Here’s the growth forecast for Games Workshop shares through to 2027!

Games Workshop (LSE:GAW) remains (to my mind) one of the UK’s most exciting growth shares. It’s why the now-FTSE 100 company takes pride of place in both my Stocks and Shares ISA and Self-Invested Personal Pension (SIPP).

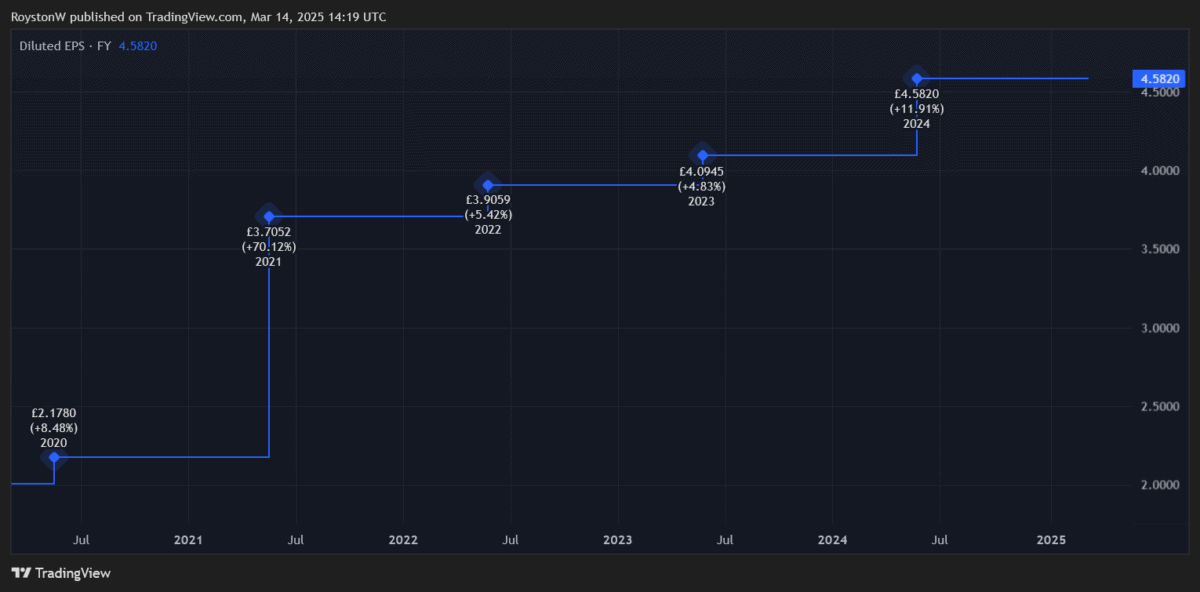

Earnings soared at the business during the Covid crisis, with lockdowns providing the perfect opportunity for new (and old) hobbyists to build, paint and then do battle with their model armies. Profits have continued rising strongly since then:

Yet Games Workshop is no flash in the pan. Growing interest in fantasy tabletop gaming has been powering profits higher for decades. It’s a market that’s tipped for further substantial growth too.

That’s not to say earnings will continue soaring in a straight line. The prospect of a global economic slowdown — and a subsequent fall in consumer spending — is a significant threat over the short-to-medium term. US trade tariffs might exacerbate spending declines too, and create supply chain issues for the company.

With this in mind, here are the growth forecasts for Games Workshop shares for the next few years.

Mixed outlook

| Financial year ending May… | Predicted earnings per share | Annual movement |

|---|---|---|

| 2025 | 514.74p | + 12% |

| 2026 | 512.37p | – 1% |

| 2027 | 554.10p | + 8% |

As you can see, Games Workshopâs long streak of earnings growth is set to stall, with a rare profit drop forecast for 2026 by City brokers.

But this isn’t a signal of worsening trading conditions, an expected jump in costs or other issues at the company. Instead, the predicted bottom-line decline for financial 2026 reflects an empty slate of major product launches.

Sales this year were boosted by the latest edition of the Warhammer: Age of Sigmar games system hitting shelves. Additionally, high-margin licensing revenues are tipped to cool next year after the stunning success of the Warhammer 40,000: Space Marine 2 video game launched last September.

These create tough comparatives for Games Workshop to go up against.

With a raft of new product releases likely in financial 2027, the business is tipped to move back into rapid growth.

Gold standard

As a long-term investor, I remain pretty upbeat about what returns I can expect from Games Workshop shares.

