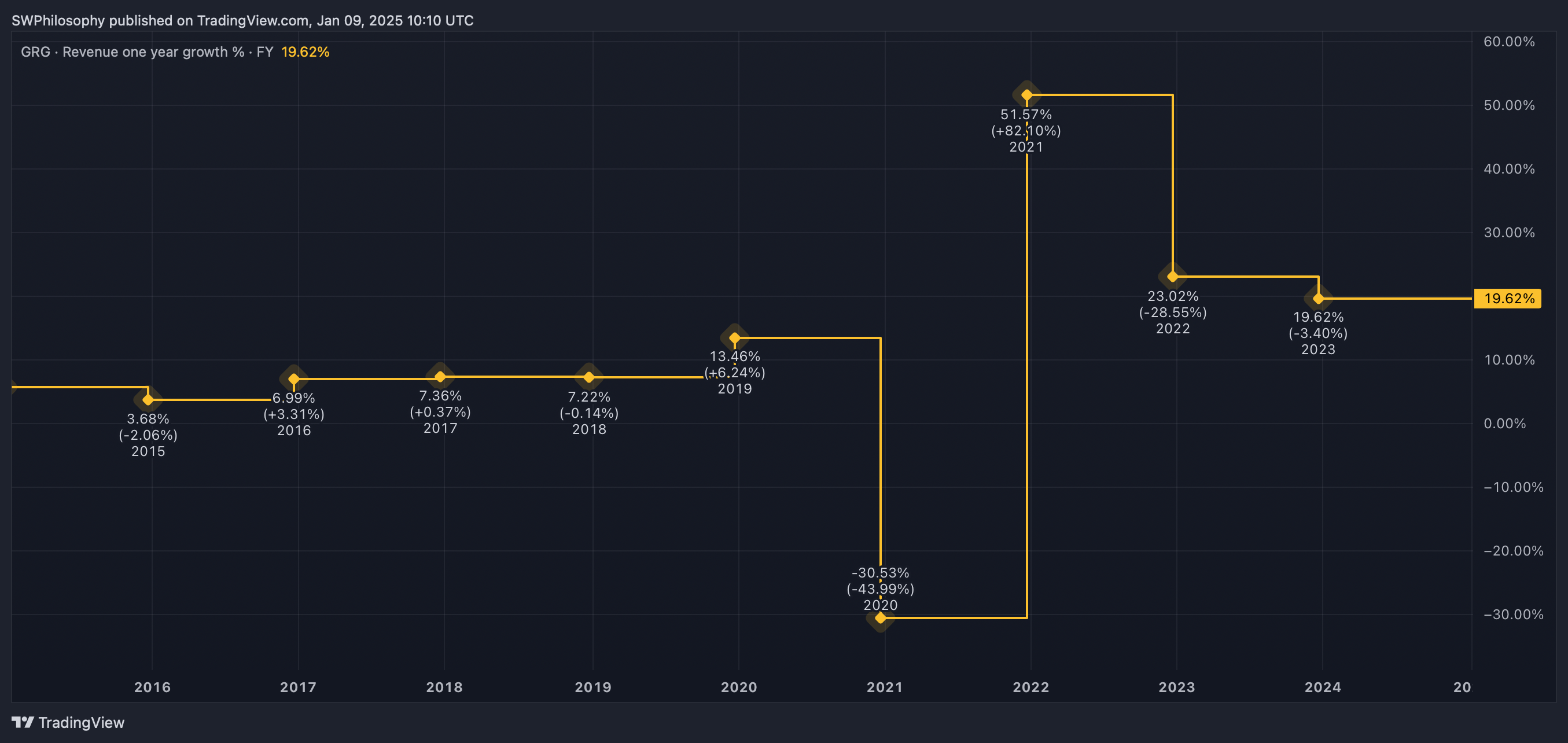

Sales growth

While 8% growth might seem pretty good, context is everything when it comes to the stock market. It means the firm’s rate of sales growth has been slowing consistently since 2021.

Greggs revenue growth 2015-24

Created at TradingView

Furthermore, Greggs is a growth stock – and is priced like one. At the start of the week, it was trading at a price-to-earnings (P/E) multiple of 21, which indicates investors are expecting solid growth ahead.

Greggs P/E ratio 2024-24

Created at TradingView

On top of this, like-for-like sales increasing by 2.5% is a slightly worrying sign. It means that the rest of the increase has come from Greggs opening more stores, which it won’t be able to do indefinitely.

When the firm reaches its eventual capacity in terms of stores, the only way it will be able to keep growing will be like-for-like sales. And the most recent update coming in below inflation is a concern.

Outlook

The outlook for 2025’s also fairly underwhelming. Greggs is expecting to open between 140 and 150 new outlets this year, as well as relocating 50 of its existing stores.

Again, context is key. The company currently has 2,618 venues, meaning the anticipated new openings will only increase the existing store count by around 5.5%.

That means like-for-like revenues are going to have to pick up in order to generate significant sales growth. Given the difficulties in the last quarter, I’m not surprised to see the share price falling.

Is this my opportunity?

From an investment perspective, I think there’s a lot to like about Greggs as a stock. Despite weak Q4 sales, its business model of providing low-cost food to people is one I think’s going to prove durable.

Over the long term I expect this to also be relatively resilient in difficult economic environments. And the firm has a very strong balance sheet with £125m in net cash, which should add to its resiliency.

The big question in my mind is what price I’m willing to buy it at – and that comes down to its future growth prospects. The company’s aiming for 3,000 outlets, but it’s rapidly closing in on that level.

That doesn’t leave a lot of room for further growth, especially if same-store sales don’t do much more than offset the effects of inflation. And that’s why I’m not rushing to buy the stock right now.

It’s getting close

Even after the latest decline, the Greggs share price is still around 10% higher than where I’d like to buy it. But given the pressure UK stocks have been under, it might well get to this level.

Given the competitive pricing of its products, I think overpaying for Greggs shares would be an ironic mistake. So I’m looking to be patient with this one – but I am hoping for a buying opportunity.

The post Greggs shares plunge 11% despite growing sales. Is this my chance to buy? appeared first on The Motley Fool UK.

But what does the head of The Motley Fool’s investing team think?

Should you invest £1,000 in Greggs Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Greggs Plc made the list?

More reading

- Greggs shares are forecast to grow another 16% in 2025 – time to buy?

- 2 no-brainer growth shares to consider in 2025!

- Buying more Greggs shares is top of my New Year’s resolutions!

- Could Greggs shares shine in 2025?

- £5,000 invested in Greggs shares at the start of 2023 is now worth…

Stephen Wright has no position in any of the shares mentioned. The Motley Fool UK has recommended Greggs Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.