Forget gold! Here’s why I prefer investing in growth stocks

Several investors have been looking to gold recently as a way of protecting their wealth. But Iâm still focusing on growth stocks â especially ones trading at unusually cheap prices.

Even in a volatile stock market, there are two reasons I prefer shares in businesses over gold. And thatâs especially true with where things are at the moment.

Gold

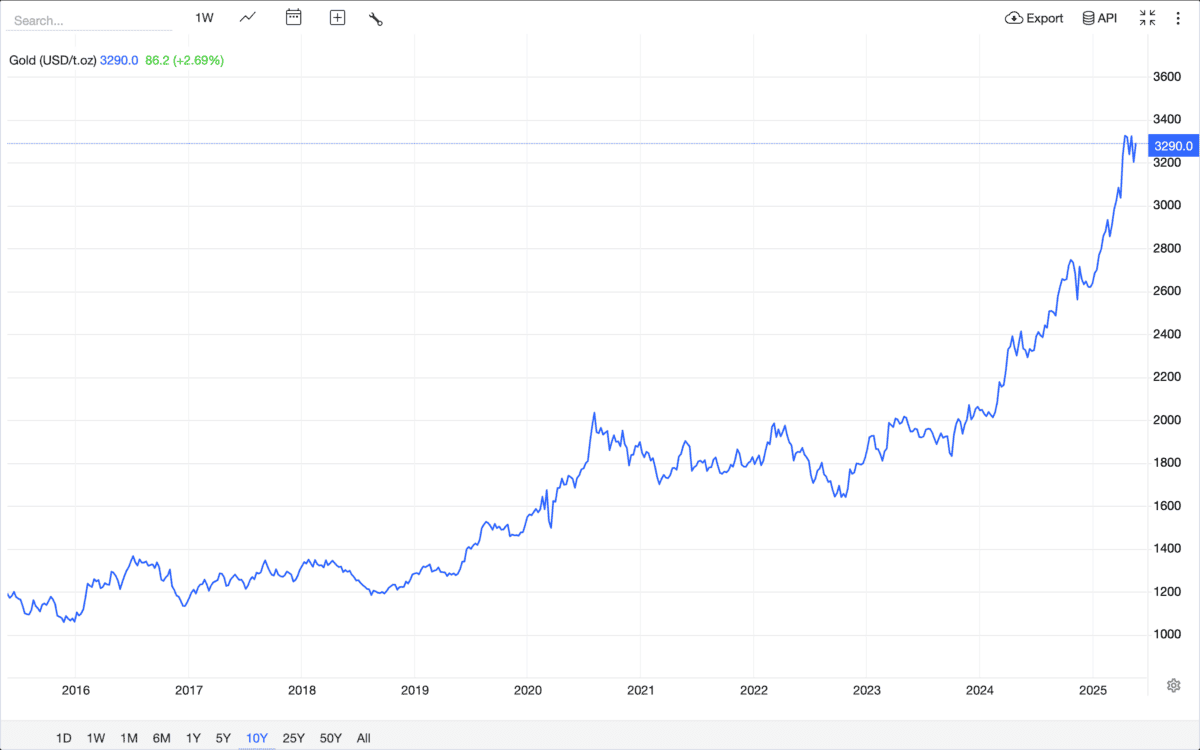

One reason Iâm staying away from gold at the moment is that it doesnât look like the right time to buy it. Prices are at their highest levels in a decade, which isnât particularly encouraging.

Source: Trading Economics

By itself, thatâs not a great reason â the gold price was unusually high last year, yet itâs up almost 37% since then. But itâs not just me who thinks itâs not a great time to be buying what’s undeniably a safe-haven asset.

