Rolls-Royce shares have surged… this stock could be next

While Rolls-Royce shares have skyrocketed over the past two years, shares in Melrose Industries (LSE:MRO) have remained distinctly flat.

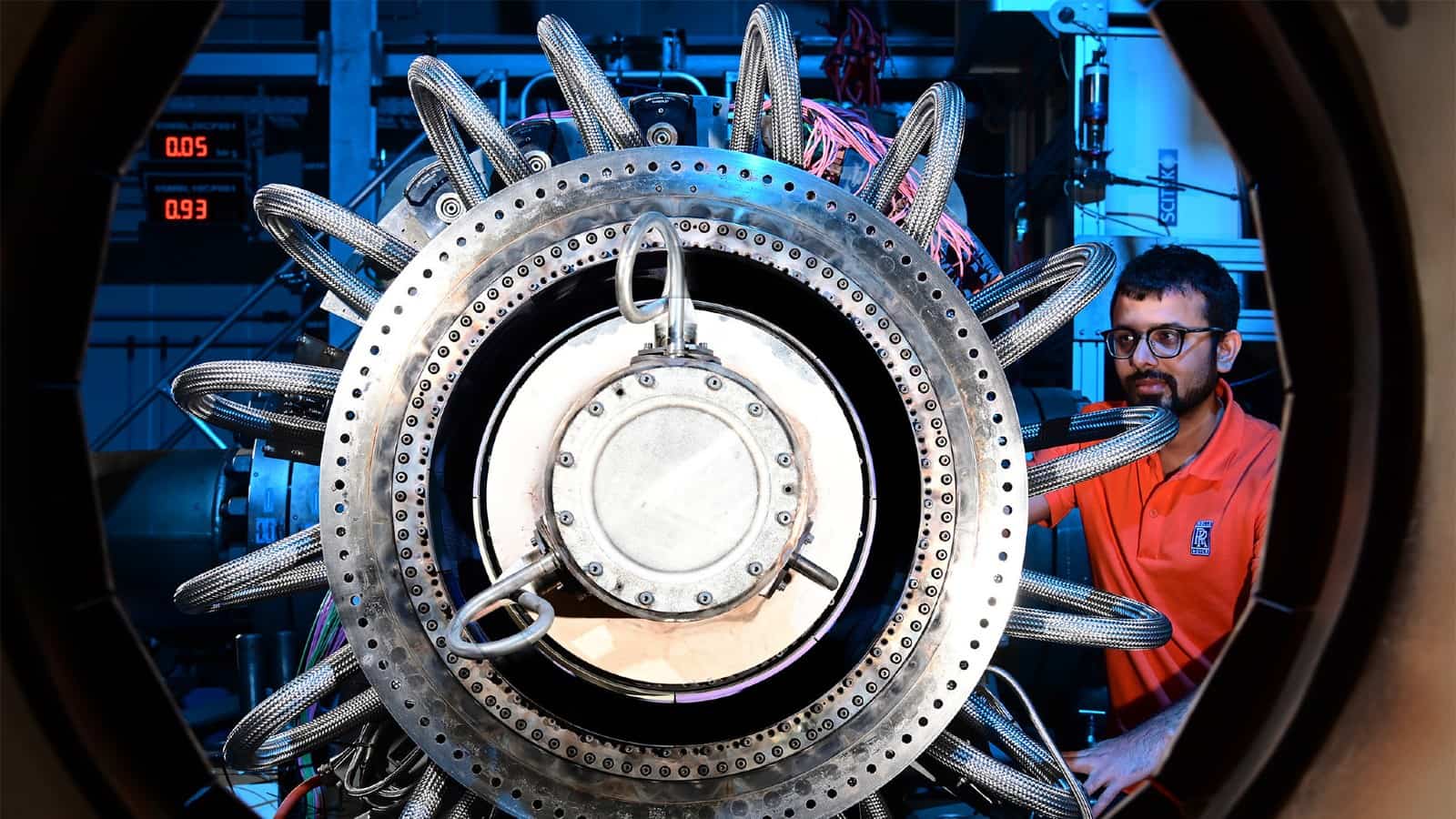

Melrose however, is a really interesting proposition. It operates in aviation and defence, meaning it has exposure to some of the same cyclical drivers that’s pushed Rolls-Royce stock higher in recent years.

