275 shares to consider for a 9.64% Stocks & Shares ISA return!

For me, investing in UK shares with a Stocks and Shares ISA and/or a Self-Invested Personal Pension (SIPP) is a no-brainer.

Data from money comparison website Moneyfacts shows why. Over the last 10 years, the average annual return on a Stocks and Shares ISA has been an impressive 9.64%. By comparison, the yearly average on Cash ISAs sits way back at 1.21%.

That’s not to say that savings accounts don’t play an important role. I personally use one to balance risk in my portfolio and to hold money for a rainy day. But the vast majority of my capital is tied up in shares, funds, and trusts.

This way, I think I have a much better chance of hitting my retirement goals.

A clear path

Let’s say someone invested £400 a month in a Stocks and Shares ISA and another £100 in a Cash ISA. If those rate of returns of the past decade remained unchanged, after 30 years our investor would have a portfolio of £880,996 to fund their retirement.

They could then use that money to buy an annuity, purchase dividend shares, or make a regular drawdown for a healthy passive income.

If they chose to put the full £500 monthly sum into a Cash ISA instead, they’d have made just £216,879 over the same timeframe to retire on. I doubt this would give them anywhere near the £43,100 that the Pension and Lifetime Savings Association (PLSA) says that single people need to retire on each year.

As I’ve already alluded to, investing in shares involves more danger than parking one’s cash in a savings account. However, by investing in a range of different stocks, individuals can reduce the risk they face while still targeting strong portfolio growth.

275 shares for a winning ISA

Stocks and Shares ISA holders can easily and cheaply build a diversified portfolio with an investment trust or exchange-traded fund (ETF). These pooled investments often hold dozens, or hundreds, or even thousands of assets to capture different investment opportunities and spread risk.

The JP Morgan American Investment Trust (LSE:JAM) is one such vehicle I think demands serious consideration. With an average annualised return of 14.48% since 2015, shareholder gains here have outstripped what the average Stocks and Shares ISA investor has enjoyed over that timeframe.

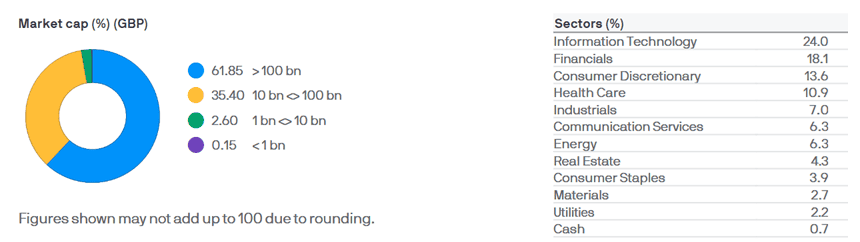

In total, this trust has holdings in 275 different US equities spread across both cyclical and defensive sectors. This gives it strength throughout the economic cycle. What’s more, around 93% of its capital is tied up in large-cap companies (those with market caps of £10bn and more), giving investors large exposure to robust, market-leading companies with cash-rich balance sheets.

Major holdings here include Microsoft, Amazon, Berkshire Hathaway, Nvidia, and Mastercard.

While reducing risk, this investment trust doesn’t eliminate danger entirely. For instance, returns here could disappoint looking ahead if economic conditions in the US worsen and/or global trade tensions worsen.

But, in my opinion, the long-term resilience of the US stock market means this trust still merits serious consideration from ISA investors.

The post 275 shares to consider for a 9.64% Stocks & Shares ISA return! appeared first on The Motley Fool UK.

5 Shares for the Future of Energy

Investors who don’t own energy shares need to see this now.

Because Mark Rogers — The Motley Fool UK’s Director of Investing — sees 2 key reasons why energy is set to soar.

While sanctions slam Russian supplies, nations are also racing to achieve net zero emissions,

he says. Mark believes 5 companies in particular are poised for spectacular profits.

Open this new report — 5 Shares for the Future of Energy

— and discover:

- Britain’s Energy Fort Knox, now controlling 30% of UK energy storage

- How to potentially get paid by the weather

- Electric Vehicles’ secret

backdoor

opportunity - One dead simple stock for the new nuclear boom

Click the button below to find out how you can get your hands on the full report now, and as a thank you for your interest, we’ll send you one of the five picks — absolutely free!

More reading

- Here’s a Warren Buffett share I’m considering adding to my portfolio!

- 7% and 13.4% dividend yields! 2 investment trusts to consider for a second income

- £10,000 invested in NatWest shares 5 years ago is now worth…

- Does the GSK or AstraZeneca share price currently offer the best value?

- Looking for FTSE 100 stocks? Here’s one I think could lift off in 2025!

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Royston Wild has no position in any of the shares mentioned. The Motley Fool UK has recommended Amazon, Mastercard, Microsoft, and Nvidia. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.