Here’s a cheap FTSE 100 share to consider buying today and holding for 10 years!

Looing for low-cost FTSE 100 shares to buy and hold for the long term? Here’s one I think has considerable share price potential over the next decade and may merit further research.

Copper’s story

Gold’s surge to record highs in 2025 has attracted plenty of headlines. But copper‘s rapid price ascent — in this case, driven by President Trump’s pledge to slap 50% tariffs on copper imports — hasn’t grabbed nearly enough attention.

Red metal miner Antofagasta‘s (LSE:ANTO) share price has risen almost 17% in the year to date, carried higher by copper’s swell above $10,000 per tonne. Can it continue rising in the near term? Possibly, though it’s far from a sure thing.

As we’ve seen, prices are highly sensitive to US trade policy. And with White House plans on tariffs seemingly changing by the hour, it’s tough to make predictions here.

Stripping this out, questions persist over copper demand given the uncertain economic outlook, though falling interest rates could continue providing support. Concerns are especially high over future Chinese copper concentrate imports, after they surged during the first half.

That said, production issues in key regions like Chile are worsening shortages of the bellwether metal and keeping prices higher. The declining US dollar could also remain a significant price driver, making it cheaper to buy buck-denominated commodities like metals.

Supply shortages

Yet while the near-term outlook is uncertain, I feel confident that copper prices — along with major red metal producer Antofagasta — will rise strongly over the next 10 years as supply and demand balances worsen.

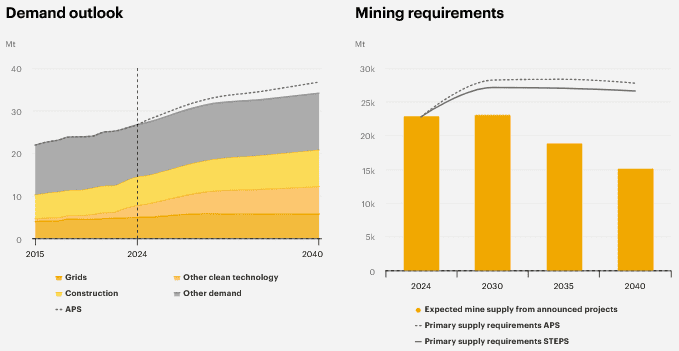

Put simply, consumption of the highly conductive metal is tipped to soar across a variety of industries and sectors. Consumer electronics, construction and defence are all set to drive steady increases. However, rapid growth in the digital and green economies are tipped to be the main game changers over the next

As analyst Nikos Tzabouras of trading platform Tradu.com notes: Tthe non-ferrous metal is essential to these transformational trends, with heavy usage in semiconductors and data centres powering AI, as well as in electric vehicles, solar power systems, and other clean energy technologies.”

At the same time, there’s a substantial lack of new mining projects in the pipeline to meet this demand. There’s also the problem of declining ore grades in key producing areas.

The International Energy Agency (IEA) thinks the copper market could experience a 30% supply deficit by 2035, a scenario that could drive prices sharply higher.

A top value share

Despite its price rise in the year to date, Antofagasta’s shares still offer excellent value in my book.

As mentioned earlier, the near-term outlook for copper prices is highly uncertain. But City analysts are confident and expect Antofagasta’s earnings to rise 48% in 2025.

This leaves the FTSE firm trading on a price-to-earnings growth (PEG) ratio of just 0.6. Any reading below 1 indicates that a share is undervalued.

Production issues are a constant threat to mining stocks’ earnings. But over the long-term, I’m confident that Antofagasta’s profits will rise strongly, driven by copper’s changing market dynamics and the firm’s heavy spending to expand its portfolio (capital expenditure of $3.5bn has been earmarked for 2025 alone).

The post Here’s a cheap FTSE 100 share to consider buying today and holding for 10 years! appeared first on The Motley Fool UK.

5 Shares for the Future of Energy

Investors who don’t own energy shares need to see this now.

Because Mark Rogers — The Motley Fool UK’s Director of Investing — sees 2 key reasons why energy is set to soar.

While sanctions slam Russian supplies, nations are also racing to achieve net zero emissions,

he says. Mark believes 5 companies in particular are poised for spectacular profits.

Open this new report — 5 Shares for the Future of Energy

— and discover:

- Britain’s Energy Fort Knox, now controlling 30% of UK energy storage

- How to potentially get paid by the weather

- Electric Vehicles’ secret

backdoor

opportunity - One dead simple stock for the new nuclear boom

Click the button below to find out how you can get your hands on the full report now, and as a thank you for your interest, we’ll send you one of the five picks — absolutely free!

More reading

- £10,000 invested in Palantir stock 5 years ago is now worth…

- Here’s why I’ve changed my mind on this plummeting FTSE 100 share!

- The more Apple stock falls, the more tempting it looks!

- Is the Lloyds share price taking a breather before its next move up?

- Down 18%, this FTSE 100 dividend stock just hit a 16-year low!

Royston Wild has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.