How to aim for a second income from scratch with just £5 a day

In light of geopolitical uncertainty and rising living costs, the safety of a second income is more appealing than ever. Savings rates barely outpace inflation and job security feels fragile, leaving the stock market attractive as a means to build financial resilience.

But building a second income doesn’t require risking a small fortune in speculative bets on confusing tech stocks. In fact, even a small amount invested regularly – say, £5 a day – could, over time, generate a reliable income stream.

A good place to start might be the FTSE 100 or FTSE 250 — both homes to a number of stable, dividend-paying companies. These firms often have longstanding dividend policies and are well-suited to investors seeking predictable returns.

Healthy returns

Income-focused investors may want to consider FTSE 250 dividend stocks like Assura (LSE: AGR), for example. This real estate investment trust (REIT) owns and manages GP surgeries and primary healthcare facilities across the UK.

It has established itself as a strong candidate for income investors, boasting a dividend yield typically between 6-8%. Better yet, it has increased its payout for 12 consecutive years — not something many companies can claim.

Adding to its appeal is a set of solid financials. Its payout ratio sits at a conservative 64%, showing dividends aren’t being stretched beyond earnings. Operating margins top 80% and its balance sheet looks solid, with debt comfortably covered by equity.

And with a price-to-earnings (P/E) ratio of 9.5 and a price-to-book (P/B) ratio of 0.99, it looks undervalued at the current price.

Of course, no investment’s without risk. For Assura, higher interest rates are the main concern. Debt costs have risen and, as a property owner, the trust’s funding structure is exposed to these changes. When interest rates rise, the cost of servicing this debt increases, which can reduce profitability and put pressure on dividend payments.

However, with a focus on essential infrastructure, I’d say its rental income’s generally more stable than many other REITs.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

Building income

Which brings us to income generation. What happens if an investor contributes £1,825 a year (just £5 a day) to a diversified dividend portfolio full of stocks like Assura?

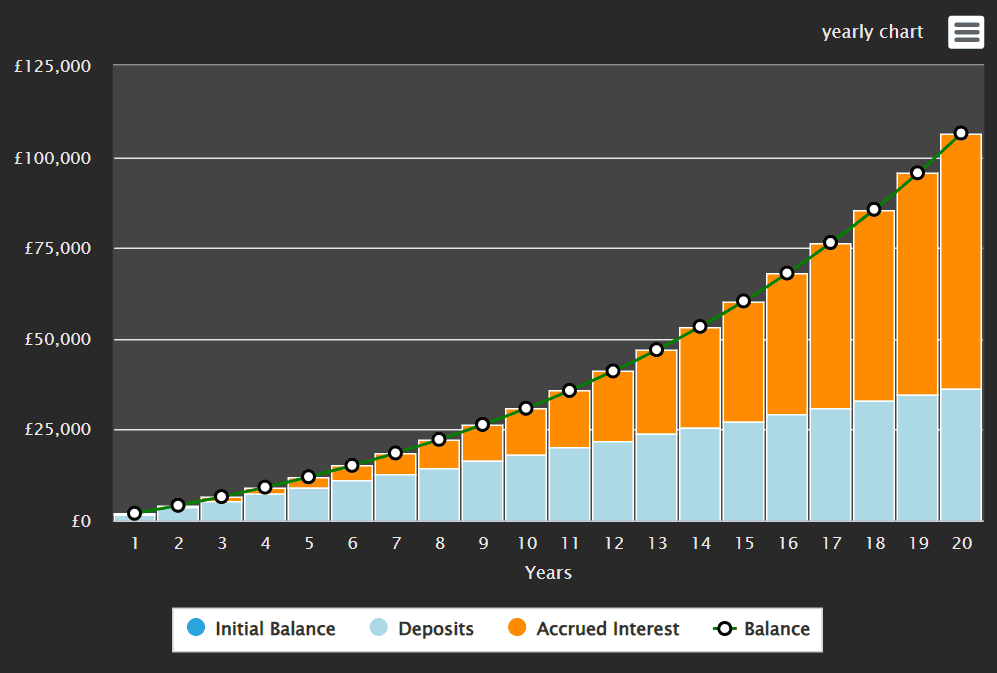

Assuming an average annual yield of 6% and market growth of 3%, that portfolio could grow to around £32,000 in 10 years (with dividends reinvested). That sum could be generating £1,554 a year in income by then — a moderate £130 a month. Over 20 years, it could snowball to almost £100,000, delivering £6,000 a year in passive income.

This shows the quiet power of compounding. Small amounts, invested steadily, can build a second income that grows and pays out without having to sell shares.

In uncertain times, that kind of resilience is hard to ignore. For investors with a long-term mindset, FTSE dividend stocks like Assura are worth considering. They offer a simple yet powerful route to better financial security, all with just a fiver a day.

The post How to aim for a second income from scratch with just £5 a day appeared first on The Motley Fool UK.

More reading

- Will I make more from putting £2k in growth shares or income stocks right now?

- 2 dividend growth shares to consider for a reliable passive income!

Mark Hartley has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.