As the FTSE 100 recovers from US trade war losses, here are the winners and losers

The FTSE 100‘s back where it was before the US administration announced a 10% trade tariff on UK goods. When the shocking news hit in early April, the index fell almost 1,000 points in a few days.

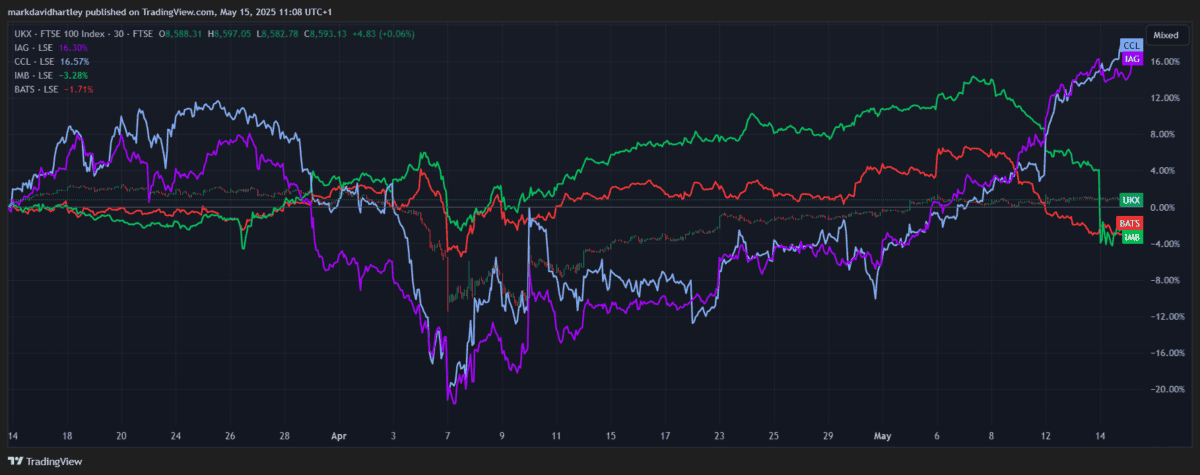

Now back to around 8,500 points, it’s near the same level it was in mid-March. The variation in performance of stocks over this period is a good indication of how different industries are affected by tariffs.

FTSE 100 stock performance

In this instance, there are clear sector-specific winners and losers. Travel-related stocks were among the hardest hit by tariffs, while tobacco stocks, which experienced minimal losses at the time, have since suffered worse losses.

International Consolidated Airlines Group fell sharply when the tariffs were announced, but is now up almost 16% since before the announcement. The FTSE 250 stock Carnival Cruises suffered similar losses but has enjoyed even greater gains since. The most likely explanation for this is falling fuel prices — the largest expense these two companies face.

Meanwhile, tobacco giants Imperial Brands and British American Tobacco (LSE: BATS) are both down by 2%-3% since mid-March.

So why’s tobacco suffering now, and how is it related to tariffs? I decided to find out.

Trade war tensions

The most likely factor contributing to the recent drop in tobacco stock prices is the announcement of tariff reductions between the US and China. The two countries agreed to lower reciprocal tariffs by 115% for 90 days, aiming to de-escalate ongoing trade tensions. While this led to a net positive gain in most global markets, defensive industries like tobacco took a hit.

Why? The environment provides an opportunity for risk-hardy investors to exploit the resulting price fluctuations. Subsequently, many are shifting funds out of stable defensive stocks to take advantage of those more sensitive to tariff changes.

And it’s not just tobacco — other popular defensive stocks such as Unilever, Reckitt and AstraZeneca also suffered minor losses this week.

Those benefiting most from the changes are sectors including technology and consumer goods that are more directly impacted by trade policies.

An opportunity?

British American Tobacco’s falling share price might look attractive to value investors — but does it have long-term potential?

The company’s been grappling with several operational challenges recently, which gives reason for pause. In its latest annual report, it outlined expectations of lower first-half profits, attributed to macroeconomic pressures and the rise of illegal vapor products in the US. Besides this, its venture into the vapor market has faced additional setbacks. Legal challenges have been a key issue, along with increased competition from disposable products in Europe and patent disputes in the US.

These problems have raised concerns about the company’s ability to successfully transition to next-gen product categories.

But with a consistently high yield and one of the best dividend track records on the FTSE 100, it still offers significant value. Currently, with a yield around 8%, dividends have grown at an average annual rate of 5%, with no cuts or reductions in decades.

That’s why it remains one of the top-earning dividend stocks in my passive income portfolio. There are certainly challenges ahead, but for income-focused investors, I think it’s still one worth considering.

The post As the FTSE 100 recovers from US trade war losses, here are the winners and losers appeared first on The Motley Fool UK.

But this isn’t the only opportunity that’s caught my attention this week. Here are:

5 Shares for the Future of Energy

Investors who don’t own energy shares need to see this now.

Because Mark Rogers — The Motley Fool UK’s Director of Investing — sees 2 key reasons why energy is set to soar.

While sanctions slam Russian supplies, nations are also racing to achieve net zero emissions,

he says. Mark believes 5 companies in particular are poised for spectacular profits.

Open this new report — 5 Shares for the Future of Energy

— and discover:

- Britain’s Energy Fort Knox, now controlling 30% of UK energy storage

- How to potentially get paid by the weather

- Electric Vehicles’ secret

backdoor

opportunity - One dead simple stock for the new nuclear boom

Click the button below to find out how you can get your hands on the full report now, and as a thank you for your interest, we’ll send you one of the five picks — absolutely free!

More reading

- One of Britain’s best dividend shares is soaring! Time to buy?

- These 3 dividend shares are on fire but they’re still dirt-cheap and pay piles of income!

- 8.1% yield! Here’s the dividend forecast for British American Tobacco shares through to 2027

- £20K in savings? Here’s how that could produce a £9,148 second income per year!

- £10k in savings? Here’s how investors could target £1,500 in passive income a month

Mark Hartley has positions in AstraZeneca Plc, British American Tobacco P.l.c., Reckitt Benckiser Group Plc, and Unilever. The Motley Fool UK has recommended AstraZeneca Plc, British American Tobacco P.l.c., Reckitt Benckiser Group Plc, and Unilever. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.