Could this FTSE 100 stalwart turn my Stocks and Shares ISA into a passive income machine?

Despite being founded before anyone can remember, Tesco (LSE:TSCO) continues to dominate the UK grocery market. And I’m wondering whether I should add it to my Stocks and Shares ISA.

A 3.5% dividend yield is above what I’m currently getting from my portfolio. Furthermore, the firm has just reported an impressive Christmas trading period, giving investors plenty to be positive about.

Dividends

Genuine customer loyalty in the supermarket industry is about as realistic as a world where everyone agrees on something. And this makes the emergence of Aldi and Lidl a risk for Tesco shareholders.

It’s worth noting, though, that the UK’s largest supermarket company has been defending its territory very well. According to data from Kantar, Tesco’s market share in the last quarter of 2024 was 28.5%.

That’s up from 27.7% the year before. And with the market as a whole expanding as Brits spent more on Christmas groceries than ever before, investors have a lot to feel positive about.

Importantly, Tesco also has some long-term advantages that make it difficult to compete with. Most obviously, its scale puts it in a powerful position when it comes to negotiating prices with suppliers.

In a world where retailers across the board are being forced to compete on price, having lower costs than the competition is a huge advantage. And it’s hard for other supermarkets to replicate this.

In other words, while barriers to entry might be low, barriers to scale are high. And it’s the size of Tesco’s operation that makes its market position harder to shift than a rusted-out tank.

Growth

Tesco’s strong competitive position makes it look like a great passive income investment. But I’m a bit wary – when I’m looking for stocks to buy, dividends aren’t the only thing I think about.

I also pay close attention to a company’s future growth prospects. Specifically, I’m interested in what opportunities a business has to reinvest its profits to increase its income in the future.

This comes down to two things. The first is how much Tesco is going to be able to increase its revenues and profits by and the second is how much it’s going to have to invest in order to do that.

