£15,000 invested in Greggs shares at the start of 2025 is now worth…

Greggs shares (LSE: GRG) have been a major let-down lately. In fact, investing in them has been like ordering a hot steak bake, only to bite in and realise it’s stone cold in the middle.

In other words, Greggs is not quite the hot growth stock expected, but merely a dividend stock.

So far in 2025, shares of the FTSE 250 bakery chain have dropped 35%. This means anyone who invested £15,000 in them back then would now have £9,750 on paper.

Thankfully, I didn’t have that much in Greggs. Yet I was still down 12% when I sold the stock last week (including dividends).

Here are five reasons I pulled the ripcord to get out.

Easing growth

In 2023, like-for-like (LFL) sales growth in Greggs’ company-managed shops jumped 13.7%. Last year, that eased to 5.5% versus the 6.3% that was expected. It was 2.5% in the Christmas quarter.

Then in the first nine weeks of 2025, LFL sales were up just 1.7%. Management blamed “challenging weather conditions” in January. To be fair, we did have Storm Éowyn, which shut 250 Greggs shops in Scotland and Northern Ireland.

The firm also said there was “improved trading” in February. However, this year is expected to be a slog. CEO Roisin Currie warned: “Looking ahead to 2025, the macroeconomic landscape remains tough. Inflation remains elevated, and many of our customers continue to worry about the cost of living.”

Gloomy economic outlook

This brings me to my second reason for selling: the UK economy.

Greggs has recently flirted with the idea of international expansion, and I think franchised locations would do well in British holiday hotspots like Spain. Of course, it would have to adapt the menu, but Greggs has proven to be a master of that in the past.

For now though, there’s just the UK. And according to Chancellor Rachel Reeves, the global tariff war will hit the UK: “We will be affected by slowing global trade, by a slower GDP growth, and by higher inflation than otherwise would be the case.”

Higher costs

Following the last UK budget, which increased employment costs, Greggs expects 6% cost inflation this year.

To mitigate this, it has implemented price increases and cost efficiencies. But it’s uncertain how much further these can be stretched to maintain profits. If Greggs keeps putting prices up, I fear it could lose its value reputation among consumers.

High street Armageddon

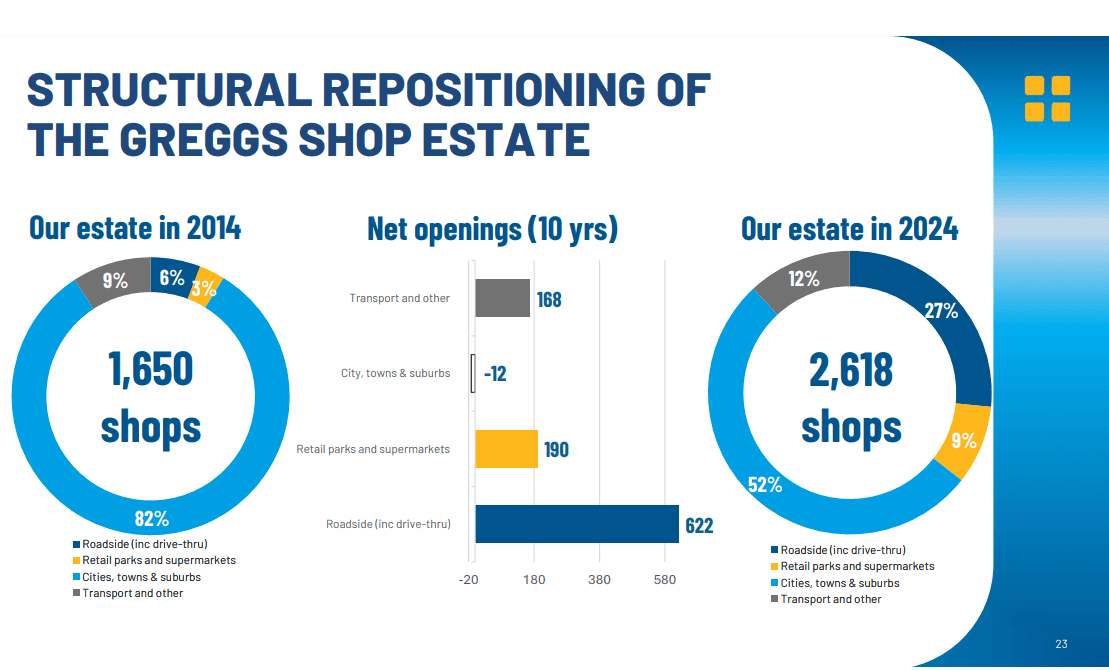

Next, due to high business rates and e-commerce, the UK high street is in terminal decline. And while Greggs is doing a splendid job of diversifying its shop estate and increasing digital channels, it still has over half its locations (52%) in cities, towns, and suburbs.

I fear that falling footfall on high streets could undermine decent growth elsewhere. Of course, this issue and the economic conditions are out of the company’s hands.

GLP-1 threat

Finally, we have a risk that isn’t yet part of the story but could be in future. That is the unstoppable rise of GLP-1 weight-loss drugs.

These treatments reduce cravings for the sugary and high-carb treats that Greggs is famous for. As of 2022/23, 64% of adults in England were classified as overweight or obese. So the potential market for these treatments is significant.

The post £15,000 invested in Greggs shares at the start of 2025 is now worth… appeared first on The Motley Fool UK.

But here’s another bargain investment that looks absurdly dirt-cheap:

Like buying £1 for 31p

This seems ridiculous, but we almost never see shares looking this cheap. Yet this Share Advisor pick has a price/book ratio of 0.31. In plain English, this means that investors effectively get in on a business that holds £1 of assets for every 31p they invest!

Of course, this is the stock market where money is always at risk — these valuations can change and there are no guarantees. But some risks are a LOT more interesting than others, and at The Motley Fool we believe this company is amongst them.

What’s more, it currently boasts a stellar dividend yield of around 10%, and right now it’s possible for investors to jump aboard at near-historic lows. Want to get the name for yourself?

More reading

- The Greggs share price is too tasty for me to ignore!

- £10,000 invested in Greggs shares 1 year ago is now worth…

- As inflation hits Greggs shares, should investors consider snapping up a bargain?

- Here’s the Greggs share price forecast for the next 12 months!

- How much would someone need to invest in Greggs shares to target a £1,000 monthly passive income?

Ben McPoland has no position in any of the shares mentioned. The Motley Fool UK has recommended Greggs Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.