How to get a big advantage in the stock market

The stock market‘s a great place to make money, but it can also be a place to lose it. Fortunately, investors can put themselves ahead of the competition by just avoiding one simple mistake.

In general, the worst thing investors can do is sell stocks when prices are low. This seems like a straightforward principle, but itâs surprising how often it seems to happen.

Sell low?

Warren Buffett‘s instruction to be greedy when others are fearful is well known. But â as Buffett also acknowledges â working out when prices are at their lowest is nearly impossible.

Even if buying when prices are at their lowest is difficult, it should at least be possible to avoid selling at those times. But investors seem to have an uncanny knack for doing exactly this.

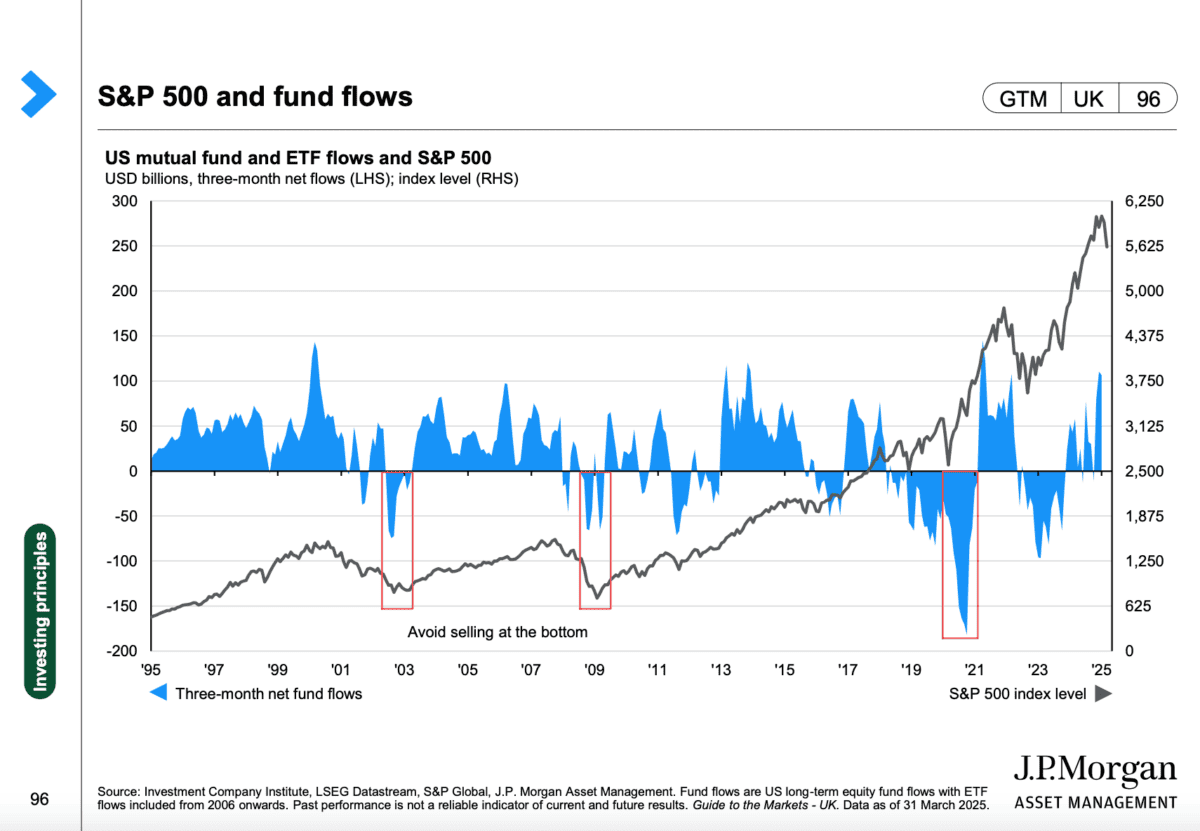

According to JP Morgan, the biggest outflows from US equity funds in the last 30 years have been at times the S&P 500 has been falling. In other words, investors sell when stocks go down.

There are a couple of lessons investors can take from this. One is that following Buffettâs advice is easier said than done, but the other is those who can are at a big advantage.

Exceptions

Like all good rules however, there are exceptions. During the Covid-19 pandemic, Buffett sold Berkshire Hathawayâs stakes in the major US airlines after their share prices had fallen.

There was however, a very good reason for this. Travel restrictions meant the businesses started losing money and had to take on significant amounts of debt to stay afloat.

United Airlines, for example, went from having $13bn in long-term debt at the end of 2019 to $30bn at the end of 2021. And that made the companyâs future prospects look very different.

A big change in the underlying business can justify selling a falling stock. But when this isnât the case, investors should be wary of the temptation to sell when prices are low.

An example from my portfolio

One of the stocks in my portfolio is JD Wetherspoon (LSE:JDW). Since I started buying it at the start of 2024, the share price has fallen 25%, but the business has performed relatively well.

Sales have grown and earnings have more than doubled. And the firm has invested heavily into owning its pubs outright â rather than leasing them â to bring down costs in future.

The stock’s been falling due to concerns over wage inflation. Offsetting these will likely involve raising prices and this brings an inevitable risk of putting customers off.

This is a genuine issue, but I donât think JD Wetherspoon has ever been in a better position to deal with it. So Iâm not looking to sell my investment despite the falling share price.

Staying the course

Avoiding selling when prices are low seems easy, but the market data suggests itâs surprisingly hard to follow. I think that means thereâs a big potential advantage here for investors.

JD Wetherspoon is an interesting example. Its key strengths â its scale and its reputation for low prices â are still firmly intact and the business is looking to expand by opening new pubs.

I can understand why thereâs fear around, but I think the company’s situation is better than people think. So I think selling with the share price falling would be a mistake I’m hoping to avoid.

The post How to get a big advantage in the stock market appeared first on The Motley Fool UK.

Should you buy J D Wetherspoon Plc now?

Don’t make any big decisions yet.

Because Mark Rogers — The Motley Fool UK’s Director of Investing — has revealed 5 Shares for the Future of Energy.

And he believes they could bring spectacular returns over the next decade.

Since the war in Ukraine, nations everywhere are scrambling for energy independence,

he says. Meanwhile, they’re hellbent on achieving net zero emissions.

No guarantees, but history shows…

When such enormous changes hit a big industry, informed investors can potentially get rich.

So, with his new report, Mark’s aiming to put more investors in this enviable position.

Click the button below to find out how you can get your hands on the full report now, and as a thank you for your interest, we’ll send you one of the five picks — absolutely free!

More reading

- Down 21% in 6 months! Should I buy the dip in this FTSE 250 stock?

- Down 11% in a day, this FTSE 250 stock is a buy for me

Stephen Wright has positions in Berkshire Hathaway and J D Wetherspoon Plc. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.