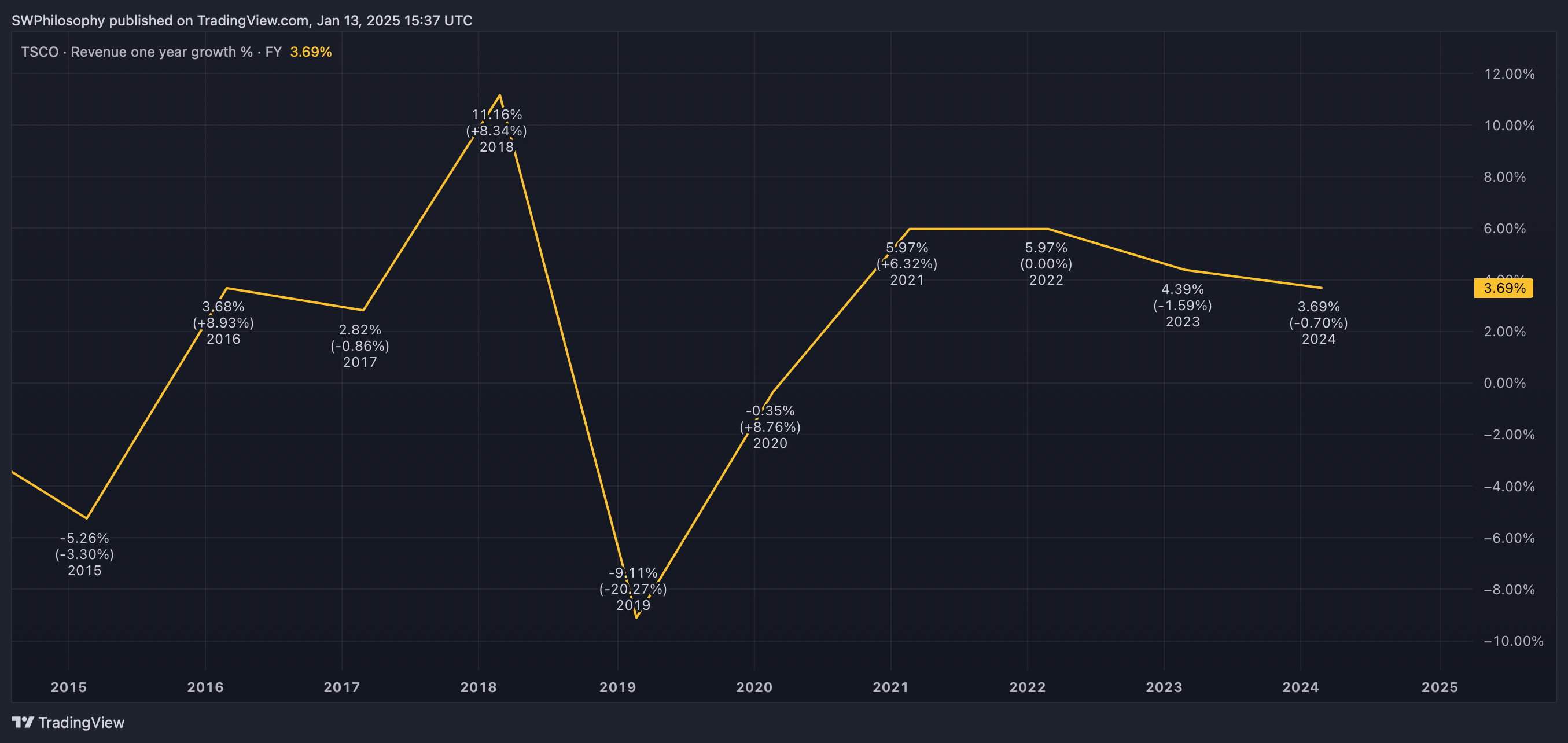

In terms of revenue growth, the last 10 years have been about as explosive as a walking tour of a library. Leaving aside the Covid-19 pandemic, sales have generally increased by more than the rate of inflation – but not by much.

