This FTSE 250 icon’s been very quiet. What’s going on?

Dr Martens (LSE:DOCS), the FTSE 250 fashion bootmaker, has endured a torrid time since making its stock market debut in early 2021. After (it’s hard to keep up) five profit warnings, the group’s shares are now worth 87% less.

But since issuing its third quarter trading update in January, there have only been 12 news releases to the market. Eleven of these have been about the number of shares in issue and stock options. The other concerned the appointment of two non-executive directors. Otherwise, it’s been very quiet.

Is this a case of ‘no news is good news’? Or should shareholders remain anxious?

Let’s take a look.

Openness and transparency

The first thing to note is that stock market rules require any information that’s likely to be used by a “reasonable investor” as part of their investment decision – and could have a non-trivial impact on a company’s share price — to be disclosed.

Based on the Financial Conduct Authority’s guidance about what information companies need to share with investors, I think we can assume that the absence of information means nothing’s changed since the company’s most recent update.

And this reported that trading was in line with expectations. What does this mean?

In April 2024, the company issued guidance on its expected performance for the year ended 31 March (FY25). It warned: “We could see a worst-case scenario of PBT (profit before tax) of around one-third of the FY24 level”.

However, it also said there are “scenarios where the profit outturn could be significantly better than this”.

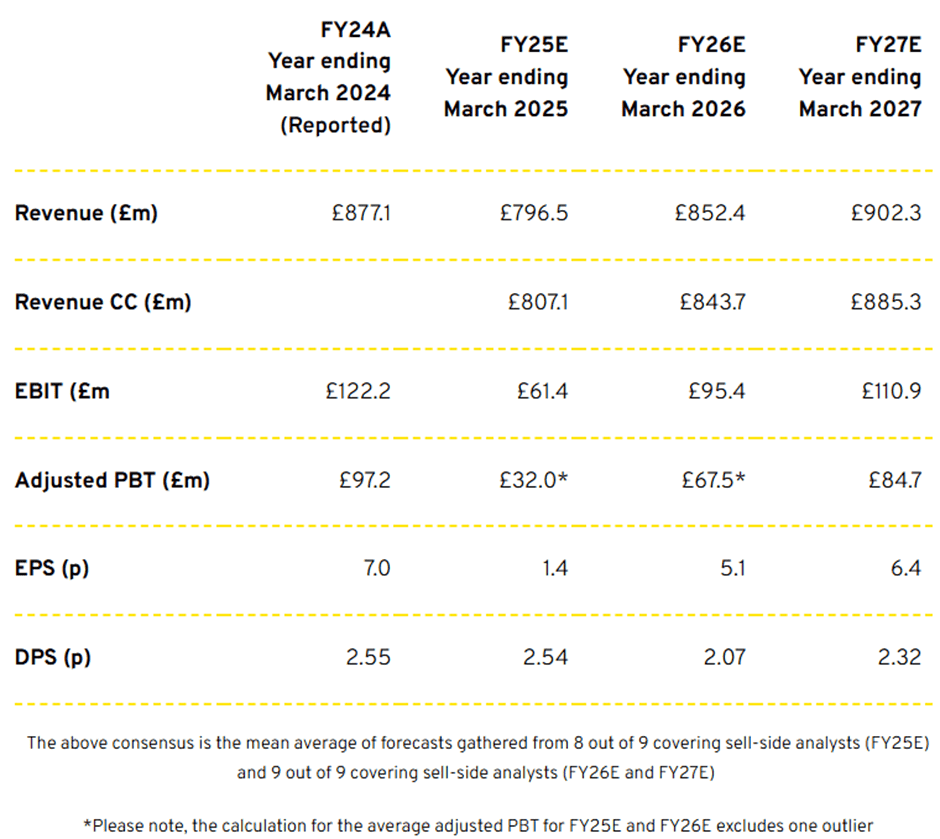

It’s hard to know what to expect. Based on their latest forecasts, analysts appear to agree with the most pessimistic assessment. The consensus is for adjusted PBT of £32m, which is almost exactly one-third of last year’s figure.

An uncertain outlook

When the company releases its FY25 results on 5 June, I wonder if the share price might react like that of JD Sports Fashion? On 9 April, it released results which were in line with expectations. Since then, its shares have increased 44%. It’s almost as though investors were looking for confirmation that everything’s okay.

And if Dr Martens could beat analysts’ predictions, who knows what might happen to the share price. On the other hand…

That’s why it’s important to take a long-term view. It’s impossible to predict movements from one month to the next.

But looking further ahead, we don’t know what President Trump’s going to do with tariffs. And North America’s a key market for the group. During FY24, 37.1% of revenue came from the Americas. However, the bootmaker doesn’t have any manufacturing facilities in the territory. It’s therefore vulnerable to additional import taxes.

The group also sees the region as a key driver of its future profit. A US economic slowdown could affect earnings.

To try and compensate for post-pandemic price rises, the group’s implemented several price rises in recent years. There are now plenty of cheaper alternatives available which could also affect earnings.

For me, there’s too much uncertainty around to part with my cash. However, I think the company retains a strong brand with a loyal following. Its shares are also cheap by historical standards.

If it does turn things around, there will be plenty to shout about.

The post This FTSE 250 icon’s been very quiet. What’s going on? appeared first on The Motley Fool UK.

AI Revolution Awaits: Uncover Top Stock Picks for Massive Potential Gains!

Buckle up because we’re about to dive headfirst into the electrifying world of AI.

Imagine this: you make a single savvy investment in some cutting-edge technology, then kick back and watch as it revolutionises entire industries and potentially even lines your pockets.

If the mere thought of riding this AI wave excites you and the prospect of massive potential returns gets your pulse racing, then you’ve got to check out this Motley Fool Share Advisor report – ‘AI Front Runners: 3 Surprising Stocks Riding The AI Wave’!

And here’s the kicker – we’re giving you an exclusive peek at ONE of these top AI stock picks, absolutely free! How’s that for a bit of brilliance?

More reading

- £20,000 invested in the FTSE 250 just 6 weeks ago would now be worth…

- 3 cheap UK stocks to consider buying right now for passive income

- Why this FTSE 100 pharma stock is one for investors to consider right now

- Just released: our 3 top income-focused stocks to consider buying before June [PREMIUM PICKS]

- Nvidia stock looks cheap… but are its chip peers better value?

James Beard has positions in JD Sports Fashion. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.