2 FTSE 100 and FTSE 250 dividend shares to consider for a passive income portfolio!

The following FTSE 100 and FTSE 250 stocks could be great ways to build a robust passive income over time. Here’s why.

FTSE-busting yields

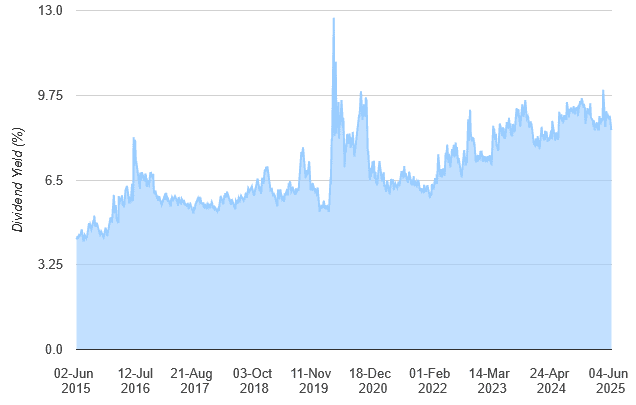

At 8.5%, the forward dividend yield on Legal & General (LSE:LGEN) shares is a proper show-stopper. This is twice the current average for the broader FTSE 100 (3.4%).

Truth be told, investors like me have become used to the enormous yields the company offers. Excluding pandemic-affected 2020, dividends here have risen for 13 straight years, helping it to maintain those market-beating payouts:

Legal & General’s resilience is thanks in part to its broad diversification. With operations spanning insurance, asset management, and retirement products, earnings and cash flows aren’t overly dependent on strength in one sector.

Furthermore, while the UK and US are critical markets for the company, its wide geographic footprint covering North America, Asia, and Mainland Europe helps cushion weakness in one territory.

Like any financial services business, Legal & General is highly sensitive to broader economic conditions, and a backdrop of high inflation and weak growth has impacted its share price performance since 2020.

This remains a risk as trade tensions disrupt economic conditions and consumer spending. But on the plus side, I’m optimistic the firm’s prudent capital management and strong balance sheet should at least help it continue paying large dividends. Its Solvency II capital ratio was 232% as of December.

Over the longer term, I expect Legal & General shares to enjoy strong momentum as demographic changes — and the growing importance of financial planning — boost demand for its products.

Top trust

The Brunner Investment Trust (LSE:BUT) doesn’t offer the same sort of jaw-dropping yields as Legal & General shares. But one of the London Stock Exchange‘s greatest records of dividend growth make it worth serious attention in my book.

The FTSE 250 trust has hiked shareholder payouts for 53 years on the spin. They’ve kept growing despite crises like banking sector meltdowns, global pandemics, and sovereign debt crises, providing an effective hedge against inflation.

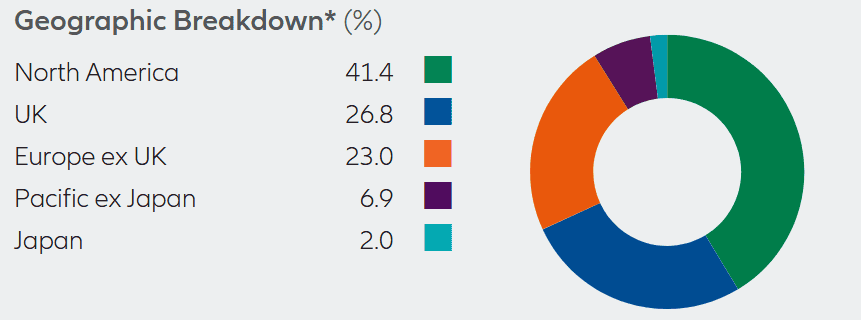

Brunner’s resilience reflects its exposure to a broad range of blue-chip multinational companies. It currently holds shares in 56 different businesses, from tech giant Microsoft and card provider Visa, to oil producer Shell and energy manager Schneider Electric.

The trading location of its shares is also well spread out, as the chart below shows. This provides some protection if, say, demand for US shares continues to decline due to political uncertainty there.

I’m happy to overlook Brunner’s handy-if-unspectacular 1.7% forward dividend yield. As a bonus, at £13.95 per share, the trust trades at a 2.8% discount to its net asset value (NAV) per share, adding an extra little sweetener.

Investors need to consider Brunner’s current high weighting to cyclical sectors. For instance, around 23% of the trust is invested in both financials and technology stocks, leaving it somewhat vulnerable to a fresh economic downturn.

But the trust’s proven long-term resilience gives me optimism that it can ride out any such trouble. It’s delivered an average annual return of 10.7% since 2015.

The post 2 FTSE 100 and FTSE 250 dividend shares to consider for a passive income portfolio! appeared first on The Motley Fool UK.

Should you invest £1,000 in The Brunner Investment Trust Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if The Brunner Investment Trust Plc made the list?

More reading

- Here’s what £11,000 invested 5 years ago in Legal & General shares is worth now…

- How much passive income could £10,000 make me?

- How millions of UK investors could secure a £10k second income with their savings

- £50k to invest? These dividend shares could provide a £4,100 second income just this year!

- Starting with £20,000, this 5-stock SIPP could generate a £1m pension pot

Royston Wild has positions in Legal & General Group Plc. The Motley Fool UK has recommended Microsoft and Visa. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.