2 brilliant thematic ETFs to consider for a Stocks and Shares ISA or SIPP in February

Thematic exchange-traded funds (ETFs) can be great investments for a Stocks and Shares ISA or Self-Invested Personal Pension (SIPP). With these products, investors can get diversified exposure to high-growth industries that are shaping the world such as artificial intelligence (AI), robotics, and renewable energy.

Here, I’m going to highlight two theme-driven ETFs I like the look of right now. I think they could be worth considering for a diversified investment portfolio in February.

An ETF for the AI revolution

While AI stocks have experienced some turbulence recently, I continue to like the theme. Over the next decade, this technology‘s going to transform nearly every industry, creating a lot of opportunities for investors.

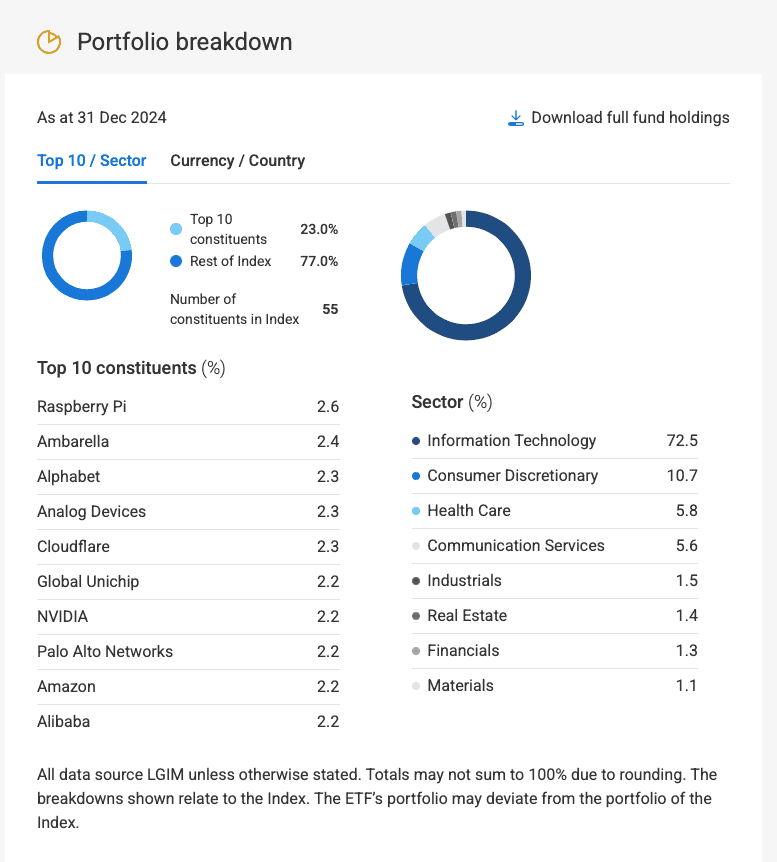

Now, one ETF that offers exposure here is the L&G Artificial Intelligence UCITS ETF (LSE: AIAG). This is a niche product from Legal & General that’s focused purely on AI stocks.

In total, it provides access to around 55 different companies. And I see that as a huge plus because, right now, we don’t know for sure who the real AI winners are going to be.

Another key feature of this ETF is that it doesn’t have massive weightings in specific stocks such as Nvidia or Alphabet (Google). This reduces risk for investors.

There are plenty of risks to consider, of course. One is that the AI industry is moving at a rapid speed and new companies/technologies are continually popping up. We saw this recently with Chinese AI start-up DeepSeek. Its emergence sent a lot of US AI stocks down.

Taking a long-term view however, I think this ETF will do well. Ongoing fees are reasonable at 0.49% a year.

Cybersecurity just became more important

Now, the emergence of DeepSeek’s low-cost AI model has definitely created uncertainty in some areas of the AI sector. For example, there are now some question marks in relation to long-term demand for Nvidia’s high-powered AI chips.

However, one thing we can be certain of is that, looking ahead, demand for cybersecurity will remain high. If anything, the emergence of Chinese AI models will actually increase demand for sophisticated cybersecurity solutions.

