A bull market could be coming for UK stocks! Here’s what I’m buying

UK stocks have traded at a discount to their US counterparts for a long time and to some extent this has been justified. But there are signs things are starting to change.

Investors have been moving away from US shares and into other assets â including cash and UK stocks. And Iâve been looking for opportunities ahead of a potential FTSE 100 bull market.

Fund flows

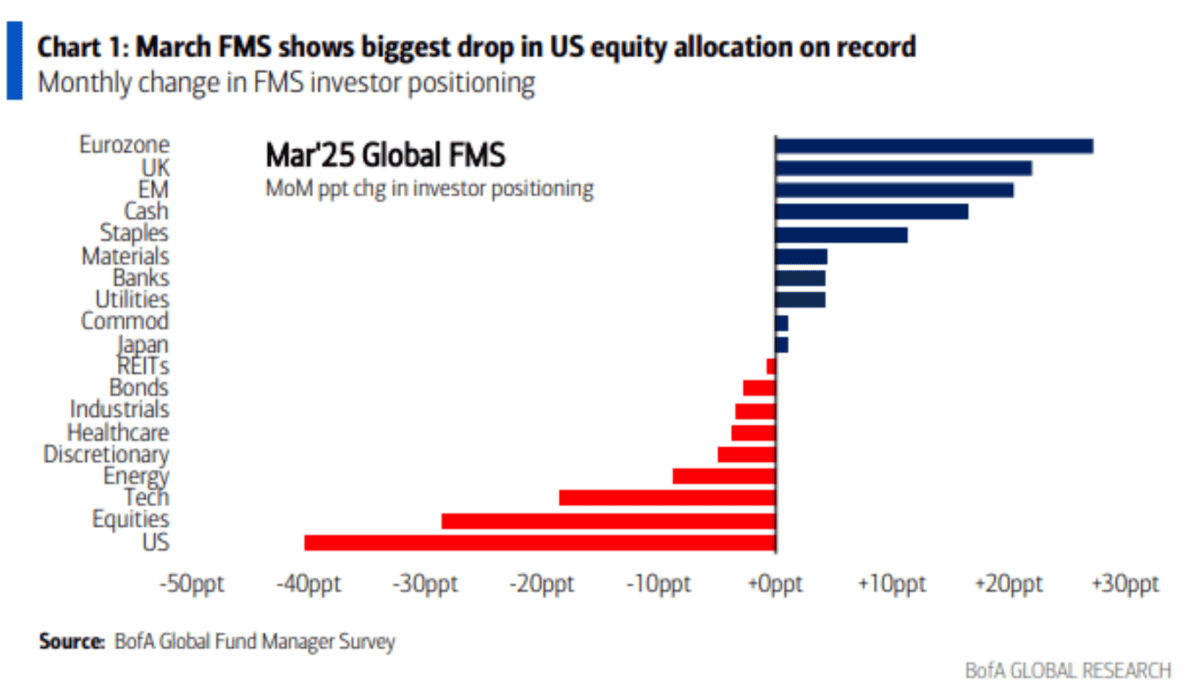

The results of Bank of Americaâs monthly fund manager survey for March generated some interesting data. The headline is that US stocks have been declining in popularity.

Participants reported moving from being 17% overweight US shares in February to being 23% underweight in March. Thatâs interesting, but there was something else that caught my eye.

Rather than where the moneyâs been taken from, Iâm interested in where itâs been going to. And along with European equities, emerging markets, and cash, the answerâs UK stocks.

During March, investors went from being 18% underweight UK stocks to 4% overweight. And I think thatâs a significant indication of improving sentiment.

Valuation

Investing though, isnât about being in front of the latest stock market trend. Itâs about finding situations where a share price doesnât reflect the value of the underlying business.

This involves looking for situations where the marketâs underestimating a company. And the chances of this are best in markets where investors have a less positive outlook.

Despite the activity, UK shares still trade at a discount to their US counterparts. The S&P 500 trades at a price-to-earnings (P/E) ratio of 27, compared with 17 for the FTSE 100.

By itself, this doesnât say anything about value. But itâs a sign investors still think US shares have better prospects, which is why Iâm still mostly focusing on the UK for stocks to buy.

Packaging

Macfarlane (LSE:MACF) is a manufacturer and distributor of specialist protective packaging. And I think it’s a strong business with shares trading at a relatively attractive price.

The firm doesnât have the advantages of scale of other packaging companies and this creates risk. But its distribution business isnât what makes it attractive from an investment perspective.

Macfarlaneâs manufacturing division focuses on specialised markets like aerospace, medical devices, and automotive parts. These are often expensive and breakages can be costly.

This means designing and engineering bespoke protective packaging for these products can be highly lucrative. And a strong position in this industry is the big attraction of Macfarlane.

I’m buying

Regardless of whether or not investors are shifting from US equities to UK stocks, I think Macfarlane shares look good value. Thatâs why Iâve been buying them for my portfolio.

Revenues and profits fell slightly in 2024, due to a tough trading environment. Thatâs an ongoing risk to consider, but I think there are some important long-term strengths.

As the company expands, its operating margins have grown consistently over the last 10 years. And I think there could be more to come, making the stock attractive at todayâs prices.

The post A bull market could be coming for UK stocks! Here’s what I’m buying appeared first on The Motley Fool UK.

Should you invest £1,000 in Macfarlane Group Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Macfarlane Group Plc made the list?

More reading

Stephen Wright has positions in Macfarlane Group Plc. The Motley Fool UK has recommended Macfarlane Group Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.