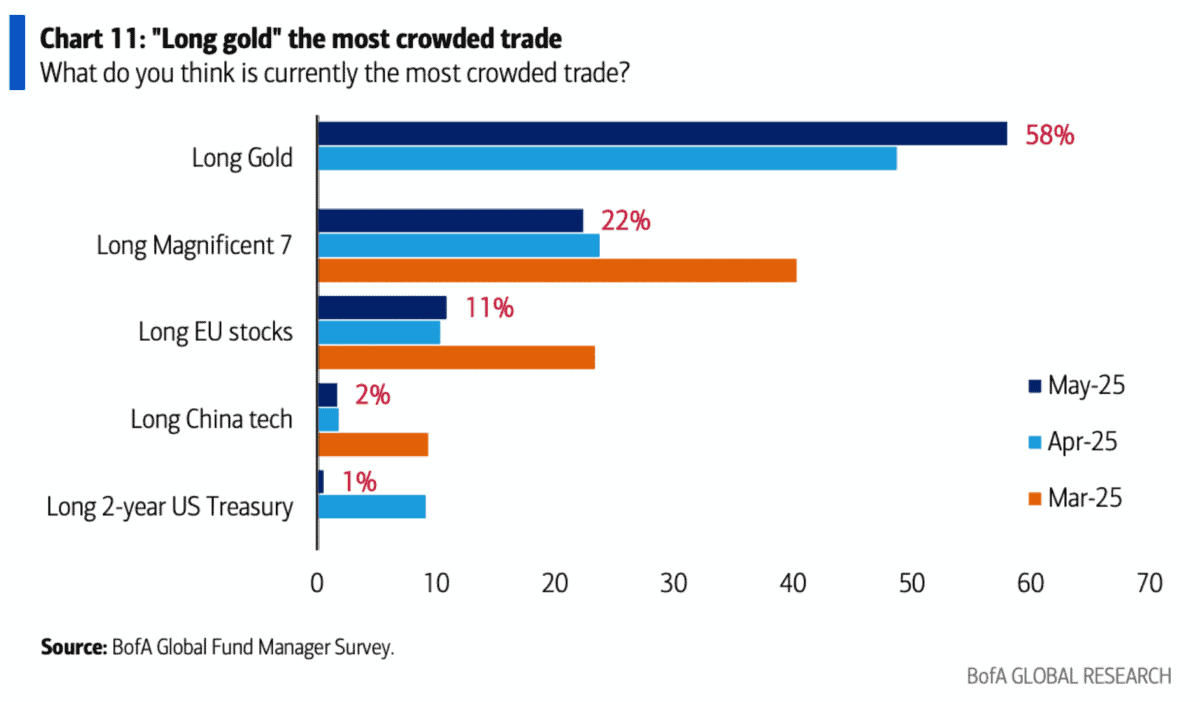

According to the latest Bank of America fund manager survey, âlong goldâ is the most crowded trade at the moment. In other words, the professionals think thereâs too much money already invested.

That wasnât the case back in May 2024 â the consensus was that âlong Magnificent Sevenâ was the most crowded trade. And this speaks to another reason I tend to stay away from gold.

The only way to make money by investing in gold is by selling it to someone else. But that requires someone else to be willing to buy it â and thatâs risky in a trade that already looks crowded.

With shares however, the underlying businesses can return cash to shareholders without them having to sell. And in the case of growth stocks, these distributions can increase over time.

