Greggs shares: here’s the latest dividend and share price forecast

Holders of Greggs (LSE:GRG) shares (including myself) have endured a truly miserable time since last autumn. Since signs of sales weakness emerged in September, the FTSE 250 stock has plummeted, resulting in an near-40% fall on a 12-month basis.

Greggs’ share price slump reflects market fears that its former breakneck sales growth could now be history.

I’ve not been tempted to sell my own shares, though. This is because I expect the retailer to recover strongly from current turbulence and deliver tasty long-term returns.

But what are City analysts expecting on the share price and dividend front over the coming year?

Perky price forecasts

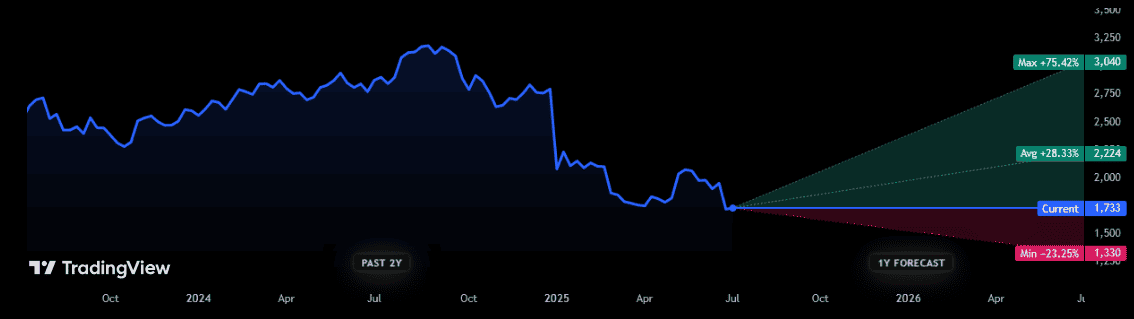

If broker forecasts prove accurate, the battered baker’s shares will rebound more sharply than some may expect. The nine analysts with ratings on it think there will be gains approaching 30% from today’s levels.

Yet, it’s worth bearing in mind that opinions among the analyst community are mixed. On the positive side, one broker thinks Greggs shares will rebound by around three-quarters from current levels and reclaim the £30 per share marker.

But at the other end of the scale, one less-convinced forecaster believes a fall of nearly 25% is on the cards.

Given Greggs’ latest poor update, they perhaps can’t be blamed. It said this month (2 July) that sales rose 6.9% in the first six months of 2025, less than half of what City analysts predicted. Like-for-like sales growth also remained highly subdued, at 2.6%.

What about dividends?

Broadly speaking, the near-term outlook in the City for the company’s dividends isn’t quite as promising. Analysts are expecting 2025’s dividend to be pared back in anticipation of a 12% annual earnings decline. They predict a 67.3p dividend, down from 69p last year.

Encouragingly, analysts tip Greggs to return to profit growth (+4%) in 2026, though. As a result, they also forecast an increased cash reward of 69.8p per share.

The good news is that despite this expected volatility, recent share price weakness means these projections give investors market-beating dividend yields to enjoy. These are 3.9% and 4% for 2025 and 2026, respectively.

Is Greggs a buy?

Latest results show that even sellers of low-cost food and drink are suffering amid the cost-of-living crisis. With Britain’s economy facing a period of low growth, it’s possible that Greggs’ profits may remain under pressure for some time.

Therefore short-term investors may want to stay away. But for long-term share pickers, I think the company’s share price plunge makes it worth serious consideration. With plans to supercharge store numbers, it has significant scope to grow sales and earnings (it’s looking to grow its portfolio from 2,649 stores today to 3,500 eventually).

This strategy also includes having a greater proportion of franchise stores (currently 20%), reducing the cost burden. More stores will also be located in high-footfall travel hubs like airports and train stations.

As a shareholder myself, I’m also optimistic that steps to boost like-for-like sales will pay off, from improving its delivery proposition to extending opening hours to seize the lucrative evening trade.

It’s not without risk, but I’m confident Greggs will recover strongly from its current problems and deliver excellent returns.

The post Greggs shares: here’s the latest dividend and share price forecast appeared first on The Motley Fool UK.

Passive income stocks: our picks

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

More reading

- Greggs shares: an outstanding bargain after crashing nearly 40%?

- Is there a good reason to consider Greggs shares?

- Is ‘SIMAGA’ the secret to avoiding stock market crashes?

- After crashing 40% in a year, is this a bargain basement value stock?

- Greggs shares slump again, but could go on a (sausage) roll

Royston Wild has positions in Greggs Plc. The Motley Fool UK has recommended Greggs Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.