The Metro Bank share price soars 14% on takeover rumours!

The Metro Bank (LSE:MTRO) share price jumped 14% in the first few hours of trading today (16 June) following weekend newspaper reports that it could be a takeover target.

However, this is just a rumour. The City is full of speculation that often turns out to be just that. Nothing’s certain until either party makes a formal announcement to the stock market.

In my opinion, it’s never a good idea to buy a stock on the basis of gossip. If talk of a bid proves to be unfounded, the share price could fall as quickly as it rises.

However, could there be other reasons to buy Metro Bank shares?

A strong recovery

Often a takeover approach results from a share price that appears to be stuck in the doldrums and that — according to the buyer — doesn’t reflect the true worth of the business.

At 31 December 2024, Metro Bank had a book value of £1.18bn. Today, its market cap is £864m. On this basis, the stock could offer good value. And this is despite a strong recent share price rally. Since June 2024, it’s risen over 250%, making it the best performer on the FTSE 250.

But look back five years and it’s only increased by 10%.

Difficult times

This reflects a poor run from spring 2023 to summer 2024 when the bank lost over 70% of its value. This was a period when it faced an uncertain future and culminated, in October 2023, with an announcement that it had raised £325m of new money and refinanced £600m of debt. Undoubtedly, this dented investor confidence.

Around this time, the bank decided to “strategically reposition its balance sheet towards higher yielding corporate, commercial and SME lending and specialist mortgages”.

As part of its new focus, in July 2024, it sold some of its residential mortgages to NatWest Group. And in February, it offloaded £584m of personal loans.

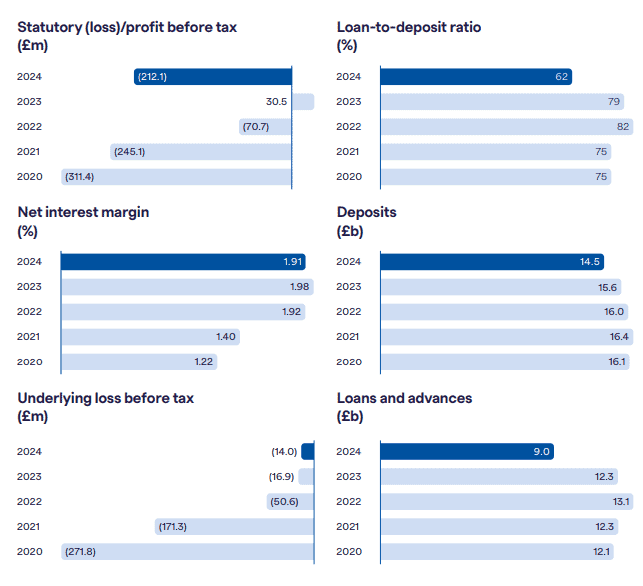

This restructuring has led to various additional costs being incurred and removing these gives a 2024 underlying loss before tax of £14m. However, the bank said it was profitable during the second half of the year.

A different approach?

As part of its marketing strategy, it places great emphasis on relationship banking. Many of its stores (it doesn’t call them branches) are open on Saturdays and it offers 24/7 phone support. This approach must be working because it now has 3m customer accounts.

But I’m not convinced it’s going to grow as hoped. Its commercial loan rate appears to be more expensive than most and I wonder if it will come to regret its emphasis on having a high street presence. The current trend is for banks to reduce the size of their expensive branch networks and move everything online.

Metro Bank’s net interest margin is also smaller than some of its larger rivals. This reflects its lower ratio of loans to deposits, which stood at 61% at March 2025. For comparison, Lloyds Banking Group’s was 96%.

A smaller margin gives it less room to manoeuvre should something go wrong. And it could be squeezed further if the base rate continues to fall.

Despite the rumoured interest of a possible bidder, I don’t want to buy shares in Metro Bank. I think there are better opportunities in the banking sector and elsewhere.

The post The Metro Bank share price soars 14% on takeover rumours! appeared first on The Motley Fool UK.

But this isn’t the only opportunity that’s caught my attention this week. Here are:

5 Shares for the Future of Energy

Investors who don’t own energy shares need to see this now.

Because Mark Rogers — The Motley Fool UK’s Director of Investing — sees 2 key reasons why energy is set to soar.

While sanctions slam Russian supplies, nations are also racing to achieve net zero emissions,

he says. Mark believes 5 companies in particular are poised for spectacular profits.

Open this new report — 5 Shares for the Future of Energy

— and discover:

- Britain’s Energy Fort Knox, now controlling 30% of UK energy storage

- How to potentially get paid by the weather

- Electric Vehicles’ secret

backdoor

opportunity - One dead simple stock for the new nuclear boom

Click the button below to find out how you can get your hands on the full report now, and as a thank you for your interest, we’ll send you one of the five picks — absolutely free!

More reading

James Beard has no position in any of the shares mentioned. The Motley Fool UK has recommended Lloyds Banking Group Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.