Could Rolls-Royce shares hit £8 in 2025?

Last year was another great year for shareholders in Rolls-Royce (LSE: RR), just like the year before. Even if Rolls-Royce shares climb by a far lower amount this year – 36% from where they are today – they would hit £8.

Given that the Rolls-Royce share price was in pennies as recently as 2022, that could be an incredible return for some investors.

But how likely might that be to happen (or not) – and ought I to invest?

Business trends are moving in the right direction

There is good reason for the share price to be in much better shape now than a few years back, in my opinion.

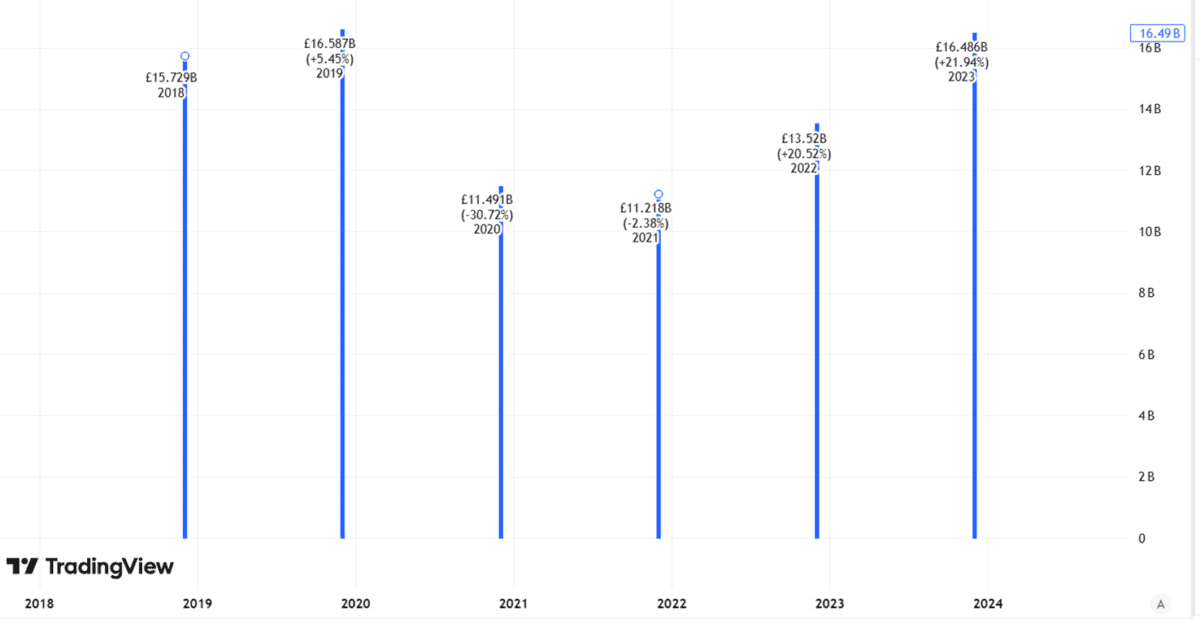

A sharp drop in civil aviation demand during the pandemic was a real test for Rolls. But since then, revenues have come back strongly.

Created using TradingView

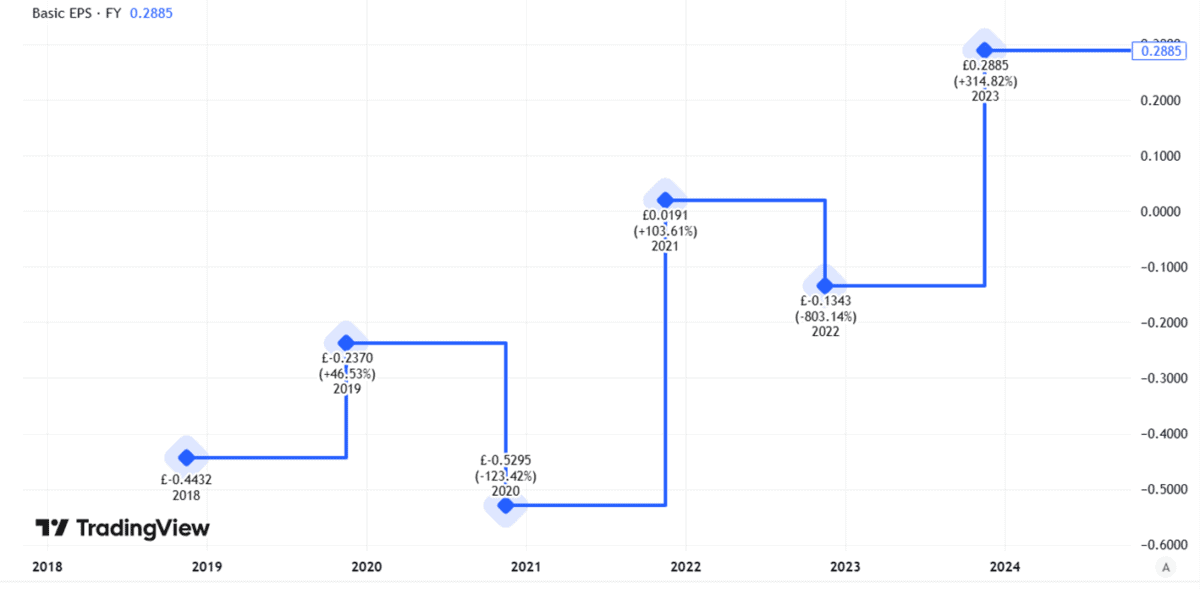

But while revenues were a concern for several years, the bigger one was profits. Making and servicing engines is a business that comes with high fixed costs. So even fairly modest moves in revenue can lead to substantial swings in the profit and loss account.

