6.7% yield! Here’s the dividend forecast for Imperial Brands shares to 2027

Given its highly addictive qualities, tobacco is one product for which demand remains stable across time. It makes businesses like Imperial Brands (LSE:IMB) dependable dividend shares across all points of the economic cycle.

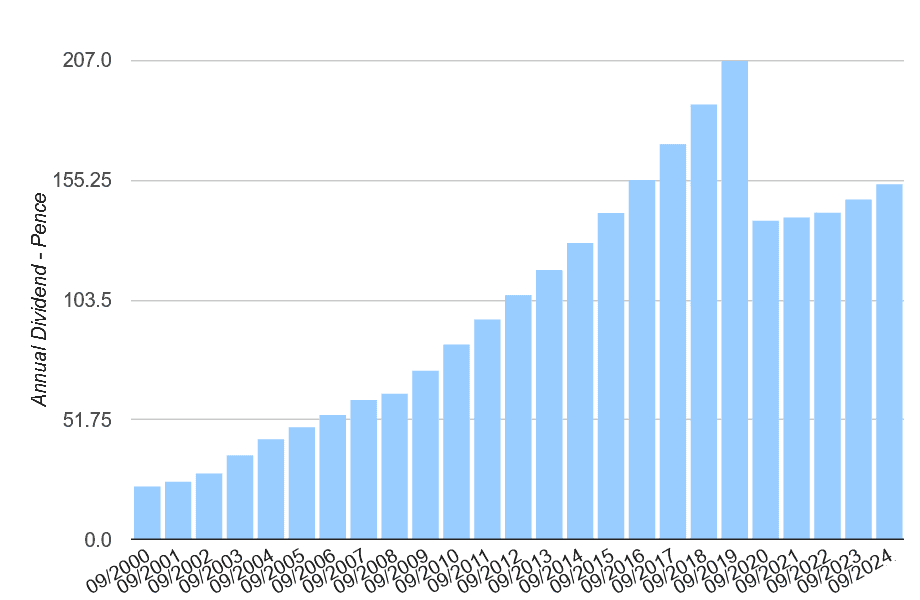

As you can see, this FTSE 100 operator has lifted dividends every year since the turn of the century, except for in 2020 when payouts fell. Dividends plummeted by a third, as pandemic uncertainty accelerated the firm’s debt-cutting plans.

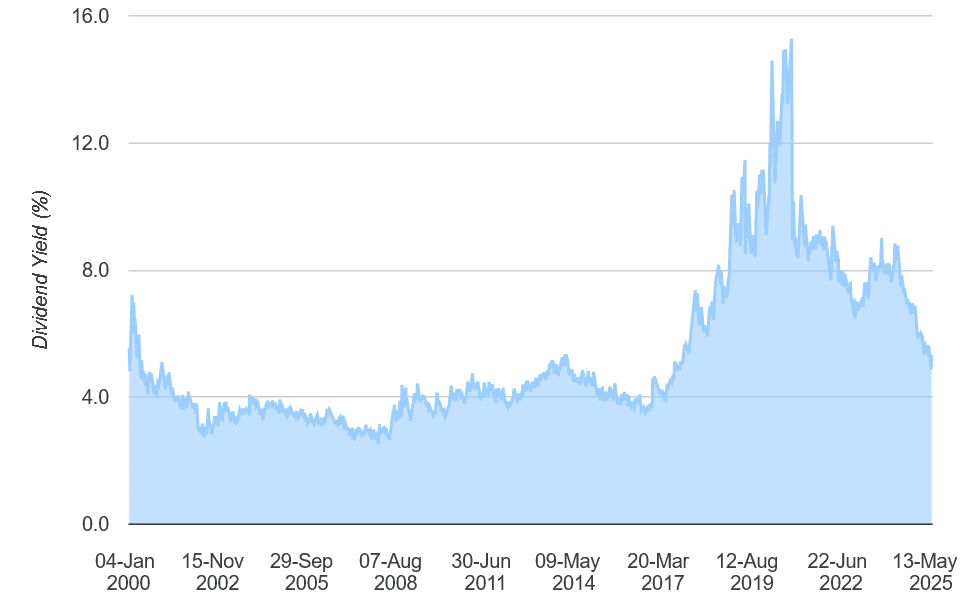

Yet despite that cut, Imperial Brands has been one of the Footsie’s greatest dividend growth shares in recent times. And as the following graph shows, its dividend yields have regularly beaten the index’s long-term average of 3-4%.

Encouragingly, City analysts expect dividends to keep soaring over the short-to-medium-term too. But does this make Imperial Brands a no-brainer buy for passive income investors like me?

Impressive forecasts

| Financial Year Ending September… | Expected dividend per share | Dividend growth | Dividend yield |

|---|---|---|---|

| 2025 | 163.2p | 6.4% | 6% |

| 2026 | 170.72p | 4.6% | 6.3% |

| 2027 | 181.33p | 6.2% | 6.7% |

Forecasters expect dividend growth to continue outpacing that of the broader FTSE 100. This also means Imperial Brands’ dividend yields range a hefty 6%-7% for the period.

It’s important to remember that dividends are never, ever guaranteed. But in this case, I think there’s a good chance of the company meeting current projections.

As mentioned, the stable nature of tobacco demand provides it with excellent profits visibility and dependable cash flows. Predicted dividends are also well covered by expected earnings all the way through to 2027, providing another layer of safety. Dividend cover ranges from 1.9 times to 2.1 times over the period.

On top of this, work to reduce debt levels continues, with the business targeting a net-debt-to-EBITDA ratio of 2 times by financial year’s end. This will give it firmer financial foundations with which to pay more market-beating dividends.

Time to buy?

Yet despite its impressive dividend prospects, I’m not tempted to invest in Imperial Brands today. This is because its share price outlook through to 2027 and beyond is far less secure. The company’s share price has dropped 16% over the past 10 years and I believe it could continue falling as tobacco consumption steadily declines.

Fresh interims today (14 May) underline the rising pressure Imperial Brands finds itself under. Tobacco volumes sank 3.2% in the six months to December, to 87bn sticks, which the firm said reflected “wider industry market size declines across our footprint“.

On the plus side, net revenues edged 0.7% higher, to £3.6bn, driven by market share gains and another strong performance from its next-generation products (NGPs). Net revenues among its blu vapourisers and other non-combustibles soared 15.4%.

But those declining stick volumes and further NGP-related losses meant operating profit dropped 2.5% to £1.5bn. Adverse currency movements worsened the annual drop, another constant threat given the firm’s wide geographical footprint.

As a potential investor, I’m concerned that the strict regulations hammering tobacco demand could also sap NGP sales in the future. And this could have severe consequences for dividends as well as Imperial Brands’ share price.

So despite its bright dividend forecasts to 2027, I’d rather buy other shares for passive income.

The post 6.7% yield! Here’s the dividend forecast for Imperial Brands shares to 2027 appeared first on The Motley Fool UK.

Passive income stocks: our picks

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

More reading

- Up 68%, is this top UK dividend share still a bargain buy?

- £10,000 invested in Imperial Brands shares 10 years ago is now worthâ¦

- Is it wrong for me to buy these FTSE 100 tobacco stocks?

- Up 73% in one year, is this the best value stock in the FTSE 100?

- 2 UK dividend shares that look dirt cheap right now

Royston Wild has no position in any of the shares mentioned. The Motley Fool UK has recommended Imperial Brands Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.