How investors can target £1,000 of monthly passive income

For many investors, the dream of earning £1,000 a month in passive income is both motivating and achievable. But it requires a disciplined, long-term approach. By consistently investing £250 each month and targeting an annualised return of 10%, investors can build a substantial portfolio over time. After 22 years, it would be possible to withdraw just under £1,000 a month. All tax-free.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

The strategy

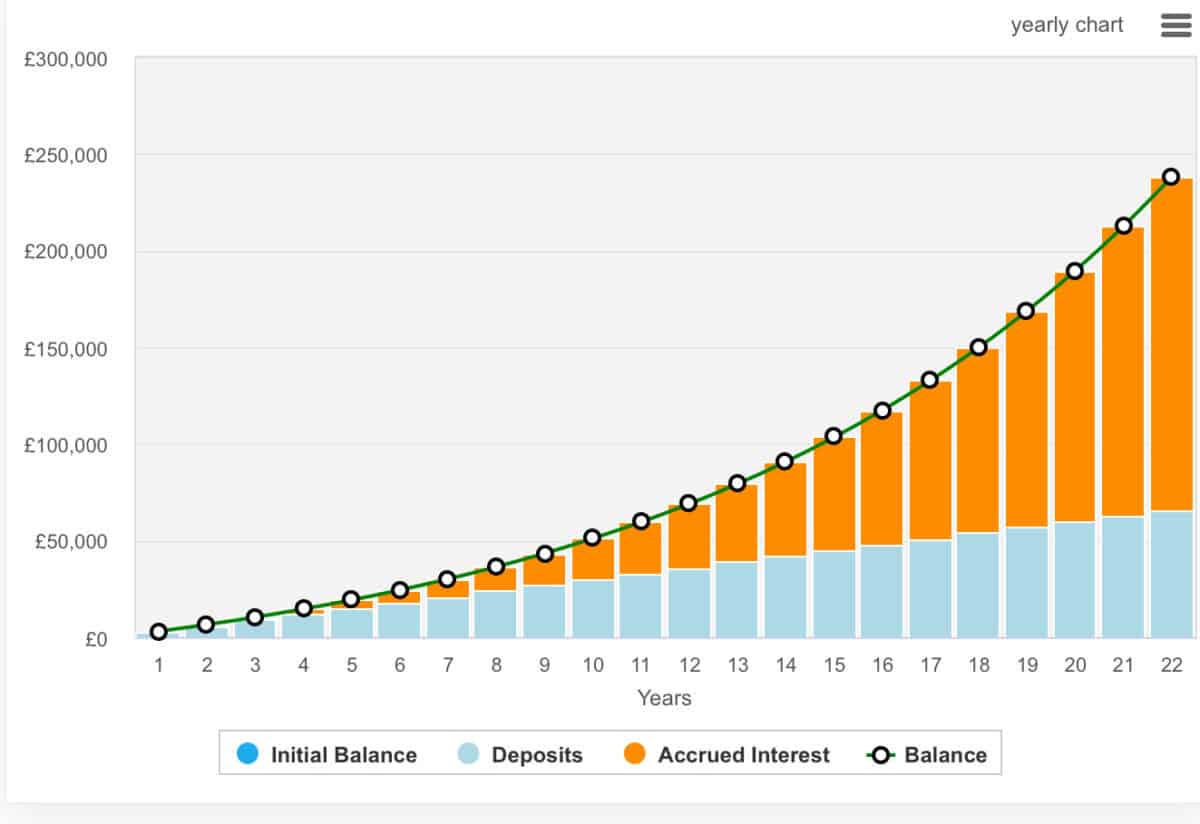

Starting from zero, the investor would need to deposit £250 a month. In the first year, the portfolio grows modestly, ending with a balance of £3,141.39 after earning £141.39 in interest. As the years progress, the power of compounding becomes increasingly apparent. By year five, the total balance reaches £19,359.27, with £4,359.27 coming from accrued interest.

By year 10, the portfolio has grown to £51,211.24, and the interest earned each year continues to increase. This acceleration is the result of compounding, where the returns themselves start generating additional returns. By year 15, the balance stands at £103,617.59, with interest now contributing more than the annual deposits.

After 22 years of consistent investing and 10% annualised growth, the portfolio reaches a value of £238,293.44. At this point, withdrawing 5% annually (a common, sustainable withdrawal rate) would provide an income of around £11,900 a year. That’s just under £1,000 a month. If the investor chooses to withdraw at a slightly higher rate, the £1,000 monthly target becomes comfortably achievable.

As we can see, the speed of growth increase towards the end of the period even though the contributions remain consistent. This is simply how compounding works and why starting earlier is always best.

Investing for success

However, any investor can lose money as stock prices can fall and dividends can be cut. Losing money is particularly common with novice investors who make poor investment decisions. Avoiding losses can be more important than chasing big gains, because when your investment plunges, your portfolio has to work even harder to get you back to where you started.

A simple way to mitigate risk in the early years is to invest in funds, trusts and exchange-traded funds (ETFs). A popular option is Scottish Mortgage Investment Trust (LSE:SMT). For context, it was the first investment I made in my daughter’s pension.

Scottish Mortgage, as the name suggests, is an investment trust. It’s managed by Baillie Gifford and its focus is on technologies and innovation. Its current top holdings include SpaceX, MercadoLibre and Amazon.

The trust’s objective is to maximise total returns by investing in a portfolio of exceptional growth companies, both public and private, across the world. This unconstrained approach allows Scottish Mortgage to seek out pioneering businesses at the forefront of change, particularly in sectors such as technology, healthcare, and consumer innovation.

However, the trust does use gearing (borrowing to invest). And that can magnify losses as well as gains. That’s a risk worth bearing in mind.

Despite this, I think it’s a very appealing growth-oriented stock. It’s definitely worthy of broad consideration.

The post How investors can target £1,000 of monthly passive income appeared first on The Motley Fool UK.

But this isn’t the only opportunity that’s caught my attention this week. Here are:

5 Shares for the Future of Energy

Investors who don’t own energy shares need to see this now.

Because Mark Rogers — The Motley Fool UK’s Director of Investing — sees 2 key reasons why energy is set to soar.

While sanctions slam Russian supplies, nations are also racing to achieve net zero emissions,

he says. Mark believes 5 companies in particular are poised for spectacular profits.

Open this new report — 5 Shares for the Future of Energy

— and discover:

- Britain’s Energy Fort Knox, now controlling 30% of UK energy storage

- How to potentially get paid by the weather

- Electric Vehicles’ secret

backdoor

opportunity - One dead simple stock for the new nuclear boom

Click the button below to find out how you can get your hands on the full report now, and as a thank you for your interest, we’ll send you one of the five picks — absolutely free!

More reading

- £5 a day invested in cheap shares could create a passive income worth £20,000

- 5 reasons buying shares in an investment trust can be a good idea

- 2 top FTSE 100 stocks to consider for the artificial intelligence (AI) revolution

- Rome wasn’t built in a day, and neither is £51k a year in passive income!

- Scottish Mortgage is a passive income superstar! Who knew?

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. James Fox has positions in Scottish Mortgage Investment Trust Plc. The Motley Fool UK has recommended Amazon and MercadoLibre. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.