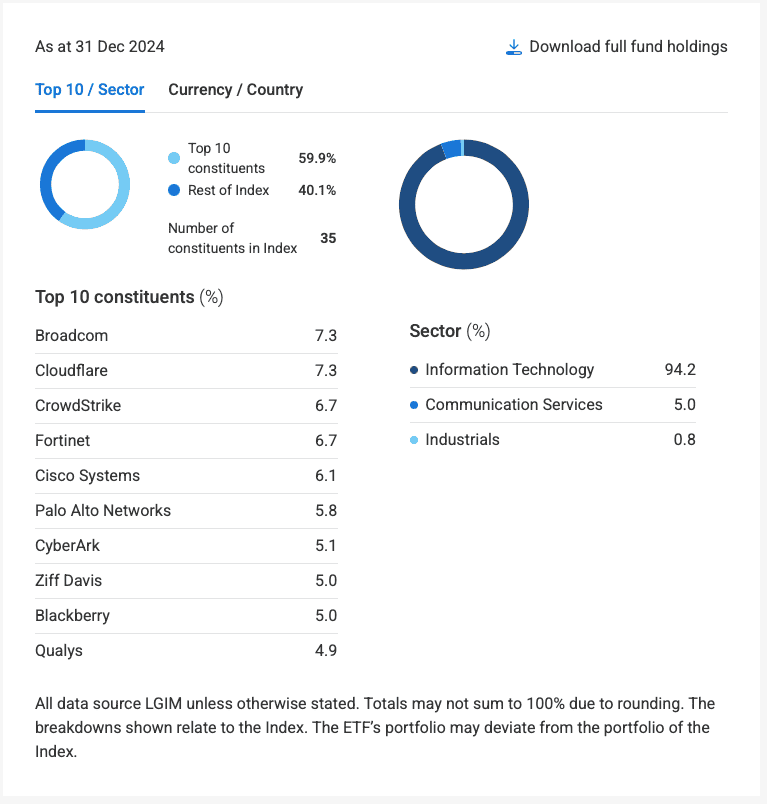

One ETF I like for exposure here is the Legal & General Cyber Security UCITS ETF (LSE: ISPY). It provides broad, global exposure to the cybersecurity industry. Overall, there are around 35 stocks in the ETF. At the end of 2024, top holdings included Broadcom, Cloudflare, and CrowdStrike.

It’s worth pointing out that this ETF’s been around for a while now. And it’s done pretty well over the long run. For the five-year period to the end of 2024, it returned 71% (in US dollar terms), or 11.3% a year. However, past performance isn’t an indicator of future returns.

If the tech sector was to experience a major pullback for some reason (eg rising interest rates), this product could underperform. There’s also some company-specific risk here as this ETF does have quite large weightings in certain stocks.

I believe it’ll do well over the next five years on the back of the growth of the cybersecurity market however. Ongoing fees are 0.69% a year.

The post 2 brilliant thematic ETFs to consider for a Stocks and Shares ISA or SIPP in February appeared first on The Motley Fool UK.

5 Shares for the Future of Energy

Investors who don’t own energy shares need to see this now.

Because Mark Rogers — The Motley Fool UK’s Director of Investing — sees 2 key reasons why energy is set to soar.

While sanctions slam Russian supplies, nations are also racing to achieve net zero emissions,

he says. Mark believes 5 companies in particular are poised for spectacular profits.

Open this new report — 5 Shares for the Future of Energy

— and discover:

- Britain’s Energy Fort Knox, now controlling 30% of UK energy storage

- How to potentially get paid by the weather

- Electric Vehicles’ secret

backdoor

opportunity - One dead simple stock for the new nuclear boom

Click the button below to find out how you can get your hands on the full report now, and as a thank you for your interest, we’ll send you one of the five picks — absolutely free!

More reading

- With DeepSeek on the scene, should investors ‘go retro’ with their Stocks and Shares ISAs?

- £5,000 invested in this penny stock 1 year ago is now worth…

- This passive income plan is boring and unimaginative. That’s why it actually works!

- These FTSE 100 stocks could catapult forward as AI gets cheaper

- Forget Nvidia — this UK stock uses AI and has a 9% dividend yield too!

Edward Sheldon has positions in Alphabet, CrowdStrike, and Nvidia. The Motley Fool UK has recommended Alphabet, Cloudflare, CrowdStrike, and Nvidia. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.