Tesco revenue growth 2015-2024

Created at TradingView

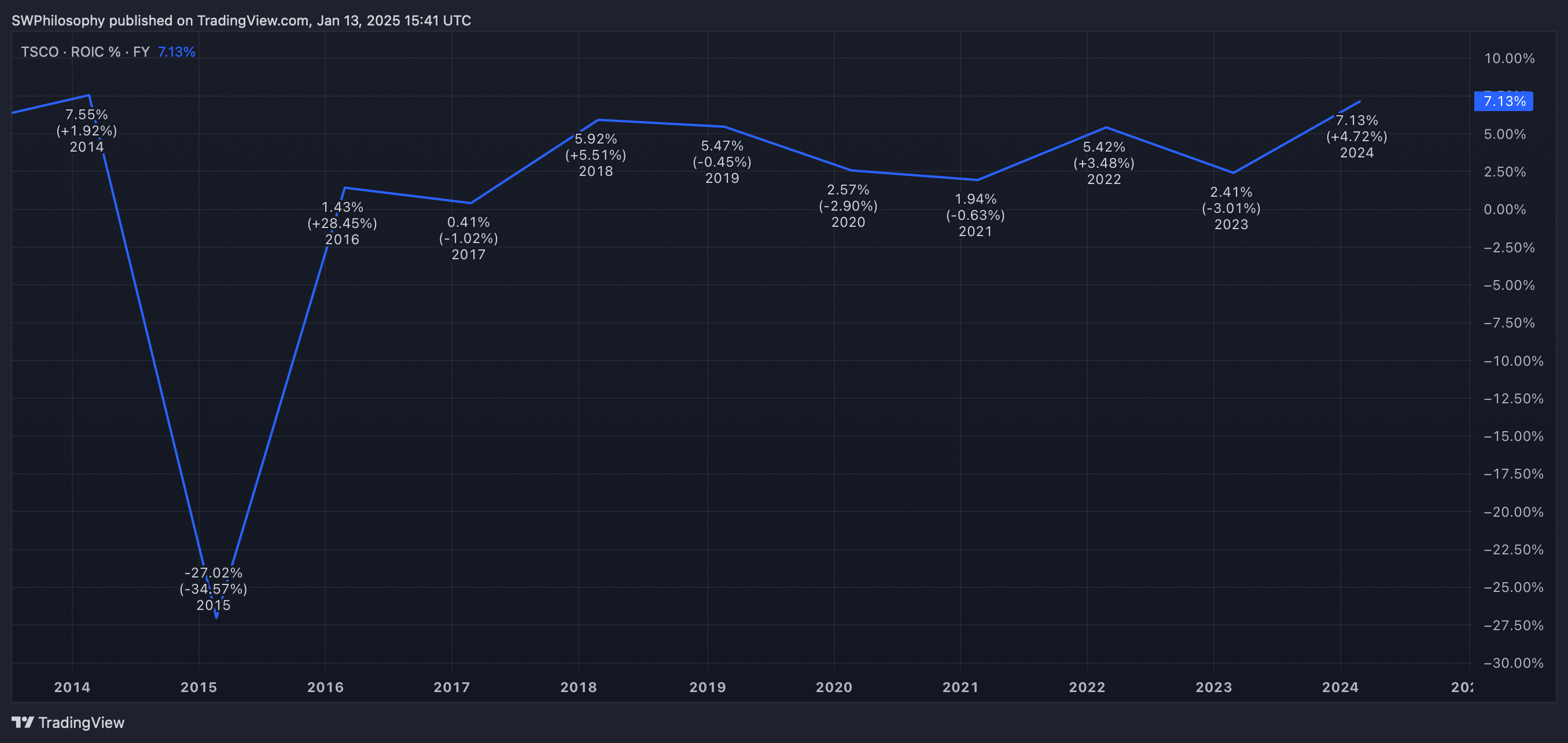

It’s also worth noting that this growth has been fairly expensive. Over the last decade, Tesco’s return on invested capital (ROIC) has consistently been below 10%, which isn’t particularly impressive.

Tesco ROIC 2014-2024

Created at TradingView

This indicates that the company has to commit quite a lot of its capital into things like inventory and equipment to achieve this growth. And this isn’t a particularly good sign for investors.

An opportunity?

Tesco has been part of the FTSE 100 since 1996 and its scale gives it a big advantage over the rest of the UK grocery industry. From a dividend perspective, I think the stock looks attractive.

The thing is, there’s more to investing than just dividends. And with growth looking both modest and capital-intensive, I think I can find better opportunities right now.

The post Could this FTSE 100 stalwart turn my Stocks and Shares ISA into a passive income machine? appeared first on The Motley Fool UK.

But there may be an even bigger investment opportunity that’s caught my eye:

Investing in AI: 3 Stocks with Huge Potential!

🤖 Are you fascinated by the potential of AI? 🤖

Imagine investing in cutting-edge technology just once, then watching as it evolves and grows, transforming industries and potentially even yielding substantial returns.

If the idea of being part of the AI revolution excites you, along with the prospect of significant potential gains on your initial investment…

Then you won’t want to miss this special report inside Motley Fool Share Advisor – ‘AI Front Runners: 3 Surprising Stocks Riding The AI Wave’!

And today, we’re giving you exclusive access to ONE of these top AI stock picks, absolutely free!

More reading

- Have Tesco shares had their best days already?

- 3 UK shares to consider as a long-term investment for retirement

- Will ‘biggest ever Christmas’ help keep the Tesco share price climbing in 2025?

- 9,400 points? Here’s what one bank’s forecasting for the FTSE 100 stock market

- 3 key FTSE 100 stock updates to watch for in January

Stephen Wright has no position in any of the shares mentioned. The Motley Fool UK has recommended Tesco Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.