Is the Rolls-Royce share price still a bargain in 2025?

At multiple points in the past few years, investing in Rolls-Royce (LSE: RR) was an outstanding bargain, seen from today’s perspective. The Rolls-Royce share price is now north of £8, so could it still potentially be a bargain for my portfolio?

Back in 2022, it sold for pennies – a price that now looks like a screaming bargain!

In 2023, it was the best performing of any FTSE 100 share. Yet, for most of the year, the Rolls-Royce share price was below £2. What a deal!

Having done so well in 2023, it might stand to reason that the share was not such a bargain in 2024. In fact, it was one of the best-performing FTSE 100 shares last year. But even since September, it has risen 75% — and shareholders have had the additional good news that the dividend would be reinstated. Again, a massive bargain!

What about this year, so far? The Rolls-Royce share price has risen 38% since the turn of the year. Wow!

The valuation looks high to me

Normally when deciding whether to buy a share, I first consider its business and commercial prospects and only if I like them do I then get into the nitty gritty of valuation.

Here, though, we can go straight to valuation. The current Rolls-Royce share price-to-earnings ratio of 27 immediately raises my hackles as an investor.

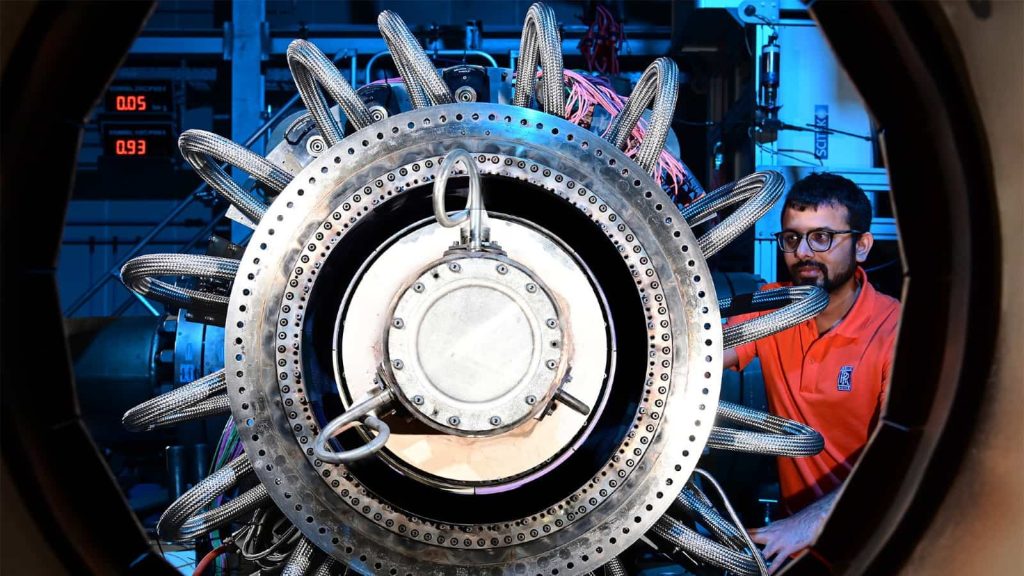

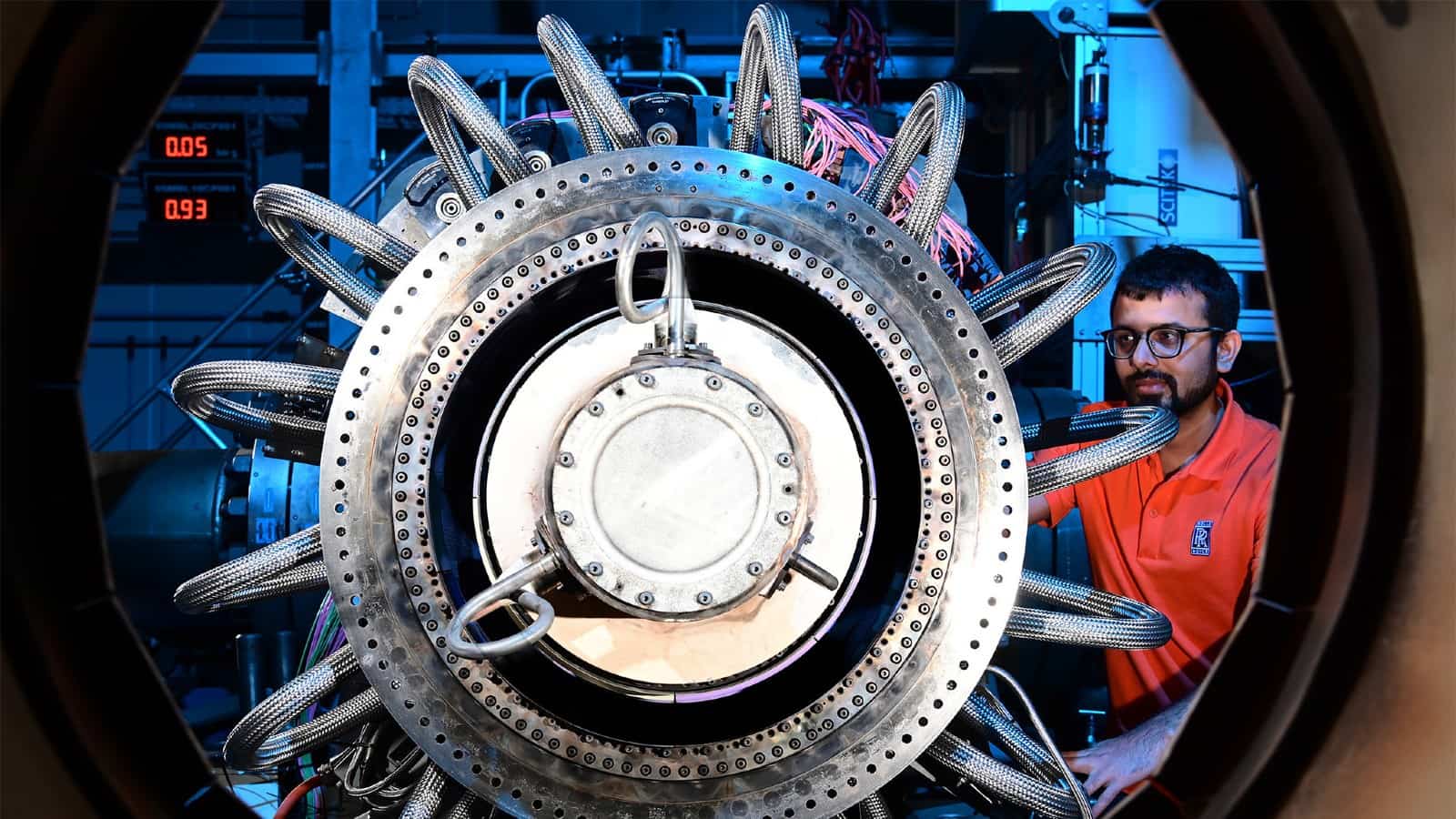

This is not some sparkly new startup with a transformational business model. It is a firm established five years after Queen Victoria died, operating in a selection of mature industries and with a long history of chequered financial performance due to the long development timeframes and high costs that are still a structural part of the aircraft engine industry.

Could there be hidden value here?

So, from the valuation alone, I am already sceptical.

Going back to the business, am I missing something that could potentially justify the current Rolls-Royce share price – and perhaps a higher one in future?

