How much do you need in a SIPP to target a £3,659 monthly passive income?

The Self-Invested Personal Pension (SIPP) is a powerful weapon in building long-term passive income. Like the Stocks and Shares ISA, individuals don’t have to pay a penny in capital gains or dividend tax on their investment returns, giving them more financial firepower to grow their wealth.

But that’s not all. With one of these products, investors enjoy tax relief of between 20% and 45%, depending on their personal income tax bracket. This can be especially valuable for people who don’t have large lump sums to invest, or who can’t make substantial regular contributions.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

With everyday living expenses rising, and social care costs rising even more sharply, these financial products are becoming ever more important. But how much passive income would someone need from their personal pension to retire comfortably?

£2,661 a month

The answer to this question depends on each of our individual circumstances and plans for retirement. But using the UK average laid down by Pensions UK (formerly the Pensions and Lifetime Savings Association) is a good place to start.

It believes the average single person needs a total income of £43,900 each year for a comfortable retirement. That amounts to just under £3,659 a month.

With the current State Pension set at £11,973 per year — or £998 a month — that leaves a shortfall of £31,927 that needs to be made up by a SIPP or other personal savings or investing product. That’s just over £2,661 a month.

Generating a pension income

There’s several ways to use a pension to make a second income in retirement. These include regular drawdown, purchasing an annuity, and buying dividend-paying stocks.

My own plan is to buy high-yield dividend shares. It’s a strategy that could provide me an income for life, unlike using a set-percentage drawdown from my retirement pot. And would also leave scope for further portfolio growth over time.

If I bought 6%-yielding income stocks today, I’d need £533,000 in my SIPP to give me that monthly income of £2,661.

That’s not small change. But by committing to regularly investing, over time this goal is very achievable.

Smashing the target

One quick and simple way is by buying an exchange-traded fund (ETF) like the iShares FTSE 250 (LSE:MIDD) product. Holding this particular fund leverages the exceptional growth potential of UK mid-cap growth shares. And with holdings in hundreds of different stocks spanning multiple industries, it does so in a low-risk way.

Major holdings here include recovering luxury good retailer Burberry and financial services provider Aberdeen.

There have been bumps along the way, as — like other equity-based funds — it can fall in value during broader stock market downturns. But the excellent long-term returns speak for themselves.

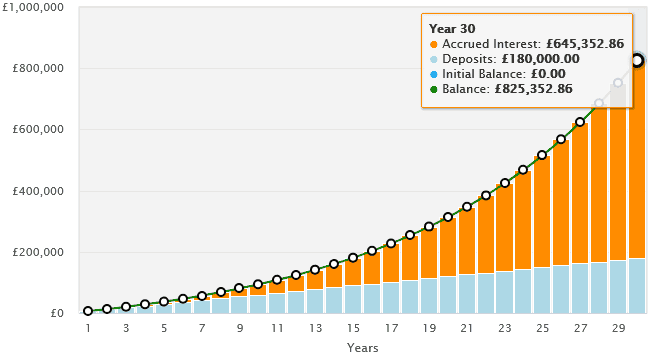

Since its creation in 2004, this FTSE 250 tracker’s provided an average annual return of 8.5%. If this continues, someone who invested £500 each month here in a SIPP (through a comination of personal contributions and tax relief) would have £825,353 in their pension pot after 30 years.

That’s well above our £533,000 target, and would give plenty of flexibility for rising living and social care costs three decades from now.

Past performance is no guarantee of future returns. But history shows that a diversified pension including funds like this really can deliver a comfortable retirement.

The post How much do you need in a SIPP to target a £3,659 monthly passive income? appeared first on The Motley Fool UK.

More reading

- What types of shares offer the potential to earn big passive income?

- Tesla stock looks overpriced to me. But might it be a long-term bargain?

- The secret sauce of ISA millionaires: buy high-yielding stocks

- £500 buys 251 shares in this 10.1%-yielding income stock!

- To live comfortably, here’s how big your pension might need to be…

Royston Wild has no position in any of the shares mentioned. The Motley Fool UK has recommended Burberry Group Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.