Here’s a cheap FTSE 250 share I’m avoiding like the plague right now

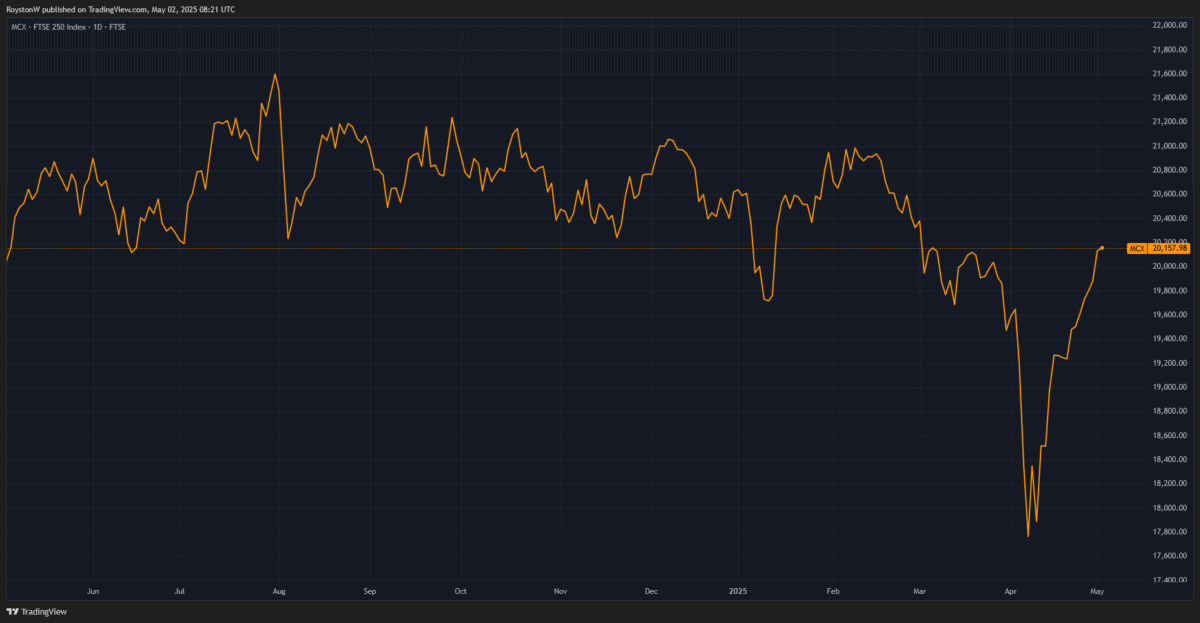

Over many decades, the UK stock market has proved its resilience and ability to rebound from crises. The FTSE 250 has more than tripled in value in the last 20 years, and is staging another rapid recovery as worries over a full-blown trade war recede.

The FTSE 250 is a great place to find top-quality growth shares, some of which I own in my own portfolio. Yet the FTSE 100‘s little brother is also packed with potential traps that could cost investors a lot of cash.

Bearing this in mind, here is one index member I wouldn’t touch with a bargepole right now.

Watch out

Sellers of big-ticket items like luxury timepieces are vulnerable during uncertain economic times like these. With Watches of Switzerland Group (LSE:WOSG), the outlook is especially dangerous as the threat of ‘Trump Tariffs’ persists.

You see, the retailer’s the US is the company’s single-largest market following rapid expansion there. Around 45% of sales now come from Stateside customers, up from less than a quarter just six years ago.

What’s more, it specialises (as the name suggests) in premium and mid-tier watches from Switzerland like Rolex, Omega and Breitling. With the US threatening import duties of 31% on Swiss goods, the danger to the retailer’s sales could clearly be considerable.

Changing models

Crushing new trade taxes aren’t the only seismic danger to Watches of Switzerland’s revenues, with Rolex’s entry into the retail market in 2023 also posing a long-term threat. This particular brand accounts for around half of the company’s total sales.

What’s more, Rolex‘s move could be the first of a flurry of luxury watch manufacturers moving to sell their own products or ramping up their own direct-to-customer (DTC) channels. Benefits include higher margins, better inventory management, and the chance to control the brand experience more closely and build direct relationships with customers.

Shortly after Rolex’s strategic announcement two years ago, Watches of Switzerland declared plans to more than double annual sales to above £3bn by financial 2028. This incorporated its expectation that US revenues would grow at a compound annual growth rate (CAGR) of 20-25% in that time.

All things considered, these plans are looking extremely shaky in my opinion.

A FTSE 250 trap?

However, there’s an argument that this threat is now baked into Watches of Switzerland’s low valuation. Its recent price collapse means the business now trades on a price-to-earnings ratio of 8.7 times for the current financial year (to April 2026).

On the plus side too, the timepieces Watches of Switzerland sells have obvious brand power that could support sales regardless of broader economic conditions and extra taxes.

The business also has a considerable foothold in second-hand luxury watches, of which its participation in the Rolex Certified Pre-Owned (CPO) programme is a key cornerstone. This could help limit the blow if consumers begin switching down to cheaper, pre-owned products.

Yet despite these factors and the company’s undemanding valuation, I’m keen to avoid this FTSE 250 share.

The post Here’s a cheap FTSE 250 share I’m avoiding like the plague right now appeared first on The Motley Fool UK.

But there may be an even bigger investment opportunity that’s caught my eye:

Investing in AI: 3 Stocks with Huge Potential!

🤖 Are you fascinated by the potential of AI? 🤖

Imagine investing in cutting-edge technology just once, then watching as it evolves and grows, transforming industries and potentially even yielding substantial returns.

If the idea of being part of the AI revolution excites you, along with the prospect of significant potential gains on your initial investment…

Then you won’t want to miss this special report inside Motley Fool Share Advisor – ‘AI Front Runners: 3 Surprising Stocks Riding The AI Wave’!

And today, we’re giving you exclusive access to ONE of these top AI stock picks, absolutely free!

More reading

Royston Wild has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.