Stocks

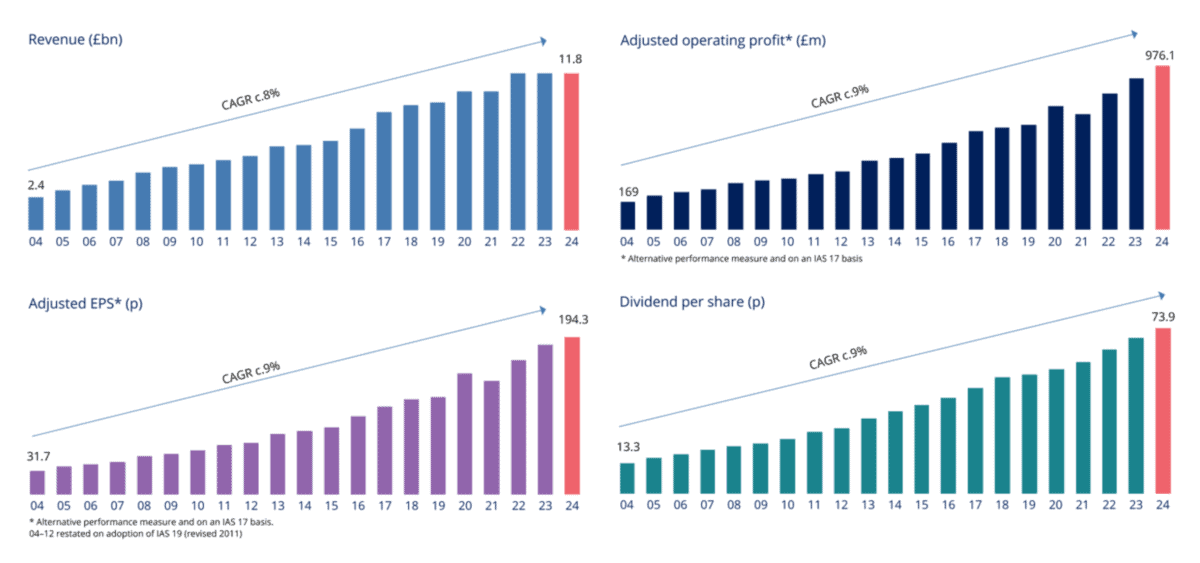

One example that Iâve been buying for my portfolio recently is Bunzl (LSE:BNZL). The company has increased its dividend per share each year for over three decades.

Source: Bunzl Website

A track record like that generally doesnât go unnoticed and itâs rare to find the stock trading at a bargain price. But I think right now looks like a rare opportunity.

The Bunzl share price has fallen almost 25% since the start of the year. And thatâs caused the dividend yield to get close to 3% as a result.Â

A set of poor Q1 results has caused the share price to fall. Part of this is due to the uncertainty around US trade policy, which is an ongoing risk for a firm that generates most of its sales across the Atlantic.Â

To some extent, a pessimistic outlook is reflected in the current share price. In its update, Bunzl reduced its revenue and profit guidance for the year and suspended its ongoing share buybacks.

Despite this, the firm did manage to increase its dividend. And itâs worth noting that company insiders and directors have been buying the stock after it fell following the weak Q1 report.

Long-term investing

In the short term, thereâs nothing to say the price of gold canât keep going higher. And it might outperform the stock market again in 2025.

Over the long term though, I think thereâs a much better chance with shares. Especially ones that can keep growing while returning cash to shareholders along the way.Â

Bunzl is just one example â there are plenty of others that are worth considering. But right now, itâs the stock Iâm looking to keep buying for my portfolio.

The post Forget gold! Here’s why I prefer investing in growth stocks appeared first on The Motley Fool UK.

But there are other promising opportunities in the stock market right now. In fact, here are:

5 stocks for trying to build wealth after 50

The cost of living crisis shows no signs of slowing… the conflict in the Middle East and Ukraine shows no sign of resolution, while the global economy could be teetering on the brink of recession.

Whether you’re a newbie investor or a seasoned pro, deciding which stocks to add to your shopping list can be a daunting prospect during such unprecedented times. Yet despite the stock market’s recent gains, we think many shares still trade at a discount to their true value.

Fortunately, The Motley Fool UK analyst team have short-listed five companies that they believe STILL boast significant long-term growth prospects despite the global upheaval…

We’re sharing the names in a special FREE investing report that you can download today. We believe these stocks could be a great fit for any well-diversified portfolio with the goal of building wealth in your 50’s.

More reading

- The FTSE 100 is on a 15-day winning streak

- Is Aprilâs worst-performing FTSE blue-chip the best share to buy in May?

- 1 month after ‘Liberation Day’, here are the FTSE 100’s winners and losers

- As these UK stocks fall, should I keep buying?

- This FTSE 100 dividend stock just fell 26% and directors are loading up on its shares

Bank of America is an advertising partner of Motley Fool Money. Stephen Wright has positions in Bunzl Plc. The Motley Fool UK has recommended Bunzl Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.