3 steps to consider to target a million pound UK shares portfolio!

History shows that, with the right strategy, investing in UK shares can be an effective way to make a million pounds or more by retirement.

WIth this in mind, are three steps for investors targeting a seven-figure portfolio to consider.

1. Try to eliminate tax

The first thing to think about is opening an investment account that can reduce or eliminate one’s tax liabilities. In the UK, we’re talking about the Individual Savings Account (ISA) and the Self-Invested Personal Pension (SIPP).

The beauty of these tax wrappers is twofold. Not only can they save investors a boatload of cash from the clutches of HMRC. The money that’s shielded can also be reinvested, giving individuals a chance to supercharge portfolio growth through the miracle of compounding.

Stocks and Shares ISA investors can invest £20k a year, while SIPP users can deposit a sum equal to their annual salary (up to a maximum of £60k).

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

2. Invest as early as possible

‘Time in the market beats timing the market’, as the old saying goes. Rather than waiting for the best opportunity to buy, investing as soon as possible — and then keeping one’s money locked up in the markets — is proven the most effective way to build long-term wealth.

Fresh evidence from Hargreaves Lansdown underlines the effectiveness of such a strategy. It says that more than a third (34%) of the Stocks and Shares ISA millionaires on its books topped up their portfolio in the first two weeks of the 2024/25 tax year.

By comparison, just 2% of its millionaires invested in the final two weeks of the period.

3. Build a diversified portfolio

The final thing to consider is creating an ISA and SIPP that’s well diversified across a number of lines (such as sector and geography). This provides investors with exposure to multiple investing opportunities, as well as risk mitigation that limits the impact of one or two underperforming assets.

This can be achieved by buying a range of individual shares. Investing in trusts or funds that hold a variety of assets works, too. I personally use a mix of both strategies, and the iShares S&P 500 ETF (LSE:CSPX) is an exchange-traded fund (ETF) I currently own.

In fact, it’s currently one of my largest holdings. With an stunning average annual return of 13.2% since 2010, I don’t think it’s difficult to see why.

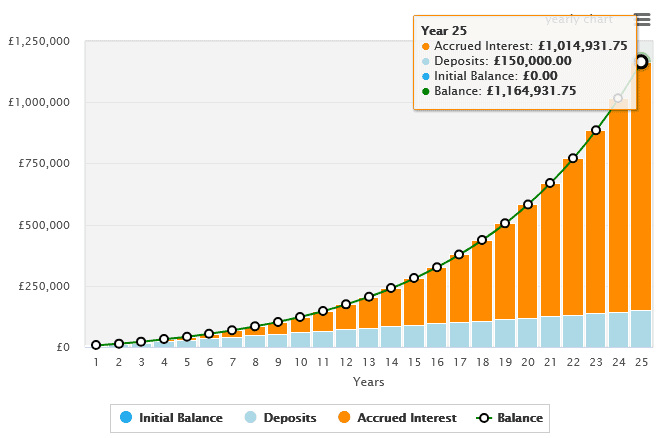

Past performance isn’t always a reliable guide to future returns. But if this ETF’s strong record continues, someone who invested £500 here a month would — after 25 years — have built an ISA or SIPP portfolio of £1.16m (excluding trading fees).

With holdings in approximately 500 large-cap companies, this one fund could facilitate a well diversified portfolio just on its own. With multinationals like Nvidia, Visa, Coca-Cola, and Amazon in its ranks, it achieves broad exposure by geography. And as that list shows, it’s also effectively diversified by industry.

Its performance more recently has been dented by the threat of growth-sapping trade wars. While this remains a threat going forwards, I believe S&P 500-based funds like this should remain powerful long-term investments.

The post 3 steps to consider to target a million pound UK shares portfolio! appeared first on The Motley Fool UK.

Should you buy Ishares Vii Public – Ishares Core S&p 500 Ucits Etf shares today?

Before you decide, please take a moment to review this first.

Because my colleague Mark Rogers – The Motley Fool UK’s Director of Investing – has released this special report.

It’s called ‘5 Stocks for Trying to Build Wealth After 50’.

And it’s yours, free.

Of course, the decade ahead looks hazardous. What with inflation recently hitting 40-year highs, a ‘cost of living crisis’ and threat of a new Cold War, knowing where to invest has never been trickier.

And yet, despite the UK stock market recently hitting a new all-time high, Mark and his team think many shares still trade at a substantial discount, offering savvy investors plenty of potential opportunities to strike.

That’s why now could be an ideal time to secure this valuable investment research.

Mark’s ‘Foolish’ analysts have scoured the markets low and high.

This special report reveals 5 of his favourite long-term ‘Buys’.

Please, don’t make any big decisions before seeing them.

More reading

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Royston Wild has no position in any of the shares mentioned. The Motley Fool UK has recommended Amazon, Nvidia, and Visa. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.