A lot of the improvement has been driven by industry-wide positive news, elevated by a highly focused and ambitious management at Rolls. The company has already reached some of its ambitious targets several years ahead of schedule.

It has set more ambitious medium-term targets and continues to benefit from a helpful selling environment, with civil aviation demand robust, defence spending growing strongly, and renewed attention being paid to power systems.

As an engine maker, Rolls knows all about tailwinds – and it looks like it has been in the right place at the right time. I reckon the share could be a bargain even now if everything keeps going as well as it has been lately.

I’m not comfortable with the risks

Equally, though, Rolls understands headwinds – and I see some that could hurt its performance.

Civil aviation demand is already showing signs of weakening in some key markets. An economic downturn could exacerbate that, posing a risk to sales volumes and profit margins.

Meanwhile, civil aviation as always remains exposed to the risk of a sudden demand downturn that comes almost from nowhere, whether due to a terrorist event, war, weather event, or recession.

I think the current Rolls-Royce share price offers me insufficient margin of safety to mitigate such risks, so I will not be investing.

The post Is the Rolls-Royce share price still a bargain in 2025? appeared first on The Motley Fool UK.

We think earning passive income has never been easier

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

More reading

- £10,000 invested in Rolls-Royce shares after ‘Liberation Day’ is now worth…

- Here’s what £10,000 in Rolls-Royce shares today could be worth in 2 years

- £10,000 invested in Rolls-Royce shares before the tariff news is now worth…

- Here’s how much £11,000 invested in Rolls-Royce shares a year ago would be worth today…

- Prediction: 1 year from now, the Rolls-Royce share price could turn £5,000 into…

C Ruane has no position in any of the shares mentioned. The Motley Fool UK has recommended Rolls-Royce Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.