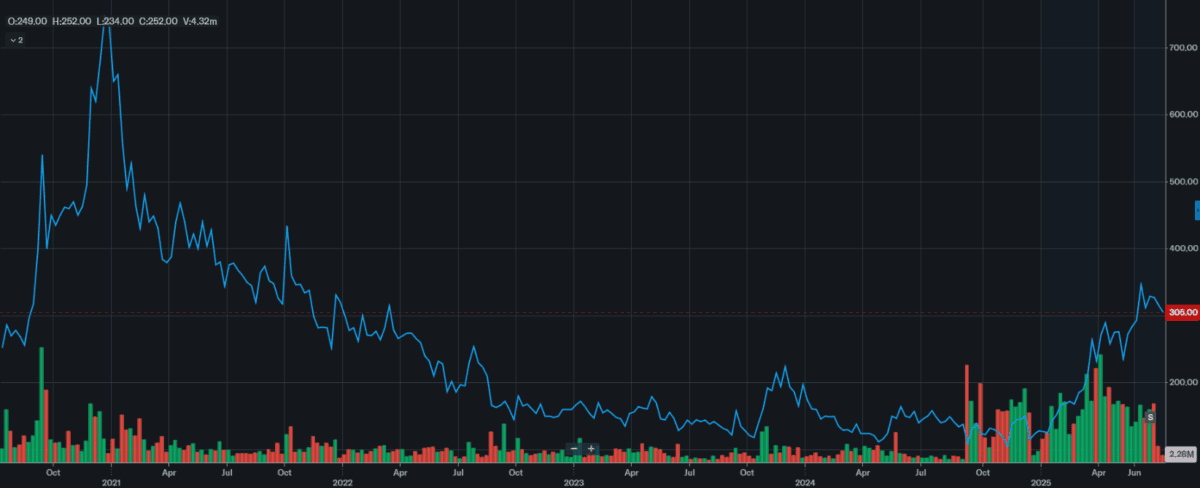

Up 140% in 2025, I think this could be among the best UK momentum stocks to consider

Investors seeking top UK momentum stocks need to give this gold mining share serious consideration, I feel. Here’s why.

A great pick?

Gold prices have come off the boil after an electrifying start to 2025. At $3,312 per ounce, they’re down almost $200 from the record peaks struck in late April.

My view is that this is a temporary pullback following earlier strength, reflecting in large part heavy profit-taking. So gold stocks like Greatland Resources (LSE:GGP) — which is up 140% so far in 2025 — still demand a close look.

Latest data from the World Gold Council (WGC) suggested that the rotation back into bullion is already under way. Global gold-backed exchange-traded funds (ETFs) added 75 tonnes of material in June, it said, snapping back from the 19-tonne drop in May. Total fund holdings were at levels not seen for 34 months at the end of last month.

Investors can buy simple gold-tracking funds like this to capitalise on a rising metal price. Doing so also eliminates operational dangers that come with owning gold mining stocks. However, other benefits of taking this route are also considerable.

Taking a leveraged approach

When metals values appreciate, they can deliver profits growth that beats the price performance of the underlying metal, thanks to the fact the bulk of their costs are largely fixed.

Greatland has predicted all-in sustaining costs (AISC) of between $2,100 and $2,250 per ounce in 2025. This is already way below the current cost of gold. And I’m optimistic the gap will widen further given the current macroeconomic and geopolitical outlook.

The threat of low economic growth and escalating global conflict, combined with the likelihood of falling interest rates and sustained US dollar weakness, all bode well for yellow metal prices.

My bullishness is shared by a raft of analysts on Wall Street. The boffins at Goldman Sachs, for instance, have predicted gold will reach $3,700 per ounce by the end of 2025 as ETF investors continue buying and central banks build their bullion holdings.

A long-term star

I believe Greatland could prove a top share to consider beyond just the near term, too. And not just because gold’s multi-year bull run seems to have much more in the tank.

I feel the company’s full control of the Havieron asset in Australia — which contains 8.4m ounces of gold equivalent — could supercharge group profits over the medium-to-long-term. First production is targeted for the second half of 2027, with a definitive feasibility study due by the end of this year.

Investors must be mindful, however, that Greatland’s share price could sharply reverse if the upcoming study fails to meet expectations. This could be due to lower-than-expected production forecasts, higher expected costs, or delays to mine development and maiden output.

But on balance, I think Greatland is a great stock to consider in the current climate, and especially at current prices. Its forward price-to-earnings growth (PEG) ratio of 0.1 sits well inside value territory of 1 and below.

The post Up 140% in 2025, I think this could be among the best UK momentum stocks to consider appeared first on The Motley Fool UK.

Should you buy Greatland Gold Plc shares today?

Before you decide, please take a moment to review this first.

Because my colleague Mark Rogers – The Motley Fool UK’s Director of Investing – has released this special report.

It’s called ‘5 Stocks for Trying to Build Wealth After 50’.

And it’s yours, free.

Of course, the decade ahead looks hazardous. What with inflation recently hitting 40-year highs, a ‘cost of living crisis’ and threat of a new Cold War, knowing where to invest has never been trickier.

And yet, despite the UK stock market recently hitting a new all-time high, Mark and his team think many shares still trade at a substantial discount, offering savvy investors plenty of potential opportunities to strike.

That’s why now could be an ideal time to secure this valuable investment research.

Mark’s ‘Foolish’ analysts have scoured the markets low and high.

This special report reveals 5 of his favourite long-term ‘Buys’.

Please, don’t make any big decisions before seeing them.

More reading

- £10,000 invested in Greatland Gold shares 6 months ago is now worth…

- After soaring 32% in a month, I think the Greatland Gold (GGP) share price is getting expensive

Royston Wild has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.