Is Tesla stock about to crash? Here’s what the charts say

Is Tesla (NASDAQ:TSLA) stock undervalued? Well, it’s hard to argue that any company trading at 100 times forward earnings is undervalued. In fact, most of the charts would reinforce that. The stock is exceedingly expensive.

Here’s what the charts say

Starting with the price-to-sales (P/S) ratio, we can see that Tesla has been more expensive, and it’s also been cheaper over the past five years. As the data highlights, Tesla is currently trading around 33% above its lowest P/S ratio during the period. However, the discount versus 2021 levels is huge.

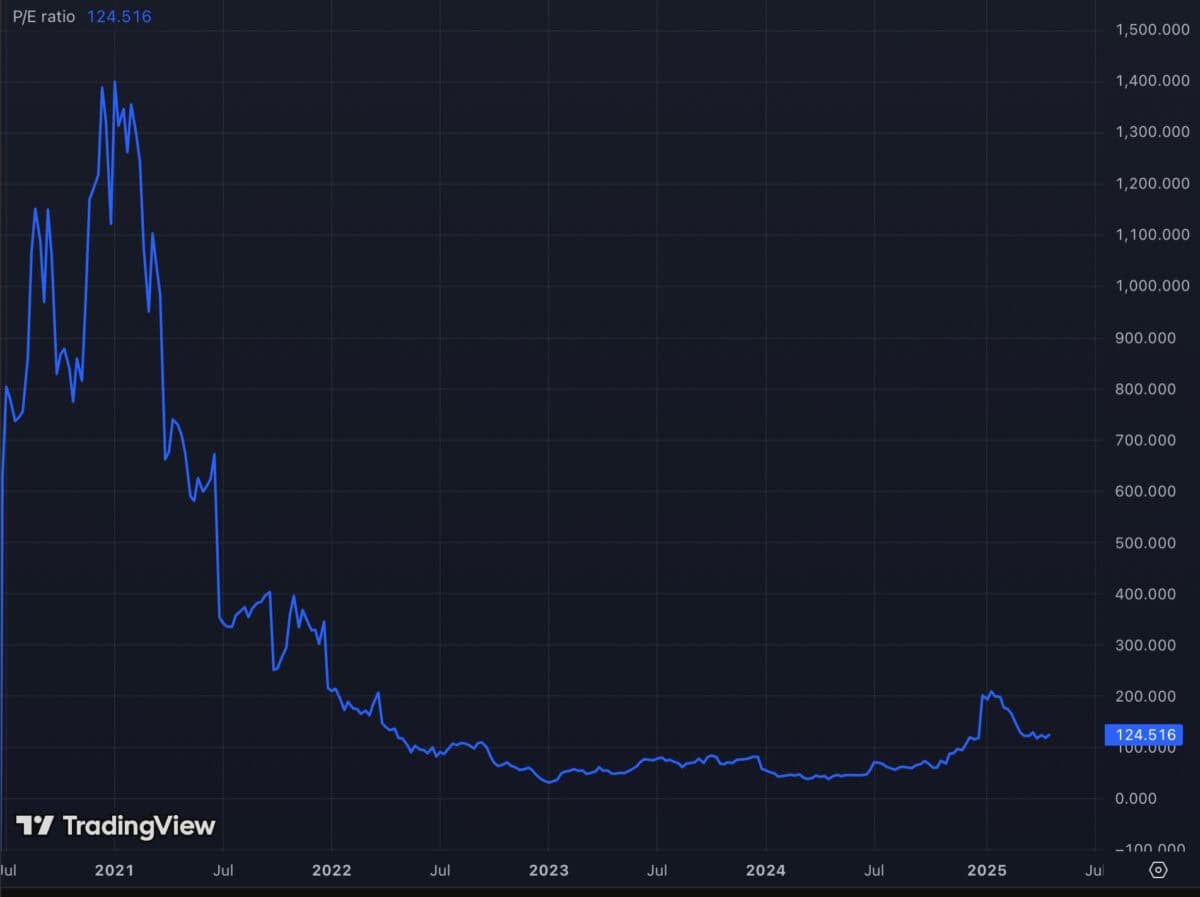

The price-to-earnings (P/E) ratio shows a similar picture. Firstly, we can see that at 124 times trailing earnings, it’s incredibly expensive for a car stock. However, it has been substantially more expensive than it is today.

What’s more, the expected earnings growth rate from here does little to satisfy this valuation. Analysts expect earnings to grow by around 11.5% annually over the medium term. That’s slower than typically ‘boring’ British companies like Lloyds. The result is a P/E-to-growth (PEG) ratio of eight. For context, fair value is considered to be one and under.

All of this suggests Tesla stock should collapse.

A multi-trillion dollar promise

So, why is Tesla so expensive? Well, Elon Musk has repeatedly asserted that Tesla could become the most valuable company in the world, even surpassing the combined market capitalisation of today’s five largest firms. Together, these companies are worth around $11trn. Musk’s vision hinges on transformative technologies beyond electric vehicles and into autonomous robotaxis and humanoid robots.

Tesla’s future is centred on full self-driving vehicles and the creation of a massive robotaxi fleet. This ride-hailing network could operate around the clock, generating continuous revenue and potentially disrupting both the automotive and transportation sectors. Analysts such as ARK Investment Management’s Cathie Wood estimate the robotaxi opportunity alone could be worth up to $14trn by 2027.

In addition, those robotaxis could, in theory, sell their unused computing power to the wider market when not in operation. After all, these vehicles will require some of the most advanced computing technology around. “So if you can imagine the future, perhaps where there’s a fleet of 100m Teslas, and on average, they’ve got like maybe a kilowatt of inference compute. That’s 100 gigawatts of inference compute distributed all around the world”, Musk said in 2024.

Musk is also betting on Tesla Optimus, a humanoid robot he claims could eventually outpace the car business in value. He envisions millions of these robots produced annually, serving in factories and homes, and forecasts that Optimus could generate over $10trn in revenue as adoption scales. These robots would also play an important role in his plan to colonise Mars.

However, coming back down to earth with a bang, there are huge execution risks. Tesla is behind some of its robotaxi peers and Optimus has yet to truly capture the imagination of the investor. I want to see Tesla continue to push technological boundaries, but I can’t put my money behind it yet.

The post Is Tesla stock about to crash? Here’s what the charts say appeared first on The Motley Fool UK.

Should you buy Tesla now?

Don’t make any big decisions yet.

Because Mark Rogers — The Motley Fool UK’s Director of Investing — has revealed 5 Shares for the Future of Energy.

And he believes they could bring spectacular returns over the next decade.

Since the war in Ukraine, nations everywhere are scrambling for energy independence,

he says. Meanwhile, they’re hellbent on achieving net zero emissions.

No guarantees, but history shows…

When such enormous changes hit a big industry, informed investors can potentially get rich.

So, with his new report, Mark’s aiming to put more investors in this enviable position.

Click the button below to find out how you can get your hands on the full report now, and as a thank you for your interest, we’ll send you one of the five picks — absolutely free!

More reading

- Why isn’t the Tesla share price crashing after Q1 earnings?

- Here’s my preview for Tesla stock, down 5.75% yesterday, with earnings due today

- With Tesla stock down 50% in tariff panic, is it time to consider buying?

- Is Tesla stock now a brilliant long-term opportunity?

- This FTSE 100 fund’s been selling Tesla stock and buying an EV rival instead!

James Fox has positions in Lloyds Banking Group Plc. The Motley Fool UK has recommended Lloyds Banking Group Plc and Tesla. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.