7.7% and 8.7% yields! 2 dividend stocks I’m considering buying to hold until 2035

Looking for great UK dividend stocks to buy? Here are two on my own personal watchlist.

Targeting stable dividends

I think renewable energy stocks like Greencoat Renewables (LSE:GRP) have considerable growth opportunities as the push towards net zero continues.

The world’s energy needs are growing, and green sources are having to make up a growing portion of the overall mix as the world reduces fossil fuel use. The outlook for the sector is especially bright in Europe — Greencoat believes the continent’s renewables market will be worth â¬1.3trn by 2030, and will swell to â¬2.5trn by 2050.

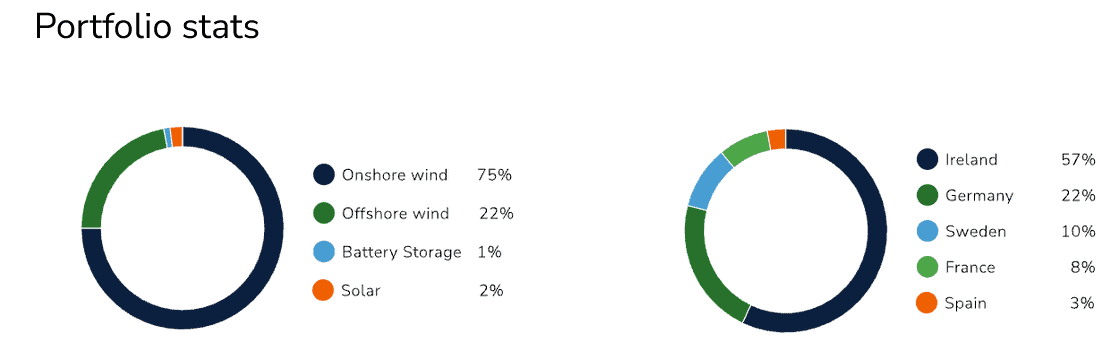

What I like about this particular stock is its wide geographical footprint. Energy production from renewable sources is highly sensitive to weather conditions. Owning assets that are located hundreds of miles apart helps smooth out varabilities in energy output.

This is essential to support stable cash flows, which are used to fund dividends. It’s not enough to just be operating in the defensive energy sector where demand remains stable. Companies need operational resilience to capitalise on this.

Greencoat Renewables has demonstrated such durability. It’s raised annual dividends each year since it listed eight years ago, excluding 2021, when payouts were frozen. In total, it’s delivered â¬350m of cumulative dividends over the period.

What’s more, its dividend yields have long beaten the long-term average for UK shares. At 8.7%, the forward yield for Greencoat is more than double the FTSE 100‘s historical average of 3%-4%, for instance.

Of course, there are dangers here, such as changing green energy policy and rising project costs. A focus on wind farms also leaves it more technologically concentrated than some other renewable energy stocks. But I still believe it’s a top dividend share to consider for at least the next decade.

A FTSE favourite

FTSE 100-listed M&G (LSE:MNG) is another British stock with a huge market opportunity today.

It doesn’t enjoy the (overall) year-to-year stability that renewable energy shares enjoy. As a major financial services provider, its earnings are vulnerable to the economic downturns that can drain consumer spending power.

But over a long-term horizon, it has considerable scope to grow earnings. Rapidly ageing populations are supercharging demand for protection, investment, and retirement products, and asset management services. The UK asset management sector, for instance is set to grow 13.4% a year between now and 2030, according to Mordor Intelligence.

While competitive threats remain, I feel M&G has the brand power and the scale to thrive in this environment. This, in turn, bodes well for dividends, which have grown every year since the company listed in 2019.

For 2025, the Footsie company carries an enormous 7.7% dividend yield. This is currently the fifth highest on the UK blue-chip index, and is underpinned by the firm’s robust balance sheet.

Thanks to its excellent cash generation, M&G’s Solvency II capital ratio was 223% as of December. This should give it ample financial firepower to keep paying large dividends while also investing for growth. Remember that dividends are never guaranteed.

The post 7.7% and 8.7% yields! 2 dividend stocks I’m considering buying to hold until 2035 appeared first on The Motley Fool UK.

Should you invest £1,000 in Rolls Royce right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Rolls Royce made the list?

More reading

- These ‘boring’ FTSE 100 dividend stocks just hit 52-week highs!

- Hereâs how investors can target a £15,882 yearly passive income from just £5 a day invested in this top FTSE dividend star!

- How much do you need in a Stocks and Shares ISA to make a £22,000 annual income?

- 2 FTSE 100 dividend stocks with double the index average yield

- See what £10k invested in this 7.7%-yielding dividend share 5 years ago is worth nowâ¦

Royston Wild has no position in any of the shares mentioned. The Motley Fool UK has recommended M&g Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.