Looking at Rolls-Royce’s basic earnings per share this is clear.

Created using TradingView

Rolls has made a number of important business moves in the past several years.

It has got rid of some businesses to focus on its strategic core. It has cut costs. It has also implemented an aggressive plan to improve financial performance.

Combined with a boom in demand for civil aviation engine sales and servicing across the industry as a whole and it is a good time for Rolls-Royce.

I’m concerned about the margin of safety

That helps explain why Rolls-Royce shares have soared.

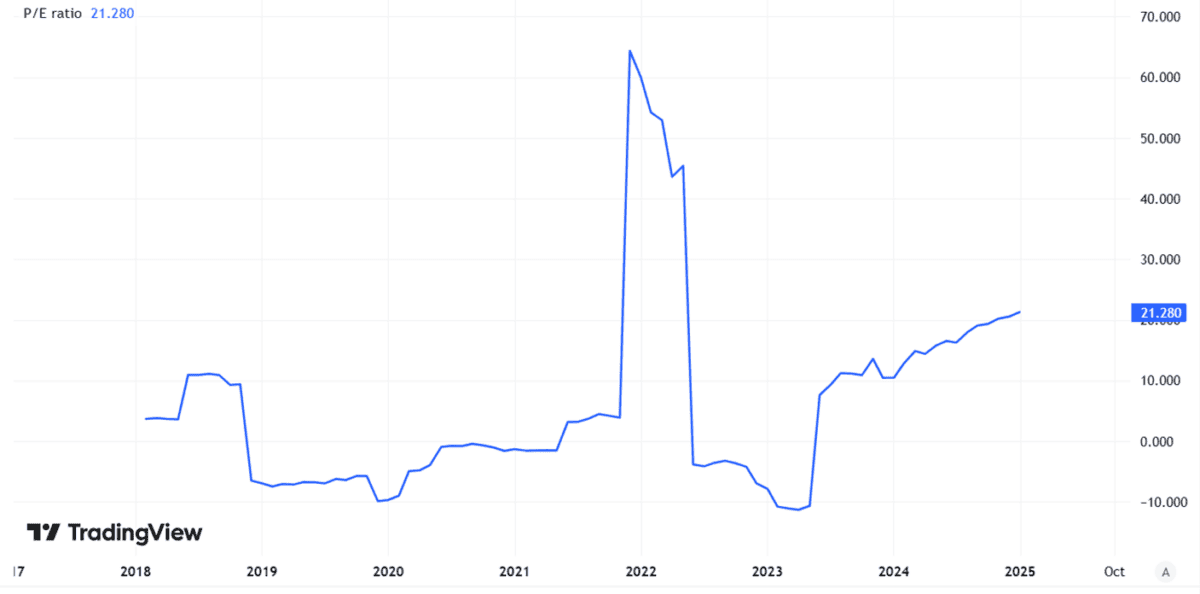

I actually think they could yet go higher from here, including potentially hitting the £8 mark. The price-to-earnings ratio of 21 looks a bit pricy to me but not massively overdone. It has been rising but remains well below its peak of recent years.

Created using TradingView

On top of that, the prospective ratio could well be lower if Rolls can improve earnings per share. I expect it to be able to do that this year and next as part of its financial transformation programme – if things go according to plan.

That, however, is where I see potential problems.

Its ambitious targets mean Rolls already has its hands full delivering on its programme with what it can control.

But what about things that are not in the plan, such as a massive external demand shock pummelling revenues and profits again?

We have seen it in the past with the pandemic but also with terrorist attacks, volcanoes, or a bad recession sending civil aviation demand sharply downwards.

I see such a risk as a matter of ‘when’ not ‘if’, although it may be decades in the future. Then again, it could be tomorrow – and I do not think the current Rolls-Royce share price offers me anything like an adequate margin of safety to account for that risk.

So, although I do think the shares may move higher still, I have no plans to invest.

The post Could Rolls-Royce shares hit £8 in 2025? appeared first on The Motley Fool UK.

We think earning passive income has never been easier

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

More reading

- Is the Rolls-Royce share price in a bubble just waiting to burst?

- With 3 major new deals signed in under a month, does Rolls-Royce’s £6.05 share price look a bargain to me?

- ChatGPT says these FTSE 100 stocks could benefit from the Trump presidency

- The Rolls-Royce share price could get a major boost from this one area

- Nuclear energy is on-trend: are Rolls-Royce shares my best option?

C Ruane has no position in any of the shares mentioned. The Motley Fool UK has recommended Rolls-Royce Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.