Forget gold! I prefer UK shares for trying to build long-term wealth

When things get tough in the stock market, investors often turn to gold. And while that’s worked very well recently, I’m looking at UK shares as a better long-term opportunity.

The price of gold has surged in an uncertain macroeconomic environment, but I think assets that generate cash for investors are a better choice. And the FTSE 100 is where I’m looking.

Going for gold?

Owning gold has worked out very well for investors recently and that’s not an accident. It tends to hold up strongly – much better than equities – in times of macroeconomic uncertainty.

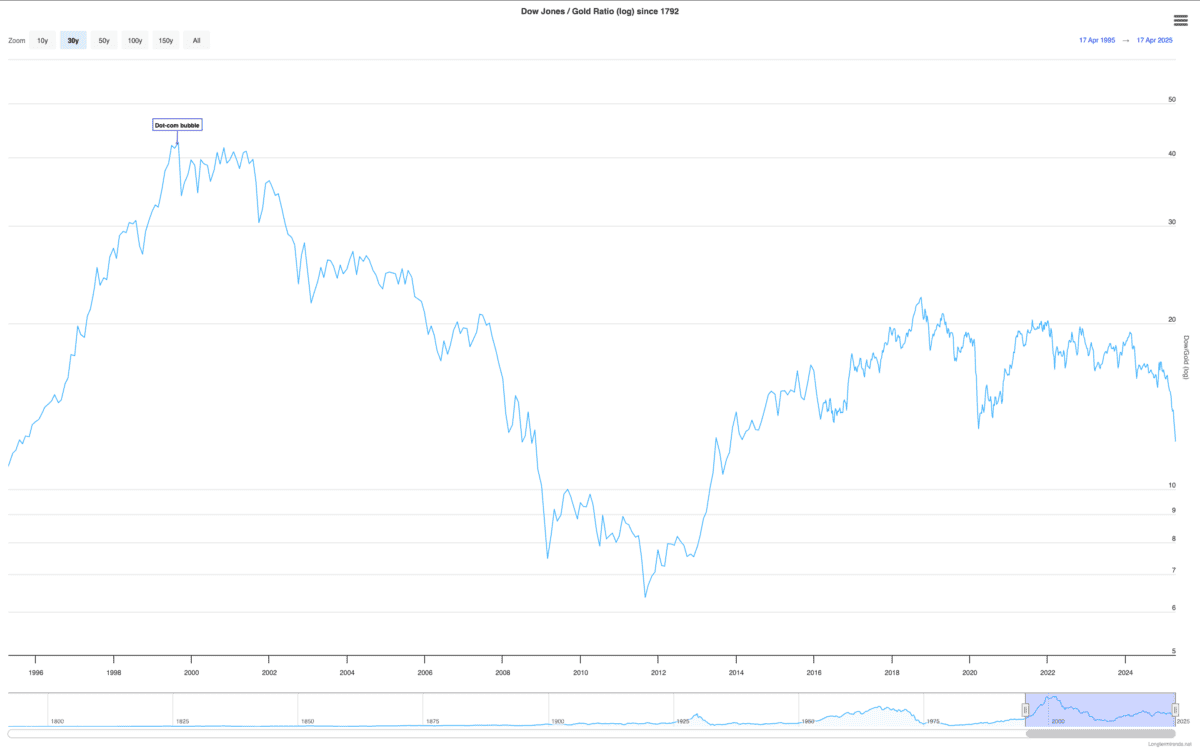

Source: Longtermtrends

Using the Dow Jones Industrial Average as a benchmark, the time stocks have been cheapest compared to gold was between 2009-2011. In other words, the Great Financial Crisis (GFC).

The other time gold prices did significantly better than the Dow was during the pandemic. But even then, the relative level held up above where it has fallen to in the last few months.

In other words, outside the GFC, gold’s at a 30-year high compared to equities. If investing well is about being greedy when others are fearful, I don’t think it’s time to think about buying gold.

FTSE 100 shares

That’s one reason for focusing on the stock market at the moment. Prices are historically cheap – relative to gold, anyway – and that can often lead to better returns over the long term.

US equities have been struggling the most. And while I don’t object to anyone looking for opportunities in the S&P 500, I’m focusing on the UK at the moment.

In my view, there are some really interesting UK companies that operate in niche markets. But I don’t think investors need to be too creative to find stocks worth considering.

The FTSE 100 ‘s made up of businesses that are well-known, established, and have strong competitive positions. One that I’ve been looking at is Howden Joinery Group (LSE:HWDN).

A potential opportunity

Howden sells kitchen, joinery, and hardware products. Its big advantage over other retailers is it doesn’t sell to DIY enthusiasts – it focuses exclusively on trade customers.

That might give it a smaller market, but it makes the company much more competitive. It means the firm doesn’t need expensive showrooms – it can operate out of cheaper warehouses.

This gives Howden’s a cost advantage over its rivals and the result is it can maintain wider margins while charging customers lower prices. That’s a win-win for everyone.

This business model is the kind of thing I think leads to strong long-term profits, which translates into better returns for investors. That’s why I’m taking a closer look.

Building wealth

There’s always risk when it comes to investing and Howden’s no exception. Inflation’s a potential threat and so is the possibility of demand dropping off in a recession.

That can make earnings volatile and the price-to-earnings (P/E) ratio an awkward one to use for valuing the stock. But on a price-to-book (P/B) basis, it’s at its lowest level in five years.

Is that cheap enough to offset the risks? I think it might be. But when it comes to building wealth over time, it’s way ahead of gold on my list.

The post Forget gold! I prefer UK shares for trying to build long-term wealth appeared first on The Motley Fool UK.

Investing in AI: 3 Stocks with Huge Potential!

🤖 Are you fascinated by the potential of AI? 🤖

Imagine investing in cutting-edge technology just once, then watching as it evolves and grows, transforming industries and potentially even yielding substantial returns.

If the idea of being part of the AI revolution excites you, along with the prospect of significant potential gains on your initial investment…

Then you won’t want to miss this special report inside Motley Fool Share Advisor – ‘AI Front Runners: 3 Surprising Stocks Riding The AI Wave’!

And today, we’re giving you exclusive access to ONE of these top AI stock picks, absolutely free!

More reading

- Should I buy Aston Martin shares for my ISA while they’re under 70p?

- Why I prefer investing with Warren Buffett to a FTSE 100 or S&P 500 tracker

- This S&P 500 stock looks crazily mispriced to me

- Meet the FTSE 100 share I’m happy to own, even during the next recession

- £10,000 invested in NatWest shares 10 years ago is now worth this much

Stephen Wright has no position in any of the shares mentioned. The Motley Fool UK has recommended Howden Joinery Group Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.