Over the last 31 years, this index has beaten the global stock market by a wide margin

Low-cost global index funds are popular these days and itâs easy to see why. Over the long run, these products â which provide broad exposure to the stock market â tend to provide attractive returns.

But could there be a way to beat the market and generate higher long-term returns? Potentially.

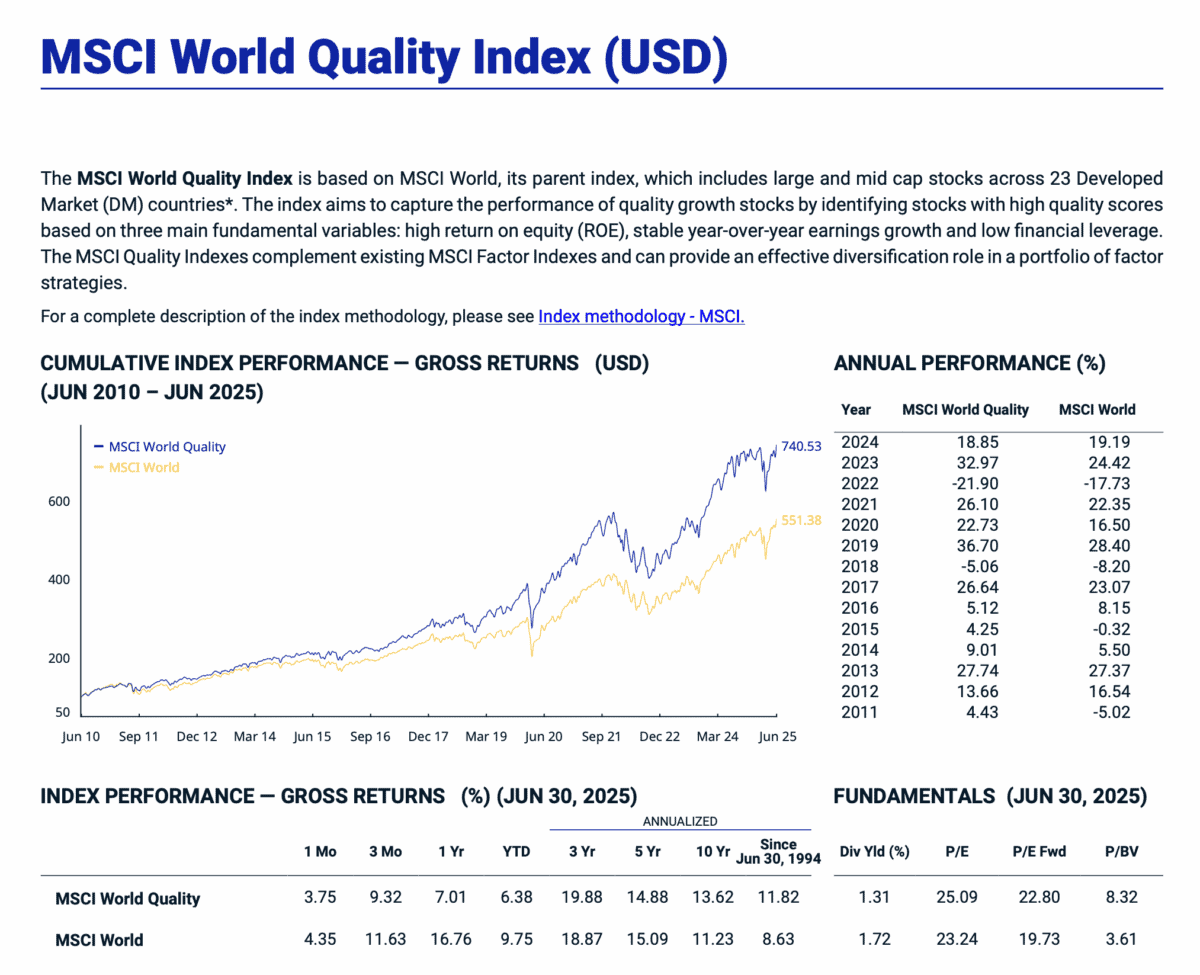

Check out the returns from the MSCI World Quality index. Over the last 31 years, this index has smashed the broader market.

A focus on quality

The MSCI World Quality index is based on the MSCI World index (which a lot of basic index funds track). However, it has a focus on âqualityâ.

The aim is to capture the performance of high-quality businesses (which often provide higher investment returns than low-quality ones) by identifying companies with:

- A high return on equity (a high level of profitability)

- Stable year-on-year earnings growth

- Low financial leverage (low debt)

Note that it contains many of the same names as the MSCI World (Apple, Nvidia, Visa, etc). However, the weightings are often quite different.

Strong long-term performance

Zooming in on performance, since 30 June 1994, this index has returned 11.8% per year (in US dollar terms). That compares to an annualised return of 8.6% for the regular MSCI World.

Thatâs a pretty significant outperformance. Itâs worth pointing out that 30 years is a long time in the stock market (meaning that this performance wasn’t a fluke or a short-term phenomenon).

Periods of underperformance

Of course, no strategy outperforms all the time. And there are times every now and then when quality lags the broader market.

It has actually lagged this year. For the first half, the MSCI World Quality index returned 6.4% versus 9.8% for the MSCI World.

Over the long run, however, it has clearly outperformed. So I think the strategy is worth considering as part of oneâs overall investment approach.

A quality ETF

Now, itâs not possible to invest directly in the MSCI World Quality index. However, UK investors have access to a range of products that track derivatives of the index.

One example here is the iShares Edge MSCI World Quality Factor UCITS ETF (LSE: IWQU). This is designed to track the MSCI World Sector Neutral Quality index, which is very similar to the MSCI World Quality index.

I think thereâs a lot to like about this product. Like the index, it screens out low-quality companies and focuses on companies with high profitably, stable earnings, and strong balance sheets.

Meanwhile, fees are low at just 0.25% per year.

Now, thereâs no guarantee that this ETF will provide superior returns in the years ahead. As I said above, quality strategies sometimes lag the broader market (especially when cyclical stocks are in favour).

All things considered though, I see it as a solid core holding. I think itâs worth considering as part of a diversified portfolio.

The post Over the last 31 years, this index has beaten the global stock market by a wide margin appeared first on The Motley Fool UK.

More reading

- Are we looking at a golden age for UK bank stocks?

- How much do you need in an ISA to target a £1,000 monthly passive income?

- As Nvidia breaks through $4trn, what next for the stock price?

- Here’s how a £20k ISA could earn £1,094 in passive income every year until 2055

- Another stock market crash could be coming. Here’s what I’m doing about it

Edward Sheldon has positions in Apple, Nvidia, and Visa. The Motley Fool UK has recommended Apple, Nvidia, and Visa. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.