How much do you need in an ISA to aim for £10,000 a month in passive income?

Earning £10,000 a month in passive income is a financial milestone that many UK investors aspire to. Whether it’s to fund an early retirement, achieve financial independence, or simply provide peace of mind, reaching this level of income is possible.

However, it requires careful planning and a well executed strategy. And, of course, it makes sense to do this through a tax-efficient Stocks and Shares ISA.

With its exemption from income and capital gains tax, the ISA’s a powerful tool for UK investors. But generating £120,000 a year in passive income from an ISA alone is a tall order. To reach that level of cash flow without drawing down capital would need a substantial portfolio. What’s more, investors would need an asset allocation designed to yield reliably.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

So how much?

So how much is “substantial”? The answer depends on several variables. Chief among them is the average yield of the investments held within the ISA.

A portfolio yielding 4% annually would require a value of £3m to produce £120,000 a year in income. At a 6% yield, the required capital falls to £2m. Of course, higher yields often come with greater risks, including income volatility as well as capital erosion.

Now, many readers may have zoned out at £2m or £3m. However, for those starting early enough, reaching these figures is very possible.

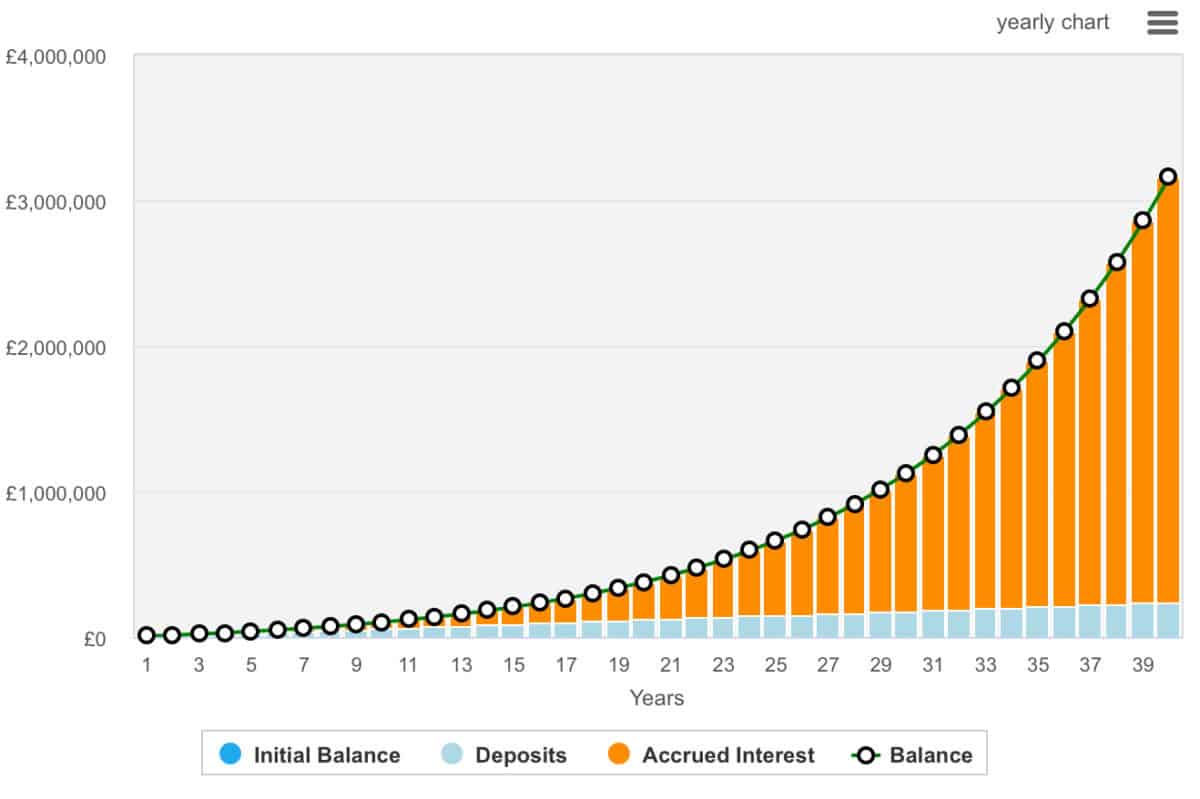

Take the case of investing £500 a month over 40 years with 10% annualised returns. In the first decade, progress can feel modest. After 10 years, the portfolio’s worth just over £100,000.

But compounding begins to accelerate. By year 20, the balance grows to around £380,000, and by year 30 it passes £1.1m. In the final 10 years, growth becomes dramatic: the portfolio adds over £2m, ending above £3.1m by year 40.

Despite contributing just £240,000 in total, over £2.9m comes purely from reinvested gains. This is the exponential nature of compounding. It starts slow, then surges.

Of course, it’s not all plain sailing. There are risks involved with investing, and we can lose as well as gain money. What’s more, 10% may prove to be a challenging target for some investors.

An investment for the long run?

Investors typically want to strive for diversification. One way to do that is by investing in 20-30 individual stocks, another is to focus on in a handful of investment trusts or funds.

Scottish Mortgage Investment Trust (LSE:SMT) offers investors exposure to a high-conviction portfolio of innovative, growth-oriented global companies. Its top holdings include SpaceX (7.4%), Mercadolibre (6.5%), Amazon, Meta, and Nvidia.

These are firms at the forefront of e-commerce, artificial intelligence (AI), and digital infrastructure. The trust actively targets transformational businesses, often before they’re fully recognised by the wider market, and includes private companies such as Bytedance.

However, this strategy comes with risks. The trust employs gearing (borrowing) to enhance returns, which can magnify losses during market downturns. Moreover, its growth bias can lead to volatility, particularly in rising interest rate environments.

For long-term investors with a decent tolerance for risk, it remains an opportunity worth considering. It has a place across my own portfolios.

The post How much do you need in an ISA to aim for £10,000 a month in passive income? appeared first on The Motley Fool UK.

More reading

- 3 reasons this investment fund could keep trouncing the rest of the FTSE 100

- The AI boom could be an opportunity for Britons to build a second income stream

- Starting with nothing? Here’s how to begin building a second income portfolio worth £2k a month in August

- Here’s why investors may want to consider Scottish Mortgage shares over a tracker fund

- 2 top FTSE 100 stocks to consider buying in August

James Fox has positions in Nvidia and Scottish Mortgage Investment Trust Plc. The Motley Fool UK has recommended Amazon, MercadoLibre, Meta Platforms, and Nvidia. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.