How to invest £500 a month in a Stocks & Shares ISA and aim for £1m

Investing £500 a month in a Stocks and Shares ISA, with the goal of reaching £1m, is a classic demonstration of the power of compound returns and the importance of starting early. The principle is simple: by consistently investing a fixed amount and allowing returns to compound over time, wealth can grow exponentially.

Market returns

This is not just theoretical. Historical data from the S&P 500, the world’s most-watched stock market index, shows why a 10% annual return is a reasonable long-term expectation for equity investors.

The S&P 500 has delivered an average annual return of about 10% since 1957, including dividends. This figure is not a guarantee for every year — returns can swing wildly from one year to the next — but over decades, the average holds remarkably steady.

For example, over the last 30 years, the S&P 500’s average annualised return has been around 9% to 10%, even after accounting for periods of dramatic losses like the dot-com bust and the global financial crisis.

Over the last 10 years, the average has been even higher, at approximately 11.3% annually. These numbers illustrate that, despite short-term volatility, patient investors who stay the course are often rewarded.

Compounding for victory

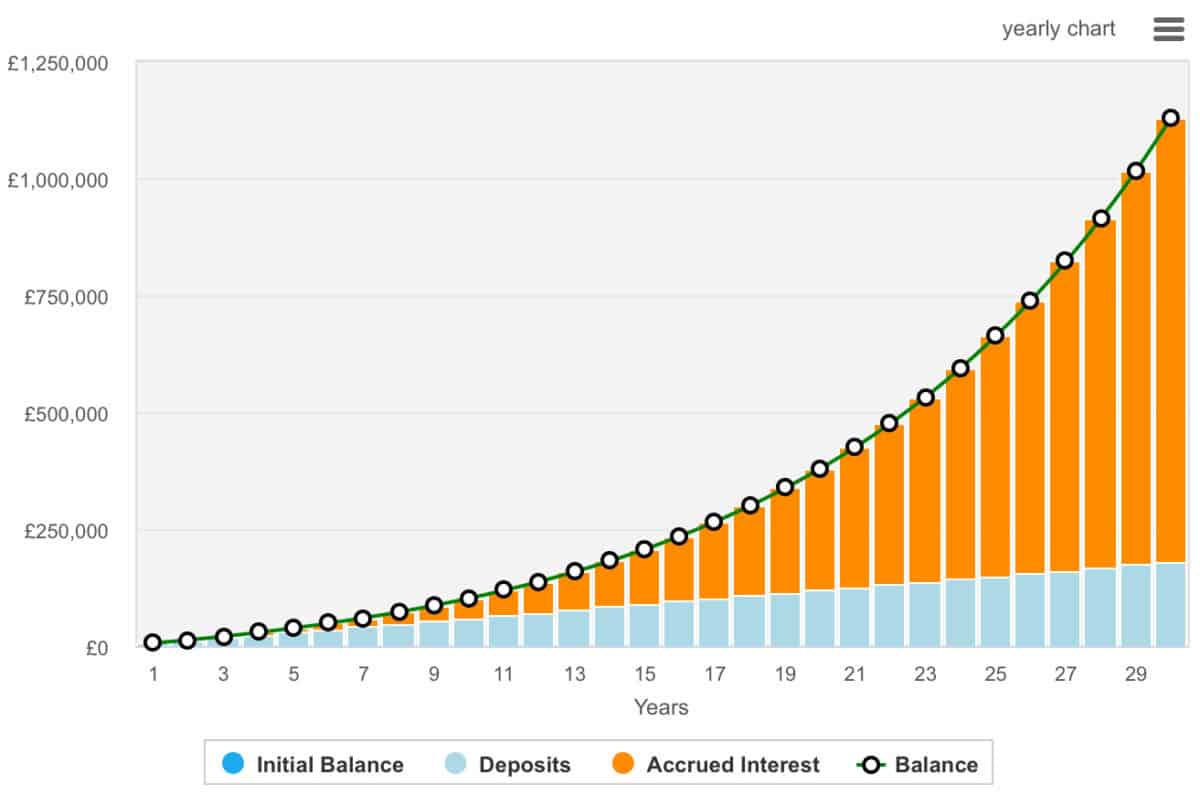

The real magic happens when investing starts early. With £500 invested each month at a 10% annual return, the compounding effect means that after 10 years, the balance could exceed £100,000, but after 30 years, that sum grows to over £1.1m.

The vast majority of this final amount comes not from the contributions, but from the interest earned on previous gains. This is why time in the market is so valuable: the longer the money has to grow, the more powerful compounding becomes.

Planning for the future by investing early and consistently is the surest way to harness the full potential of the stock market’s long-term returns. Of course, the actual investing can be the hard part. Novice investors often make the wrong decisions and can lose money.

Where to invest?

The Monks Investment Trust (LSE:MNKS) is a long-established global investment trust managed by Baillie Gifford, with a focus on achieving long-term capital growth rather than income. Investors may be more familiar with its larger sibling, Scottish Mortgage Investment Trust.

Its approach is patient and actively managed, seeking out a diversified range of growth stocks from around the world. The portfolio is spread across regions including North America, Europe, the UK, Japan, developed Asia, and emerging markets, with significant allocations to sectors such as technology, industrials, consumer discretionary, and financials.

This broad diversification helps to reduce risk and smooth out returns over time. As such, it may be a good place to start for novice investors looking to achieve immediate diversification.

Performance data shows that Monks has delivered strong long-term results, with a share price total return of approximately 198% over the past 10 years and a net asset value (NAV) total return of 192% over the same period.

Risks? Well, gearing — borrowing to invest — is always a concern as this can magnify any losses. However, I certainly believe it’s an investment worth considering. It’s also present in my daughter’s pension and mine.

The post How to invest £500 a month in a Stocks & Shares ISA and aim for £1m appeared first on The Motley Fool UK.

Of course, there are plenty of other passive income opportunities to explore. And these may be even more lucrative:

We think earning passive income has never been easier

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

More reading

- Here’s what I wish I knew about passive income when I was 22!

- Looking to de-risk a Stocks and Shares ISA? Consider this!

James Fox has positions in Scottish Mortgage Investment Trust Plc and The Monks Investment Trust Plc. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.