Over the next 10 years, I think I’ll make money from this area of the stock market

There are several mega-trends brewing in the stock market right now, including cybersecurity, AI-powered drug discovery, self-driving cars, and even quantum computing. Any of of these has the potential to be a goldmine for patient, long-term investors who pick the right shares.

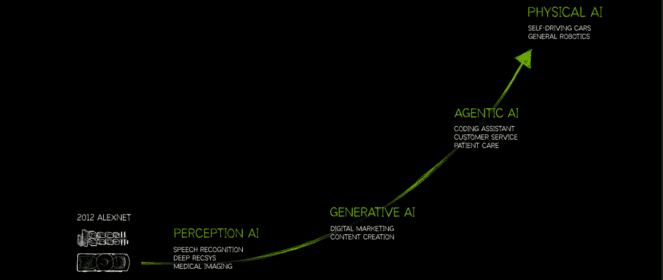

One area that I’m bullish on is AI agents, and the broader concept of agentic AI. The former is software that can carry out tasks for an organisation with minimal or no human intervention. The latter is a more advanced form that can reason and coordinate multiple agents to get complex jobs done.

Nvidia (NASDAQ: NVDA) CEO Jensen Huang says that the rise of agentic AI will spawn a multi-trillion-dollar industry. He says it will redefine how millions of people work, becoming the next tech revolution after generative AI.

What sets true AI agents apart is their ability to learn over time. Unlike traditional AI, which typically requires human prompts or manual programming for each task, these agents are capable of self-improvement through real-world use.

Still the key enabler

The most obvious enabler of this trend is Nvidia, whose GPUs and hardware remain central to the whole AI revolution. I rebought this stock when the market tanked in early April, managing to buy in at a cut-price $95.

After surging 52% since, Nvidia stock isn’t as cheap as it was. It could easily sell off again, especially if Chinese competition rises globally and AI adoption slows down during a global recession.

Nevertheless, I think Nvidia could go much higher over the next 10 years as agentic AI and physical AI (self-driving cars, humanoid robots, etc) advance. I reckon it’s still worth considering, especially on any double-digit dip.

Digital labour

On the application side, I’m optimistic that Salesforce (NYSE: CRM) could be a big winner in AI agents, and recently added the stock to my ISA portfolio.

What makes Salesforce well-placed? Well, it launched a task-specific AI agent solution called Agentforce in February, and it had already inked 8,000 deals by March (half paid, the rest pilot programmes).

This tells us that companies are very keen to automate tasks and streamline operations to improve efficiency.

Salesforce, which specialises in customer relationship management, already serves over 150,000 customers worldwide. So it has a massive base to which it can sell AI agents.

Moreover, to build the best AI agents, a company needs lots of high-quality data. In this case, customer data is the fuel, and Salesforce has access to mountains of it.

That’s why I think most start-ups will struggle to compete head-on with incumbents like Salesforce in the AI agent space. They simply don’t have the same access to real-world customer data — or trust — needed to operate them at scale.

The stock is trading at 23 times forward earnings, which isn’t ridiculous, given the long-term potential here. I think it’s worth a look.

AI agents are the new digital workforce.

Jensen Huang

ServiceNow

That said, Salesforce does face stiff competition from Microsoft and ServiceNow. If its agents aren’t quite up to scratch, these rivals could quickly capture market share with their Copilot Studio and Now Assist tools.

ServiceNow is another stock I’m watching. It’s very pricey right now, but this enterprise automation specialist also looks well-positioned to become a future leader in AI agents.

The post Over the next 10 years, I think I’ll make money from this area of the stock market appeared first on The Motley Fool UK.

Should you buy Nvidia now?

Don’t make any big decisions yet.

Because Mark Rogers — The Motley Fool UK’s Director of Investing — has revealed 5 Shares for the Future of Energy.

And he believes they could bring spectacular returns over the next decade.

Since the war in Ukraine, nations everywhere are scrambling for energy independence,

he says. Meanwhile, they’re hellbent on achieving net zero emissions.

No guarantees, but history shows…

When such enormous changes hit a big industry, informed investors can potentially get rich.

So, with his new report, Mark’s aiming to put more investors in this enviable position.

Click the button below to find out how you can get your hands on the full report now, and as a thank you for your interest, we’ll send you one of the five picks — absolutely free!

More reading

- Agentic AI is coming: these growth stocks could be the next big winners

- Could the Nvidia share price grow another 1,486%, like it’s done in the past 5 years?

- 3 proven ways to build ISA wealth in the stock market

- 2 excellent growth stocks to consider buying for an ISA in June

- Prediction: in 3 years Nvidia stock will be worth…

Ben McPoland has positions in Nvidia and Salesforce. The Motley Fool UK has recommended Microsoft, Nvidia, Salesforce, and ServiceNow. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.