3 simple steps to target a £20,000 second income from stocks

It can be quite daunting when first considering the stock market as a way to generate a second income. There is a lot of jargon to get one’s head around. But it is not quite as complex as it might first seem.

With this in mind, here are a few simple steps a new investor might follow to target sizeable dividend income.

Choose the right account

To start, there obviously needs to be an account to buy stocks in. This will be opened through a brokerage, which is a company that acts as an intermediary to facilitate the buying and selling of stocks.

There are a fair few about. Some legacy platforms like Hargreaves Lansdown still charge customers per trade. However, there are many new apps that allow free trading. To be fair, Hargreaves Lansdown has a wealth of resources for new investors, whereas the no-frills free-trade apps are very much DIY. It depends on preference.

The investing account someone would generally start with in the UK is a Stocks and Shares ISA. This marvellous vehicle enables a portfolio to grow more rapidly because there are no tax liabilities on income and returns (the annual contribution limit is £20,000).

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Consider quality high-yield dividend stocks

As the aim is to start earning a second income, the next focus will be on looking for shares that pay dividends. These are semi-regular payments made by companies to shareholders, usually from profits. They’re mostly paid twice or four times a year.

The stock’s dividend yield will determine how much passive income is on offer. For example, insurance and asset management firm Legal & General (LSE: LGEN) currently carries a mighty 8.9% yield.

In other words, an investor could put £2,000 into this FTSE 100 stock and hope to receive £178 back each year in dividends. However it could be less than this (if the firm cuts the payout, which is always possible) or ideally more.

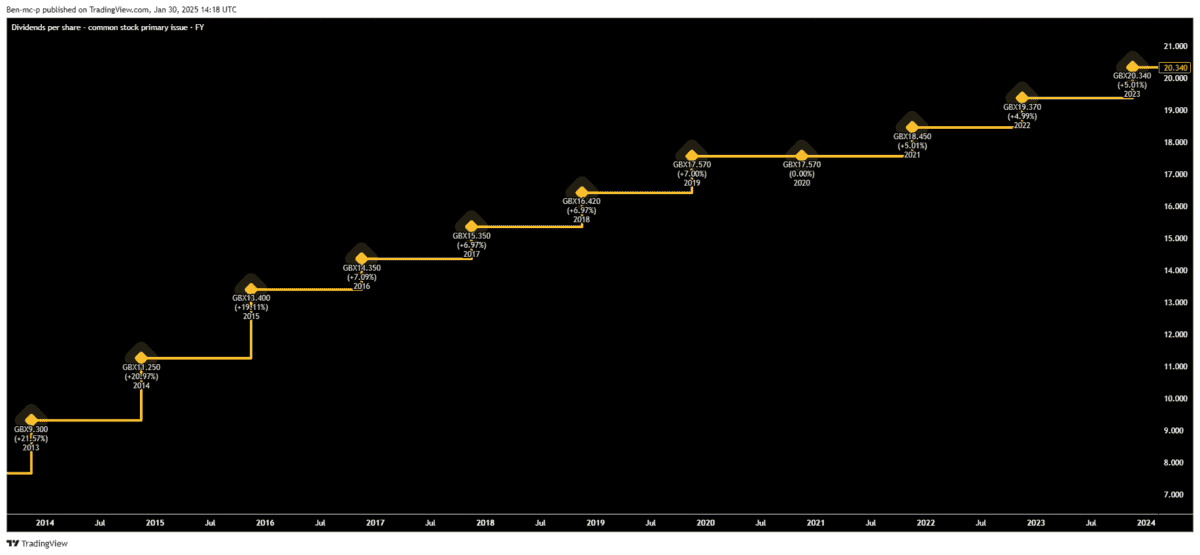

Personally, I think Legal & General is one of the best income shares around, which is why I own it in my own portfolio. The company has a strong brand, large customer base, and excellent track record of increasing its payout.

A well as opportunities though, risks can arise from the group’s massive $1trn+ assets under management. It is exposed to stock market downturns, which can quickly reduce the value of its investment portfolios, as well as shifting interest rates that drive fluctuations in bond prices. Economic downturns can also negatively impact earnings.

However, for investors looking for high-yield income, I think Legal & General is worth considering for inclusion in a diversified portfolio of quality stocks.

Invest regularly

The keys to building up a sizeable passive income portfolio are time and consistency.

Were someone to invest £750 a month, achieving an 8% average return, they’d end up with roughly £275,000 after 15 years. This assumes dividends are reinvested over this time rather than spent.

At this point in the journey, the ISA portfolio would be generating annual income of approximately £20,000. It could then be enjoyed or reinvested for longer to target an even greater figure.

The post 3 simple steps to target a £20,000 second income from stocks appeared first on The Motley Fool UK.

Should you buy Legal & General now?

Don’t make any big decisions yet.

Because Mark Rogers — The Motley Fool UK’s Director of Investing — has revealed 5 Shares for the Future of Energy.

And he believes they could bring spectacular returns over the next decade.

Since the war in Ukraine, nations everywhere are scrambling for energy independence,

he says. Meanwhile, they’re hellbent on achieving net zero emissions.

No guarantees, but history shows…

When such enormous changes hit a big industry, informed investors can potentially get rich.

So, with his new report, Mark’s aiming to put more investors in this enviable position.

Click the button below to find out how you can get your hands on the full report now, and as a thank you for your interest, we’ll send you one of the five picks — absolutely free!

More reading

- I’m considering buying these passive income stocks in 2025

- Here are 2 FTSE 100 companies Warren Buffett could afford to buy right now

- If a 20-year-old invested £5,500 in Legal and General shares now, they could make £6,446 a year in dividend income aged 50!

- 3 things investors should consider when building a £10k passive income

- With £5,000 in UK shares, how much passive income could an investor expect?

Ben McPoland has positions in Legal & General Group Plc. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.