Why isn’t everyone aiming for £37m in stocks and shares?

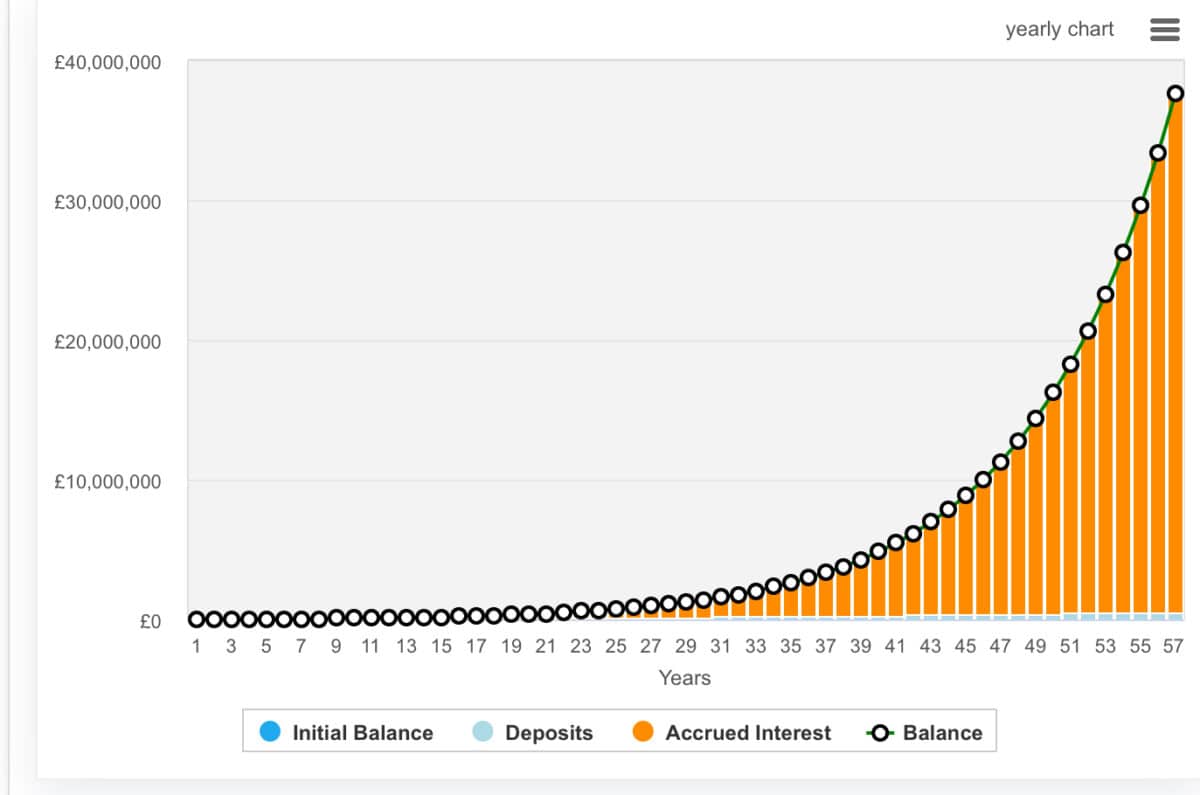

My one-year-old daughter has a Junior ISA and a SIPP (Self-Invested Personal Pension). These are accounts and tax wrappers that allow us to invest in stocks and shares and leverage the power of compounding for long-term growth. But what about this £37m figure? Well, the maths tells us that itâs possible.

In fact, this is a calculation Iâve run for my daughterâs SIPP:

- A total of £320 in monthly contributions, consisting of £240 from my own funds and £80 from HRMC.

- Iâve accounted for this figure increasing by 3% annually, assuming a rising threshold.

- A 12% annualised growth rate, which is about the rate of growth I think I can achieve for her. Other investors may wish to take a slightly lower figure.

- As of 2028, the minimum age to withdraw from a SIPP is 57 years. So, Iâve accounted for 57 years of investing and reinvesting.

Adding all this together, we come to the figure of £37m. As we can see from the graphic below, most of the growth is coming towards the end of the period. Thatâs compounding. Compounding really comes into its own when we invest for the very long run. I appreciate this requires a very long-term perspective. But Iâm surprised more people donât do this.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

This is how Warren Buffett made it

This isnât a new strategy. In fact, Warren Buffett‘s wealth is a testament to the power of compounding and time. At age 30, his net worth was $1m, growing to $25m by 39. By 56, he became a billionaire, and by 66, his wealth surged to $17bn. Remarkably, 99% of his wealth was accumulated after age 50, with $84.2bn earned post-50 and $81.5bn after 65. Today, heâs worth $160bn.

Buffett’s strategy of reinvesting profits and focusing on long-term investments allowed his wealth to snowball over decades. For example, his $1bn investment in Coca-Cola in 1988 grew to over $20bn through reinvested dividends. This exponential growth underscores the importance of starting early and letting compounding work over time.

Investing for long-term growth

With Buffett in mind, one stock to consider for long-term investing is his Berkshire Hathaway (NYSE:BRK.B) conglomerate.

Berkshire Hathaway, under Warren Buffettâs leadership, has consistently demonstrated its ability to deliver long-term growth through disciplined investing and compounding. From 1965 to 2023, the company achieved a compound annual growth rate (CAGR) of 19.8%, significantly outperforming the S&P 500âs 10.2% over the same period.

Moreover, its diversified portfolio, spanning insurance, utilities, and railroads, provides stability and resilience across economic cycles. This is why it was one of the first investments in my daughterâs SIPP.

In 2024, Berkshire reported more positive results, supported by strong insurance operations and a $334bn cash reserve. This financial strength allows Berkshire to capitalise on market opportunities, such as its recent investments in Japanese trading houses.

However, risks include its reliance on Buffettâs leadership, with succession concerns looming. Additionally, its massive size may limit agility in volatile markets, although its cash position may suggest the opposite.

Despite these challenges, Berkshireâs proven track record, wide economic moat, and conservative capital allocation make it an enticing proposition for long-term investors. Analysts maintain a Buy rating, with a 12-month price target of $511, reflecting confidence in its continued growth.

The post Why isnât everyone aiming for £37m in stocks and shares? appeared first on The Motley Fool UK.

But this isnât the only opportunity thatâs caught my attention this week. Here are:

5 Shares for the Future of Energy

Investors who don’t own energy shares need to see this now.

Because Mark Rogers — The Motley Fool UK’s Director of Investing — sees 2 key reasons why energy is set to soar.

While sanctions slam Russian supplies, nations are also racing to achieve net zero emissions,

he says. Mark believes 5 companies in particular are poised for spectacular profits.

Open this new report — 5 Shares for the Future of Energy

— and discover:

- Britain’s Energy Fort Knox, now controlling 30% of UK energy storage

- How to potentially get paid by the weather

- Electric Vehicles’ secret

backdoor

opportunity - One dead simple stock for the new nuclear boom

Click the button below to find out how you can get your hands on the full report now, and as a thank you for your interest, we’ll send you one of the five picks — absolutely free!

More reading

- Hereâs how much an investor needs in an ISA to generate a £27,500 second income

- Hereâs how much an investor needs in a Stocks & Shares ISA for a £5,000 monthly passive income

- Has Warren Buffett just played a blinder in the stock market?

- £10,000 invested in Berkshire Hathaway shares 1 month ago is now worthâ¦

- Iâm following Warren Buffettâs lead and safeguarding against Trumpâs trade tariffs

James Fox has positions in Berkshire Hathaway. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.