With a 6% yield and a decade of growth, is this FTSE 100 dividend stock a no-brainer buy?

When hunting for dividend stocks, itâs tempting to chase the highest yields. But a generous dividend means little if the company behind it is financially stretched or operating in a declining sector. What really matters is a blend of yield, dividend growth, consistent payments and strong fundamentals.

Itâs also worth remembering that dividends are never guaranteed. If business conditions turn sour, even the most established companies can reduce or scrap their payouts altogether. That’s why its critical to do a full assessment before making any investment decisions regarding dividends.

One FTSE 100 stock that currently ticks a lot of the right boxes for me is LondonMetric Property (LSE: LMP).

A quiet performer with a solid yield

Londonmetric’s a real estate investment trust (REIT) that specialises in logistics, retail parks and long-income assets. Currently sitting around 6%, its dividend yield has maintained a steady position between 5% and 7% for the past year.

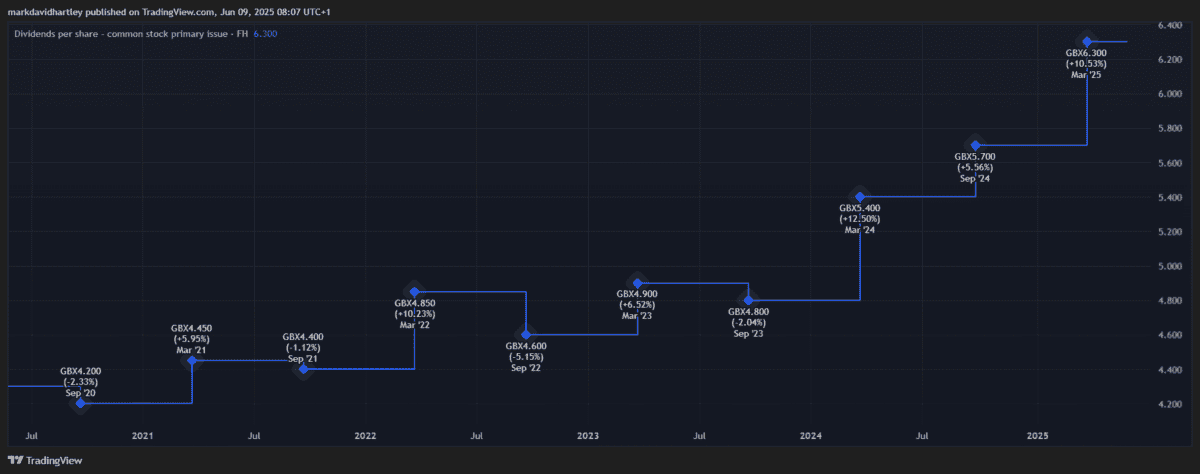

Most promisingly, it’s grown its payout every year for the past decade â a rare track record, even among blue-chips. But what exactly is a REIT and why are they good for dividend income?

Regulated returns

REITs are a specific type of company structure that focuses on owning and managing income-generating real estate. Under UK law, they’re required to distribute at least 90% of their property rental profits to shareholders. This is why they’re typically a popular choice among income-focused investors.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

LondonMetricâs focus is on sectors with structural demand tailwinds, such as e-commerce warehouses and out-of-town retail. These assets tend to have long leases and lower vacancy risks, offering some resilience during economic downturns.

This mix of long-term reliability and regulated profit distribution makes it a particularly attractive prospect.

What’s the catch?

No investment is risk-free, and LondonMetric’s no exception. Interest rate changes can impact both property values and debt servicing costs. Additionally, any major financial crisis would be a significant threat, particularly in the real estate sector (anyone remember 2008?).

The trustâs emphasis on logistics and long-lease assets offers some insulation. But no company can future-proof itself entirely from unexpected environmental or geopolitical factors.

Recent performance and financials

Looking at Londonmetric’s latest results, earnings per share (EPS) rose 3% and rent collection remains strong at over 99%. The company also reported a stable portfolio value, with asset management initiatives and rental uplifts helping to offset valuation pressures from rising interest rates.

Its dividend cover sits at 70%, which is modest but typical for REITs. The balance sheet appears healthy, with a loan-to-value ratio of around 32%, comfortably below sector averages.

Slow and steady

Londonmetric’s share price has barely moved in the past year, but it still delivered a return of 8.3% with dividends. If the UK property market enjoys a notable recovery, this figure could rise above 10%.

It’s an example of how reliable dividend stocks play a vital role in building long-term wealth. No-brainer buy? Maybe not. But with a solid yield, a strong track record and exposure to high-demand property segments, I believe LondonMetric’s worth considering as part of an income portfolio.

That said, no single stock should carry the load. Diversification remains key â across sectors, asset types and geographies â to reduce risk and keep those dividend streams flowing, even when markets turn sour.

The post With a 6% yield and a decade of growth, is this FTSE 100 dividend stock a no-brainer buy? appeared first on The Motley Fool UK.

Should you buy Londonmetric Property Plc now?

Don’t make any big decisions yet.

Because Mark Rogers — The Motley Fool UK’s Director of Investing — has revealed 5 Shares for the Future of Energy.

And he believes they could bring spectacular returns over the next decade.

Since the war in Ukraine, nations everywhere are scrambling for energy independence,

he says. Meanwhile, they’re hellbent on achieving net zero emissions.

No guarantees, but history shows…

When such enormous changes hit a big industry, informed investors can potentially get rich.

So, with his new report, Mark’s aiming to put more investors in this enviable position.

Click the button below to find out how you can get your hands on the full report now, and as a thank you for your interest, we’ll send you one of the five picks — absolutely free!

More reading

- 2 excellent growth stocks to consider buying for an ISA in June

- Forecast: in 12 months this red hot FTSE 250 stock could turn £1k into…

- If an investor bought on the Lloyds share price pandemic crash, here’s what the stake would be worth now

- 3 dirt cheap FTSE 250 investment trusts to consider this week!

- Looking to de-risk a Stocks and Shares ISA? Consider this!

Mark Hartley has no position in any of the shares mentioned. The Motley Fool UK has recommended LondonMetric Property Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.