The 2025 stock market sell-off: why now’s the time to consider buying ‘Magnificent 7’ growth stocks

Global equities have underperformed in 2025. At the heart of the weakness has been a sell-off in the ‘Magnificent 7’ growth stocks, which are some of the largest stocks in the market.

For long-term investors, I think there could be a major investment opportunity here right now. Here’s why I believe that now is the time to consider buying selected mega tech stocks.

Prone to volatility

The Magnificent 7 have all been phenomenal long-term investments. Over the last 20 years, these stocks have made investors a lot of money.

They do tend to exhibit volatility at times though. Every few years, these stocks seem to pull back 20% or more (we’re seeing this now with a few of them).

Amazing buying opportunities

History shows that these dips can be amazing opportunities to build wealth. By buying these growth stocks when they’re out of favour, investors can potentially generate fantastic returns in the following years.

Buying the dip has worked very well for me personally. For example, back in late 2018, when tech stocks were crashing, I bought into Apple for the first time. One year later, I was sitting on solid gains. Six-and-a-half years later, I’m sitting on massive gains.

Long-term growth potential

Looking ahead, I believe that most of the Magnificent 7 will continue to reward investors in the long run.

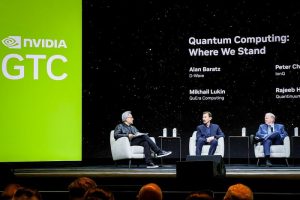

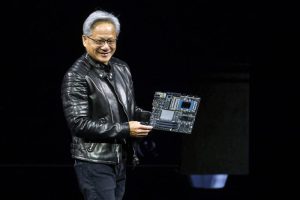

These companies operate in growth industries such as cloud computing, artificial intelligence (AI), digital advertising, and e-commerce, so they should continue to grow as the world becomes more digital.

Meanwhile, most have high returns on capital (meaning that they are very profitable), strong cash flows, fortress balance sheets, and share buybacks.

As for their valuations, they generally look attractive right now. With the exception of Tesla (which I continue to dislike as an investment due to its valuation) and perhaps Apple, they have attractive price-to-earnings (P/E) ratios relative to their growth.

| Stock | Forward-looking P/E ratio |

| Microsoft | 29.6 |

| Apple | 29.3 |

| Alphabet | 18.5 |

| Meta Platforms | 23.1 |

| Tesla | 87.7 |

| Amazon | 30.8 |

| Nvidia | 26.2 |

Growth at a reasonable price

One of them that stands out to me as cheap right now and worth considering is Alphabet (NASDAQ: GOOG) (the owner of Google and YouTube). It was trading near $210 in early February but can now be snapped up for around $165 – roughly 20% lower.

Today, Alphabet operates in a wide range of industries including digital advertising, cloud computing, AI, self-driving cars, and digital healthcare. So, I see plenty of growth potential both in the short term and the long term.

This year, Alphabet’s revenues are forecast to rise 11% to $389bn. Meanwhile, its earnings per share are forecast to jump 13.5% to $8.90.

Given that the stock currently trades on a P/E ratio of 18.5, I think there’s value on offer today. To my mind, we have growth at a reasonable price.

Of course, the big risk is internet search revenues. For 20 years, Google has had a monopoly on search. However, the way we search for information is now changing. And this adds some uncertainty.

All things considered, however, I like the risk/reward set-up. I think there’s a good chance that this stock will deliver attractive returns for investors over the next five to 10 years.

The post The 2025 stock market sell-off: why now’s the time to consider buying ‘Magnificent 7’ growth stocks appeared first on The Motley Fool UK.

But there are other promising opportunities in the stock market right now. In fact, here are:

5 stocks for trying to build wealth after 50

The cost of living crisis shows no signs of slowing… the conflict in the Middle East and Ukraine shows no sign of resolution, while the global economy could be teetering on the brink of recession.

Whether you’re a newbie investor or a seasoned pro, deciding which stocks to add to your shopping list can be a daunting prospect during such unprecedented times. Yet despite the stock market’s recent gains, we think many shares still trade at a discount to their true value.

Fortunately, The Motley Fool UK analyst team have short-listed five companies that they believe STILL boast significant long-term growth prospects despite the global upheaval…

We’re sharing the names in a special FREE investing report that you can download today. We believe these stocks could be a great fit for any well-diversified portfolio with the goal of building wealth in your 50’s.

More reading

- 5 S&P 500 ‘sell-off stocks’ Fools have added to their watchlist

- The Nasdaq Composite is in correction territory. 2 stocks to consider buying on the dip

- Is the S&P 500 heading for a bear market?

- Stock-market crash: will the S&P 500 bubble burst or deflate?

- 4 powerful words from Warren Buffett!

Edward Sheldon owns shares in Apple, Microsoft, Amazon, Nvidia, and Alphabet. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. The Motley Fool UK has recommended Alphabet, Amazon, Apple, Meta Platforms, Nvidia, Microsoft, and Tesla. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.