Here’s what an investor needs in an ISA to earn £5,000 of passive income a month

A Stocks and Shares ISA is a powerful tool for building long-term wealth and generating passive income. With tax-free gains and dividends, it provides an efficient way to grow investments without losing returns to HMRC.

Over time, compound growth can significantly enhance wealth, making ISAs ideal for those seeking financial security. Whether investing in dividend stocks for passive income or growth shares for capital appreciation, the ISA’s tax advantages and flexibility make it an essential component of any UK investor’s portfolio. So, let’s put a figure on it. In order to receive around £5,000 in monthly passive income from an ISA, I believe an investor would need around £1.2m in the ISA pot.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Here’s the formula

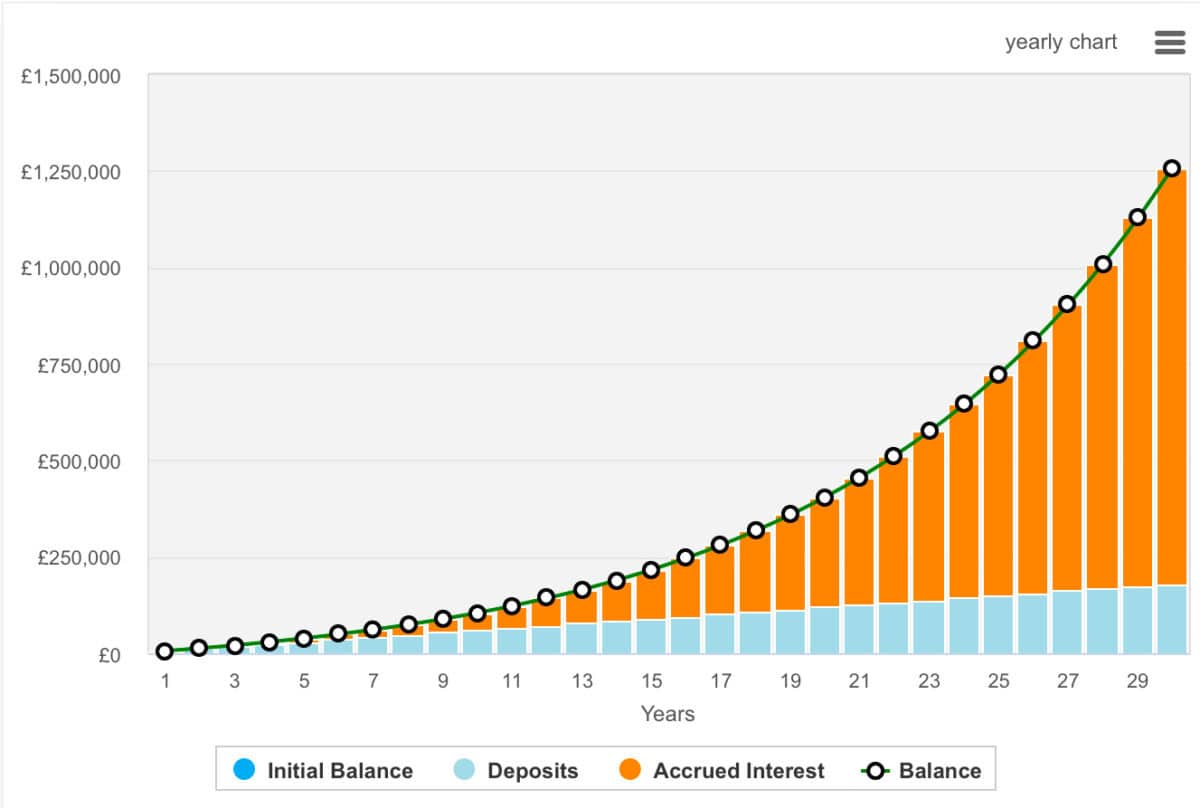

Building a £1.2m ISA pot from scratch takes time, patience, and regular investing. The key is consistency and the power of compound growth. With a fixed amount invested each month, returns start generating returns of their own, accelerating wealth accumulation. For instance, assuming a 7% annual return, investing £1,000 per month for 30 years could grow to around £1.2m. Increasing contributions or extending the timeline further boosts the chances of hitting the target. The earlier investing begins, the less heavy lifting is needed later to achieve financial independence.

Moreover, more successful investors can reach their targets faster and typically with less capital. For instance, £500 of monthly contributions for 30 years growing at a compound annual growth rate (CAGR) of 10.5% would also reach £1.2m.

Another important thing to note is the impact of compound interest. As the investment grows, the rate of growth appears to increase too. In the 30th year, the investment would grow by £124k versus £297 in the first year.

Finding diversity

As someone with a relatively mature portfolio, I prefer to pick my own stocks. I have around 25, meaning my portfolio is relatively diversified. But if I were starting afresh I’d look to achieve some diversification by investing in exchange-traded funds (ETFs) or trusts.

With that in mind, investors may want to consider The Monks Investment Trust (LSE:MNKS), which offers a compelling opportunity for long-term capital growth through its diverse global equity portfolio. The trust’s holdings include tech giants like Microsoft, Meta Platforms, and Amazon, alongside innovative companies such as Nvidia and Prosus. This mix of established and growth-oriented firms across various sectors provides a balanced approach to global investing.

With a significant portion invested in the US and smaller allocations in countries like the Netherlands, Japan, and China, Monks also offers broad geographical exposure. The trust’s relatively low ongoing charge of 0.44% makes it an attractive option for cost-conscious investors seeking actively managed global equities.

Moreover, its patient investment strategy, focusing on companies with enduring competitive advantages, aligns well with those looking for sustained value creation. The trust’s long-standing history since 1929 further underscores its resilience through various market cycles.

But while diverisification offers us protection against some risks, investors should note that some of its largest holdings, including Meta and Amazon, have fairly lofty valuations. This may put some investors off.

However, it’s a stock I’ve bought for my daughter’s SIPP.

The post Here’s what an investor needs in an ISA to earn £5,000 of passive income a month appeared first on The Motley Fool UK.

Should you buy The Monks Investment Trust Plc now?

Don’t make any big decisions yet.

Because Mark Rogers — The Motley Fool UK’s Director of Investing — has revealed 5 Shares for the Future of Energy.

And he believes they could bring spectacular returns over the next decade.

Since the war in Ukraine, nations everywhere are scrambling for energy independence,

he says. Meanwhile, they’re hellbent on achieving net zero emissions.

No guarantees, but history shows…

When such enormous changes hit a big industry, informed investors can potentially get rich.

So, with his new report, Mark’s aiming to put more investors in this enviable position.

Click the button below to find out how you can get your hands on the full report now, and as a thank you for your interest, we’ll send you one of the five picks — absolutely free!

More reading

- Is now the perfect moment to scoop up Nvidia stock?

- After its recent high, is the FTSE 100 set to keep going?

- This Q3 revenue boost could be just what the Vodafone share price needs

- I’ve bought these dividend-paying blue-chips for lifelong passive income

- As weak sales and tariff threats drive the Diageo share price lower, is it time for investors to consider cutting their losses?

James Fox has positions in The Monks Investment Trust Plc. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.