Millions are missing out on ISA account benefits! Here’s what I’m doing now

The Stocks and Shares ISA is a great account for individuals looking to build long-term wealth. Substantial tax savings give individuals more money to invest each year for superior compound gains.

Yet a huge number of people are being left behind. Here’s why I think investors should consider buying shares in an ISA today.

Fallen through the gaps

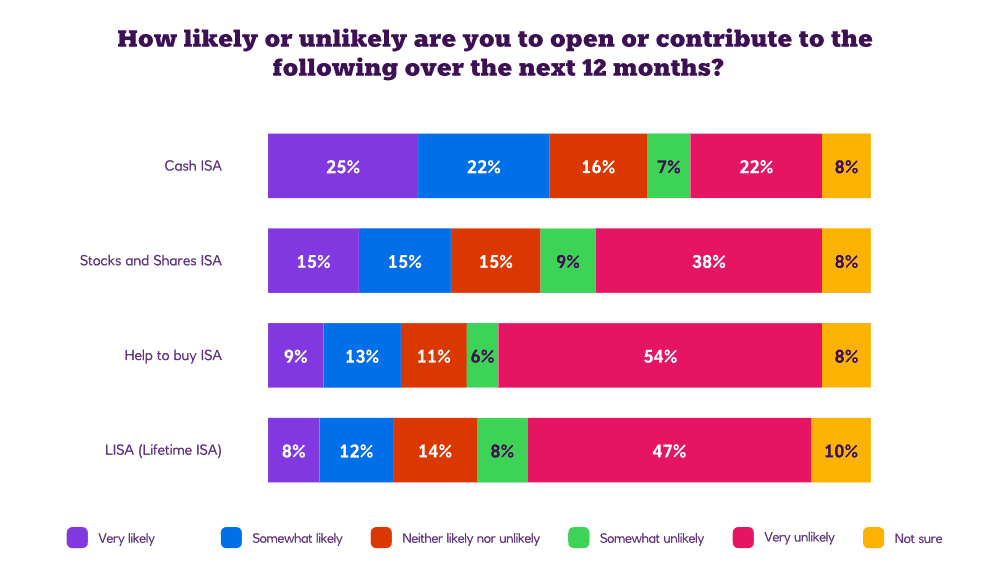

According to NatWest‘s latest Savings Index, a whopping 62% of people have no plans to either open or contribute to any sort of ISA product over the next 12 months.

This reflects to some extent a lack of awareness of the range of ISAs and how they work.

Of the 10,000 people quizzed, 73% of people knew about the existence of the Cash ISA versus 60% for the Stocks and Shares ISA. Even fewer (38%) said that they understood how the Stocks and Shares ISA works.

As a consequence, just 30% of respondents said it was likely they’d use one of these products in the next year.

NatWest’s results were even gloomier for the Lifetime ISA, a product which can also be used to buy shares, funds, and investment trusts.

Just 44% of people know these exist, and 20% of people intend to use one in the following 12 months.

Last-minute buys

This is a missed opportunity given the massive advantages these products offer. I myself own a Stocks and Shares ISA and a Lifetime ISA to invest. With the latter, investors also receive a £1 government top-up for every £4 they invest.

I myself have maxed out my £4,000 Lifetime ISA allowance this year. But I have some contribution room left in my Stocks and Shares ISA, so I’m looking for some last-minute additions before 5 April’s annual deadline.

Any of my £20,000 annual allowance I don’t use can’t be rolled over to the next year.

Following recent weakness on global stock markets, now could be a particularly good time to find last-minute bargains. Associated British Foods (LSE:ABF) is one that’s currently on my watchlist.

A FTSE 100 bargain?

I don’t need to actually buy shares to utilise any allowance I have left. I merely need to deposit the cash in my ISA account.

But given the cheapness of ABF shares today, I see no reason to delay. The FTSE 100 company trades on a forward price-to-earnings (P/E) ratio of 9.6 times.

That’s significantly below the five-year average P/E of 21-22 times, and reflects fears over increased competition for Primark and — more recently — the impact of US trade tariffs.

But I believe that, on balance, ABF remains a highly attractive stock at current prices. Primark still has significant room to grow as estate expansion continues, and especially in fast-growing North America and Central and Eastern Europe. Primark opened 22 net new stores last year to take the total to 450.

I’m also optimistic that rising investment in online shopping will help it effectively exploit the growing fast-fashion segment. Click & Collect is now available in 113 of its stores.

With many other quality blue chips also looking underpriced, I think now’s a great time to go ISA shopping.

The post Millions are missing out on ISA account benefits! Here’s what I’m doing now appeared first on The Motley Fool UK.

But here’s another bargain investment that looks absurdly dirt-cheap:

Like buying £1 for 31p

This seems ridiculous, but we almost never see shares looking this cheap. Yet this Share Advisor pick has a price/book ratio of 0.31. In plain English, this means that investors effectively get in on a business that holds £1 of assets for every 31p they invest!

Of course, this is the stock market where money is always at risk — these valuations can change and there are no guarantees. But some risks are a LOT more interesting than others, and at The Motley Fool we believe this company is amongst them.

What’s more, it currently boasts a stellar dividend yield of around 10%, and right now it’s possible for investors to jump aboard at near-historic lows. Want to get the name for yourself?

More reading

- As the FTSE 100 soars, I still see bargains!

- I’ve been on the hunt for cheap UK shares to buy – here are 3 I found!

- A 3.4% dividend yield may not be much, but investors should take a closer look at Associated British Foods shares

- If the British stock market is so cheap, why is the FTSE 100 so high?

Royston Wild has no position in any of the shares mentioned. The Motley Fool UK has recommended Associated British Foods Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.