It also has a strong position within these markets. Some 70% of its revenue comes from sole-source positions. In other words, itâs the only company providing that product. It also has an established position on all of the worldâs leading aircraft and engines.

Some may go as far to call this a quality company with a strong economic moat.

The valuation story

Melrose is targeting a compound annual growth rate (CAGR) of over 20% in adjusted diluted earnings per share (EPS) from 2024-2029. Starting from an adjusted diluted EPS of 26.4p in 2024, this guidance suggests the stock could be vastly undervalued.

Assuming Melrose achieves at least a 20% CAGR in adjusted diluted EPS from 2024 to 2029, the potential EPS in 2029 can be estimated as follows:

| CAGR Scenario | 2029 Adjusted Diluted EPS (p) |

|---|---|

| 20% | 65.7 |

| 22% | 71.4 |

| 25% | 80.6 |

As we can see, under the base case scenario, EPS could rise from 26.4p in 2024 to around 65.7p by 2029. And in a higher growth scenarios, EPS could reach 71.4p, or even 80.6p.

However, itâs not perfectly clear what the starting point should be. If Melrose achieves a 20%, 22%, or 25% CAGR from its 2023 adjusted diluted EPS of 18.7p, by 2029 EPS could reach 55.8p, 60.2p, or 71.3p respectively. This would mean potentially tripling or nearly quadrupling shareholder earnings over six years if growth targets are met.

If Melrose meets its targets, the 2029 forward price-to-earnings (P/E) ratio could fall to between 5.9 times (80.6p) and 8.5 times (55.8p), making the current valuation look highly attractive if these earnings are achieved.

The bottom line

Melrose Industries has set bold long-term targets, but to truly capture investor attention, the company needs to consistently beat earnings expectations. Its recent revenue miss â coming in below consensus â serves as a reminder that top-line delivery matters, even as adjusted profits and margins impress.

The marketâs reaction was swift, with the shares sliding despite robust operating profit growth and a 20% dividend hike. This underscores how in todayâs market outperformance is the only way to stand out among FTSE 100 peers. Thatâs why Rolls-Royce ended up where it is today.

However, itâs important to recognise that the underlying trends remain highly encouraging. Aviation and defence are both firing on all cylinders, with the Engines division posting 26% revenue growth and margins nearing 29%. Aftermarket services provide resilient, high-margin cash flows, and managementâs ambitious five-year roadmap could see revenues and profits soar.

Itâs a stock Iâve added to my portfolio, but Iâm not the only bullish one out there. The average share price target is 33% higher than the price we see today. Itâs definitely a stock I believe investors should consider.

The post Rolls-Royce shares have surged⦠this stock could be next appeared first on The Motley Fool UK.

5 Shares for the Future of Energy

Investors who don’t own energy shares need to see this now.

Because Mark Rogers — The Motley Fool UK’s Director of Investing — sees 2 key reasons why energy is set to soar.

While sanctions slam Russian supplies, nations are also racing to achieve net zero emissions,

he says. Mark believes 5 companies in particular are poised for spectacular profits.

Open this new report — 5 Shares for the Future of Energy

— and discover:

- Britain’s Energy Fort Knox, now controlling 30% of UK energy storage

- How to potentially get paid by the weather

- Electric Vehicles’ secret

backdoor

opportunity - One dead simple stock for the new nuclear boom

Click the button below to find out how you can get your hands on the full report now, and as a thank you for your interest, we’ll send you one of the five picks — absolutely free!

More reading

- Could this overlooked FTSE 100 stock be the next Rolls-Royce?

- 2 beaten-down shares to consider buying for a stock market recovery

- Investing £20k in this Stocks and Shares ISA each year since 2020 is now worth…

James Fox has positions in Melrose Industries Plc and Rolls-Royce Plc. The Motley Fool UK has recommended Melrose Industries Plc and Rolls-Royce Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.