It’s not just the fact that it operates in a steadily growing market. As the success of its video games and books also show, the company’s Warhammer franchises are hot properties that continue to expand their fan base and cultural influence.

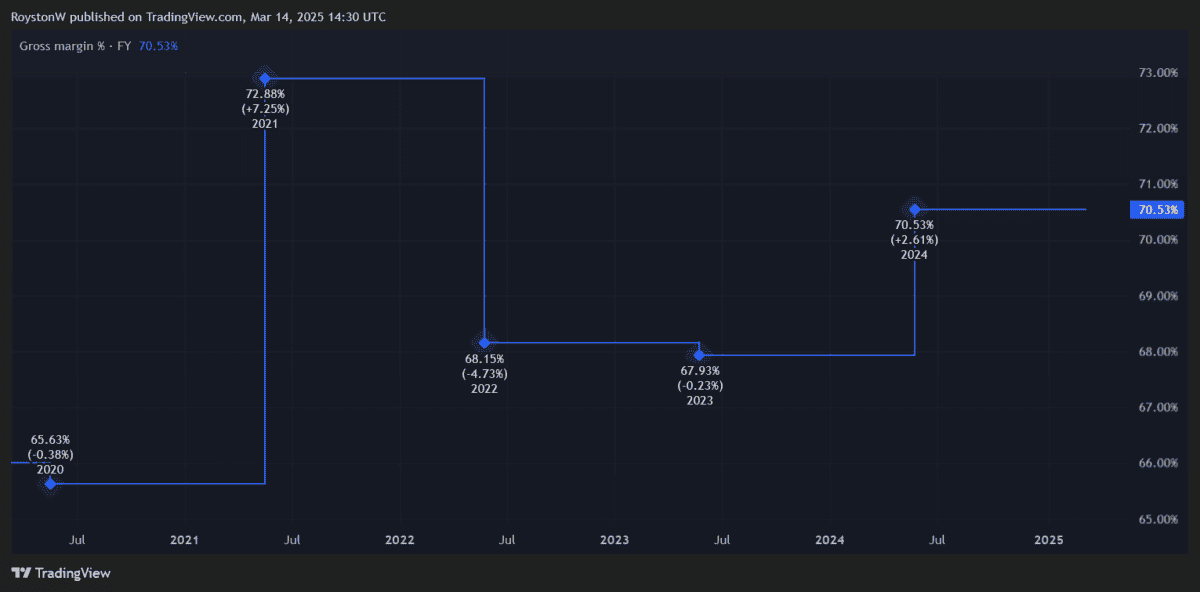

This strong brand appeal is also reflected in the high prices the company charges for its product, and as a consequence its enormous profit margins:

Branching out

As well as expanding its core operations, Games Workshop is also taking steps to boost the licensing side of the business.

It’s deal with Amazon to make films and TV content could take revenues through the stratosphere. But this isn’t all, with a follow up to last year’s money-spinning Space Marine 2 game also in the works.

Production on both is likely to take years however, so investors will need to be patient.

Today Games Workshop shares don’t come cheap. As the table further up shows, they trade on a forward price-to-earnings (P/E) ratio of 28 times.

But I believe the business — which has delivered an average annual return of 41.6% over the past decade — deserves such a premium and is worth considering.

The post Here’s the growth forecast for Games Workshop shares through to 2027! appeared first on The Motley Fool UK.

Pound coins for sale — 31 pence?

This seems ridiculous, but we almost never see shares looking this cheap. Yet this Share Advisor pick has a price/book ratio of 0.31. In plain English, this means that investors effectively get in on a business that holds £1 of assets for every 31p they invest!

Of course, this is the stock market where money is always at risk — these valuations can change and there are no guarantees. But some risks are a LOT more interesting than others, and at The Motley Fool we believe this company is amongst them.

What’s more, it currently boasts a stellar dividend yield of around 10%, and right now it’s possible for investors to jump aboard at near-historic lows. Want to get the name for yourself?

More reading

- Hereâs how a stock market crash could help investors retire 10 years earlier

- 5 UK stocks Fools have been buying!

- Up 55% in a year, this FTSE 100 stock is on fire!Â

- Up 10% today, can Games Workshop shares continue to soar?

- How 49 words lifted the Games Workshop share price by 8%!

Royston Wild has positions in Games Workshop Group Plc. The Motley Fool UK has recommended Games Workshop Group Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.