How much do you need in an ISA to target a £5,000 monthly passive income?

For most people, five grand per month in passive income would do very nicely. Indeed, that may even be enough to give up work, assuming one isn’t planning regular luxury spa breaks in The Bahamas.

Arguably the best way to target dividend income is inside a Stocks and Shares ISA. This account shields any returns from taxes, allowing wealth to build faster.

Over the past 10 years, a Stocks and Shares ISA tracking the performance of the FTSE 100 index has easily outperformed a Cash ISA. The average return is around 9% per year and slightly higher with the S&P 500 thrown into the mix.

In contrast, cash has returned around 2% to 2.5%, even including higher interest rates since 2022. This suggests savers would have lost real purchasing power over this period, due to inflation.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Aiming for a £1m portfolio

The annual contribution limit for an ISA is £20,000. This means it’s going to take time to build up to the figure mentioned in the headline.

For example, let’s say a portfolio yields 6% in future. To make a monthly income of £5,000, the Stocks and Shares ISA will need to be worth £1m.

That’s obviously a large sum, and reaching it might sound like a pipe dream, especially when the annual ISA limit is ‘only’ £20,000.

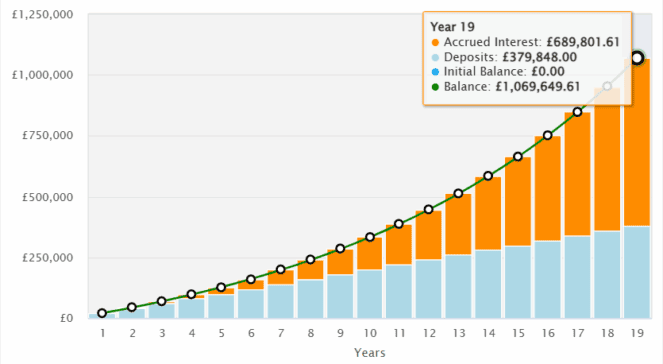

However, were an investor to achieve an average 10% return, that seven-figure sum would be reached in just under 23 years. And the great news is that would be from investing £12,000 per year (or £1,000 a month) rather than £20,000.

But if the full ISA allowance was regularly invested, £1m would be achieved inside 19 years! And both of these examples involve someone starting from scratch.

Now, I should mention that a 10% return isn’t guaranteed, while dividends can be suspended if a firm runs into trouble.

However, the potential long-term rewards can be significant.

Ready-made growth portfolio

One approach that could be used to aim for a 10% return is by investing in investment trusts. These are publicly listed companies that buy a diversified portfolio of assets, typically shares.

The Baillie Gifford US Growth Trust (LSE: USA) is one that I rate highly. Among the trust’s top holdings is Meta Platforms, whose earnings have just blown past Wall Steet’s expectations. AI is turbocharging ad performance across Facebook and Instagram, delivering efficiency and greater returns.

Meanwhile, gaming platform Roblox has done something similar. As I write today (31 July), shares of Meta and Roblox are up 12% and 17%, respectively.

It looks like the trust’s managers have an eye for great stock picks (including Nvidia).

One risk here though is that the portfolio is heavily tilted to US tech stocks. Were these to fall from grace, the trust would likely underperform. There’s also no geographic diversification (though most US tech firms are global nowadays).

The trust is currently trading at a 7.5% discount to net asset value, which I find attractive. I reckon it’s worth considering, especially as a way to gain portfolio exposure to the deepening AI revolution.

Once the ISA reaches the magic £1m mark, it would then be possible to focus entirely on dividends shares. A 6%-yielding portfolio would then throw off the equivalent of £5,000 a month in tax-free passive income.

The post How much do you need in an ISA to target a £5,000 monthly passive income? appeared first on The Motley Fool UK.

More reading

- Meet the FTSE 100 juggernaut that’s smashing Nvidia shares in 2025!

- Can the British American Tobacco dividend keep growing?

- After Shell announced another huge buyback, are its shares undervalued?

- Here’s why Unilever could be a dividend share to consider right now

- 2 FTSE 250 value stocks to consider buying while they’re hated

Ben McPoland has positions in Nvidia and Roblox. The Motley Fool UK has recommended Meta Platforms, Nvidia, and Roblox. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.